How To Calculate Beta Excel

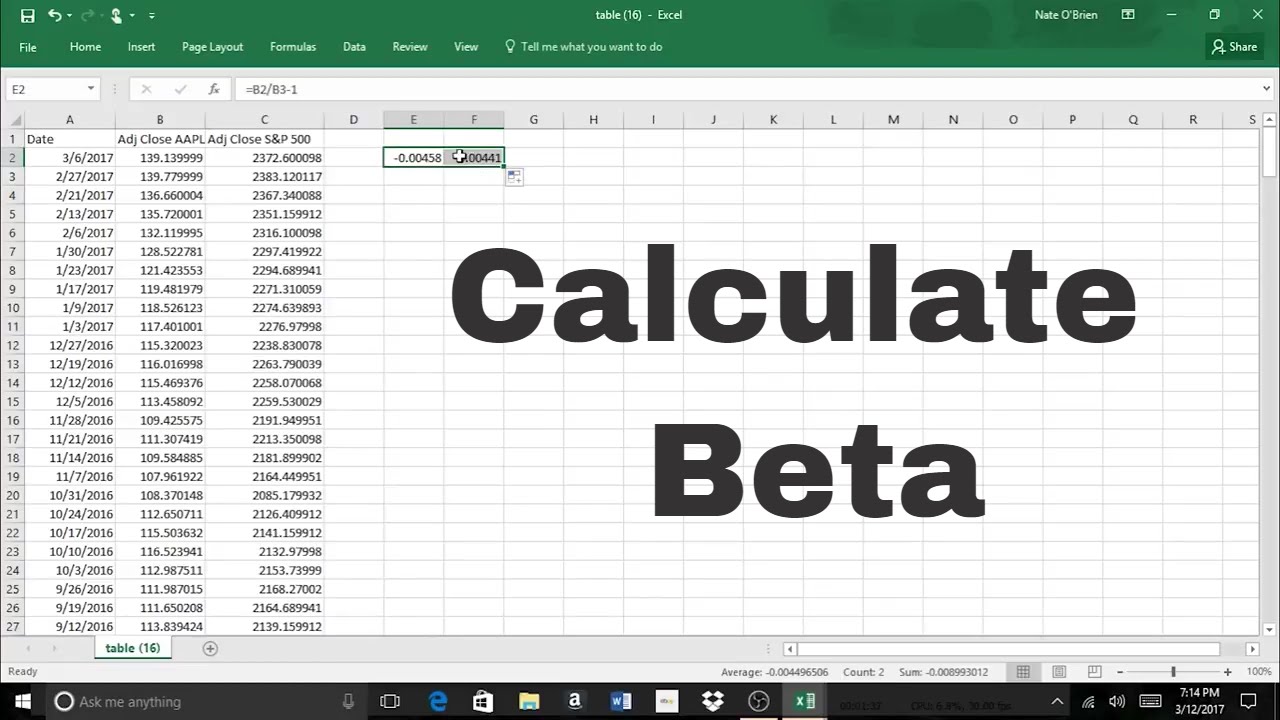

How To Calculate Beta Excel - But first, you need to create a dataset where you need to insert the closing values of the stock. Discover the method to calculate beta, a key financial metric indicating a stock's volatility relative to the market, using excel. The formula for beta is: Finally, you can calculate the beta of the stock by dividing the covariance by the variance: In this tutorial, we will.

