How To Calculate Interest On A Loan Excel

How To Calculate Interest On A Loan Excel - Step 5) divide this percentage by the number of years over which the loan is spread to calculate the annualized percentage of expense. Create row headers for principal, interest, periods, and payment. To do this, we set up cumipmt like this: You can enter a beginning. Master finance formulas and make accurate calculations easily.

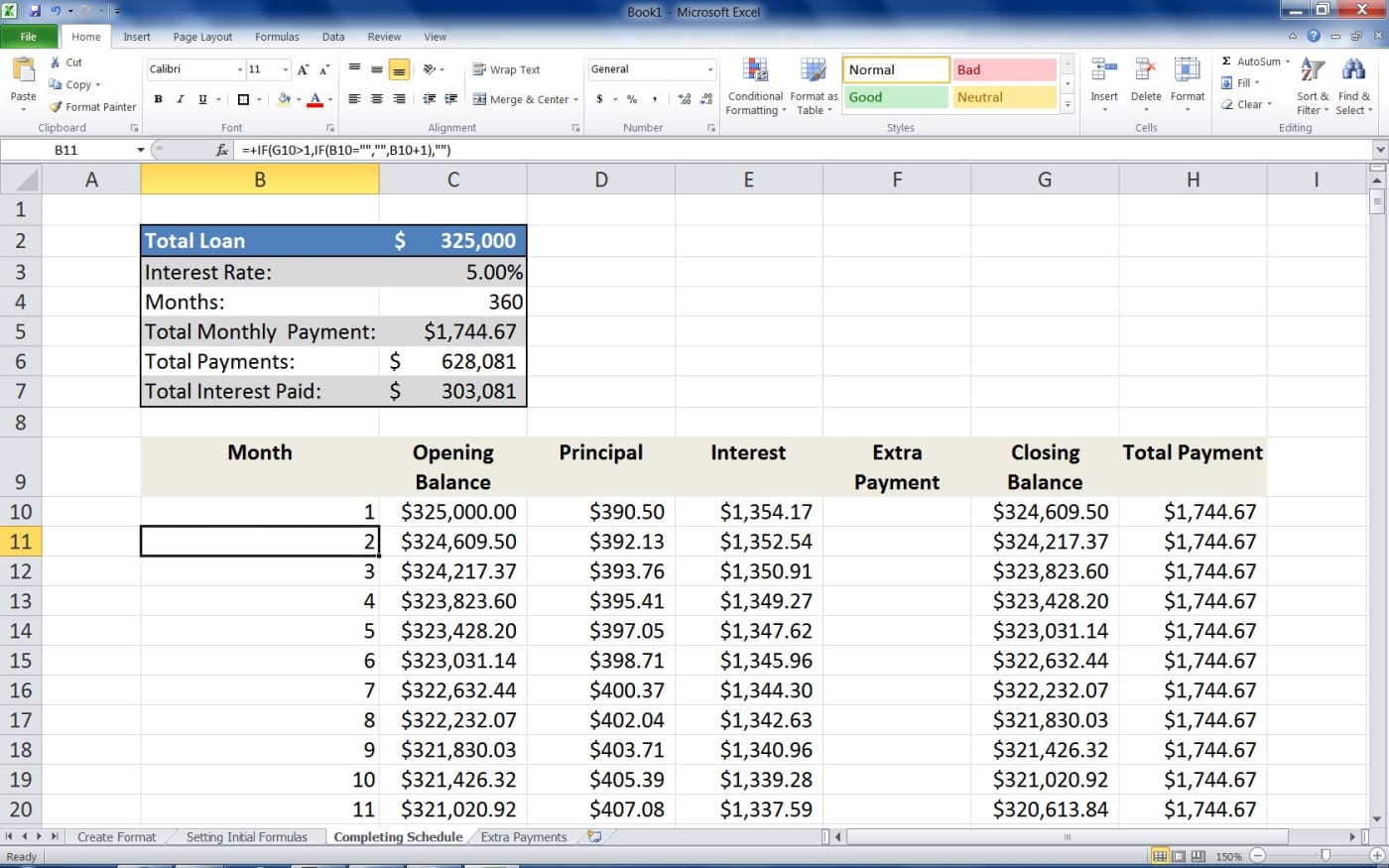