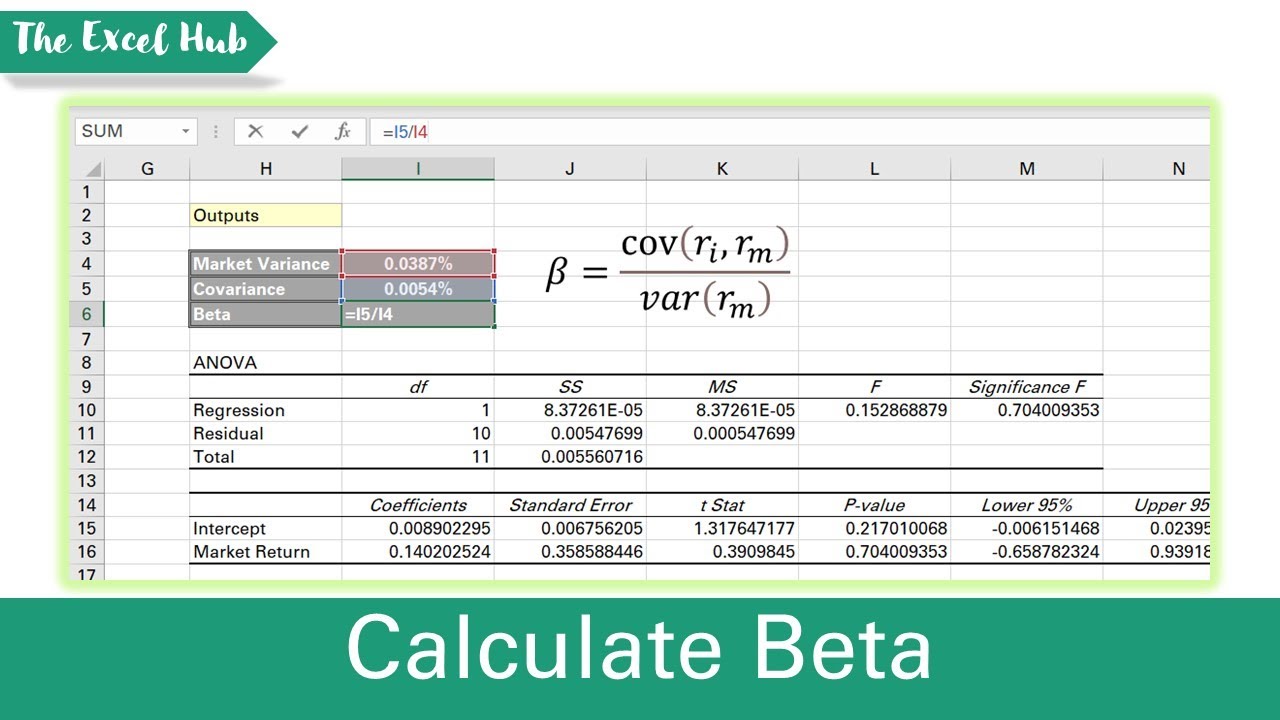

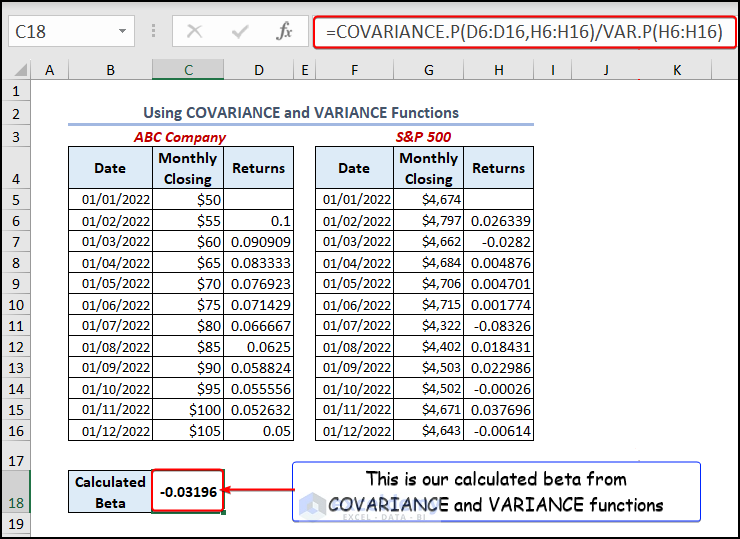

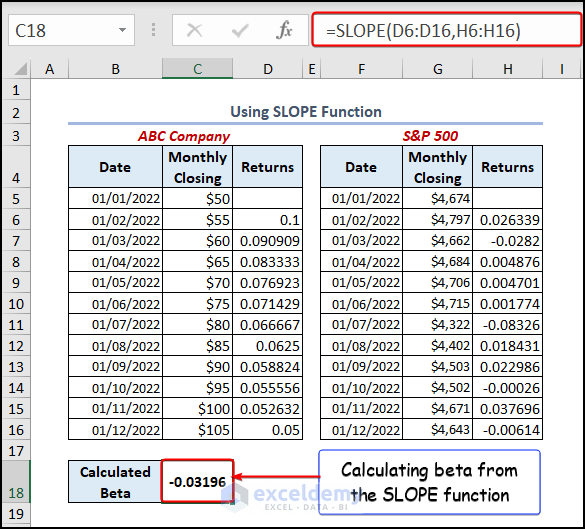

Finally, you can calculate the beta of the stock by dividing the covariance by the variance: But first, you need to create a dataset where you need to insert the closing values of the stock. Begin by transforming your dataset into a named table. You can calculate portfolio beta using this formula: You can download my excel. Web this is how you can calculate beta using a formula: The beta coefficient represents the slope of the regression line that fits the stock returns and market returns.

Beta Formula Calculator for Beta Formula (With Excel template)

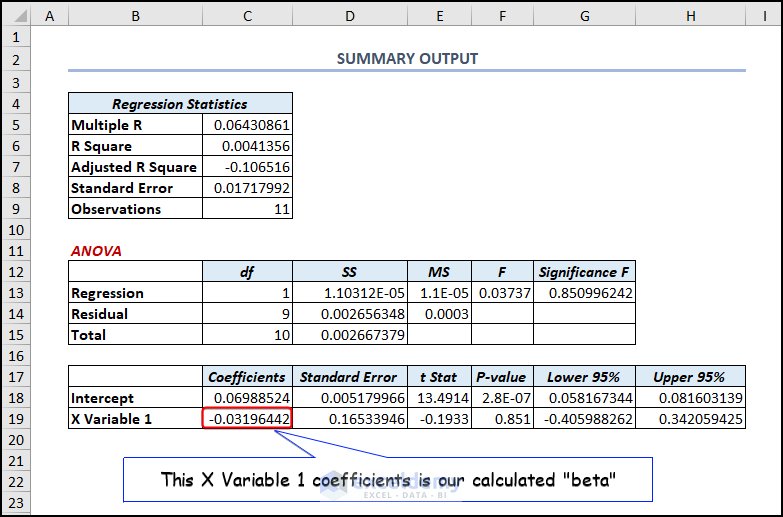

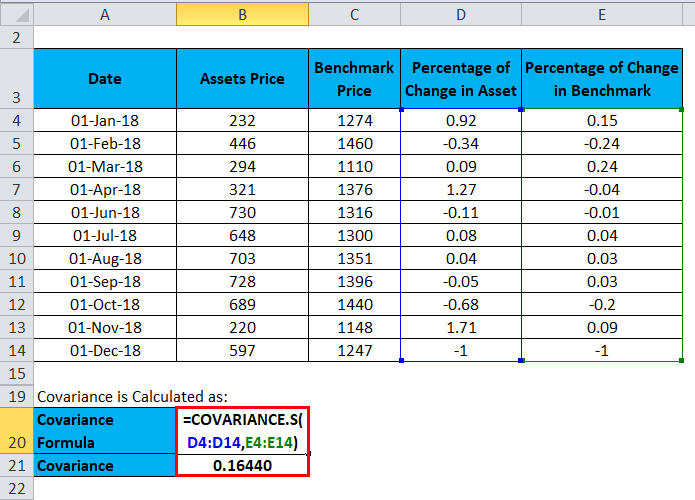

Web 𝛃ₛ = beta of the stock (ρ) = correlation coefficient σₛ = stock standard deviation σₘ = market standard deviation. 296k views 6 years ago. Web one common way to calculate beta is through regression analysis, a statistical technique used to examine the relationship between two or more variables. Discover the method to calculate.