Web here’s how you can calculate the total interest paid over the duration of a loan: Nper is the total number of payments. (many of the links in this article redirect to a specific reviewed product. At the same time, you'll learn how to use the pmt function in a formula. One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. With a monthly payment schedule, we will need to make sure we convert any annual numbers to monthly. Web use the excel formula coach to figure out a monthly loan payment.

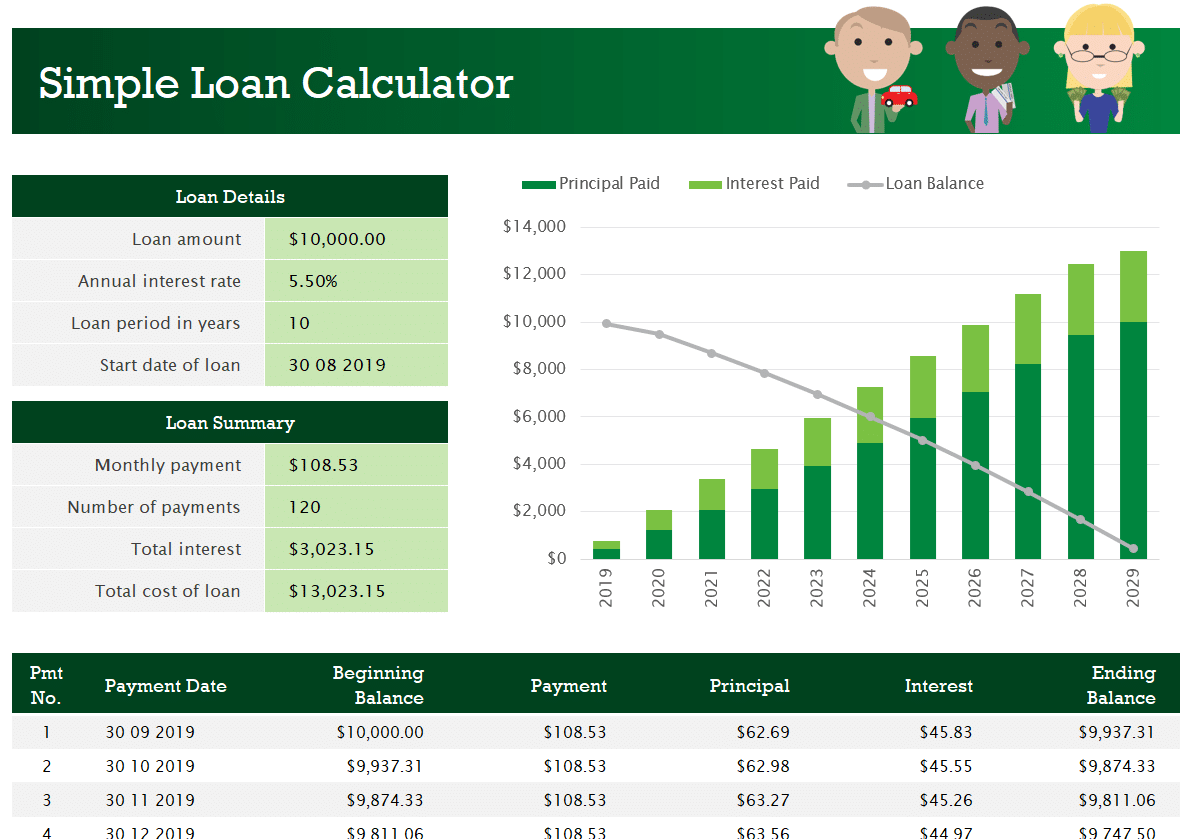

How To Use Excel's Loan Calculator Get The Simple Template Here