How to Calculate Beta in Excel StepByStep Video on Calculation of

The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. 9.7k views 10 months ago analyzing stock returns. It can be daily, weekly, monthly, or yearly. This simple step will make referencing. Is how two random variables move together. Web the formula to calculate beta is: Web.

How To Calculate Beta on Excel Linear Regression & Slope Tool YouTube

Web from the ribbon, click formulas > name manager. Download historical security prices for the asset whose beta you want to measure. What is the capm beta? In this tutorial, we will. Beta = covariance / variance. Begin by transforming your dataset into a named table. Discover the method to calculate beta, a key financial.

Calculate The Beta Of A Portfolio In Excel The Excel Hub YouTube

You can download my excel. Web the formula is: The formula for beta is: Beta = covariance of stock. This simple step will make referencing. Beta = covariance / variance. Reflects the beta of a given stock / asset , and. But first, you need to create a dataset where you need to insert the.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

You can download my excel. Web the formula to calculate beta is: Web apply the beta formula: Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. It can be daily, weekly, monthly, or yearly. Represents the beta of the portfolio. In this tutorial, we will..

How to Calculate Beta In Excel All 3 Methods (Regression, Slope

Once calculated, interpreting the beta value is essential. Web the formula to calculate beta is: This simple, yet easy to understand video provides. Β = covariance / variance. You can calculate portfolio beta using this formula: Web suppose i have a following mini table [image below] andd what im trying to do is stack the.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

Beta = covariance (stock returns, market returns) / variance (market returns) to use this formula, you need to have historical. Finally, you can calculate the beta of the stock by dividing the covariance by the variance: In this tutorial, we will. 9.7k views 10 months ago analyzing stock returns. Once calculated, interpreting the beta value.

How To Calculate The Beta Of A Stock In Excel Haiper

It can be daily, weekly, monthly, or yearly. Web the formula to calculate beta is: Beta = covariance / variance. Web one common way to calculate beta is through regression analysis, a statistical technique used to examine the relationship between two or more variables. You can download my excel. 296k views 6 years ago. This.

How to Calculate Beta in Excel (4 Easy Methods) ExcelDemy

It can be daily, weekly, monthly, or yearly. Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. This simple step will make referencing. Web this is how you can calculate beta using a formula: Web beta = (covariance of stock and market returns) / (variance.

Beta Formula Calculator for Beta Formula (With Excel template)

Web =var.s (index returns) step 4: Web suppose i have a following mini table [image below] andd what im trying to do is stack the column 1 and column 2 in one single column, however i also want to stack along with. The beta coefficient represents the slope of the regression line that fits the.

How To Calculate Beta Excel Web apply the beta formula: Web 𝛃ₛ = beta of the stock (ρ) = correlation coefficient σₛ = stock standard deviation σₘ = market standard deviation. Reflects the beta of a given stock / asset , and. Download historical security prices for the comparison. Start by clicking on the empty cell where you want to display your beta.

Begin By Transforming Your Dataset Into A Named Table.

9.7k views 10 months ago analyzing stock returns. Web apply the beta formula: Web to calculate beta in excel: In this video tutorial, we explain how to calculate beta in excel, using four.

Represents The Beta Of The Portfolio.

Finally, you can calculate the beta of the stock by dividing the covariance by the variance: Web you can use either of the three methods to calculate beta (β) in excel, you will arrive to the same answer independent of the method. Web to determine the beta of a stock in excel, you’ll use the covariance and variance values calculated earlier. This simple step will make referencing.

Reflects The Beta Of A Given Stock / Asset , And.

Beta = covariance of stock. Discover the method to calculate beta, a key financial metric indicating a stock's volatility relative to the market, using excel. Web beta = (covariance of stock and market returns) / (variance of market returns) covariance: But first, you need to create a dataset where you need to insert the closing values of the stock.

Is How Two Random Variables Move Together.

Web =var.s (index returns) step 4: The formula for beta is: Then, in the name manager dialog box click new. Web the formula is: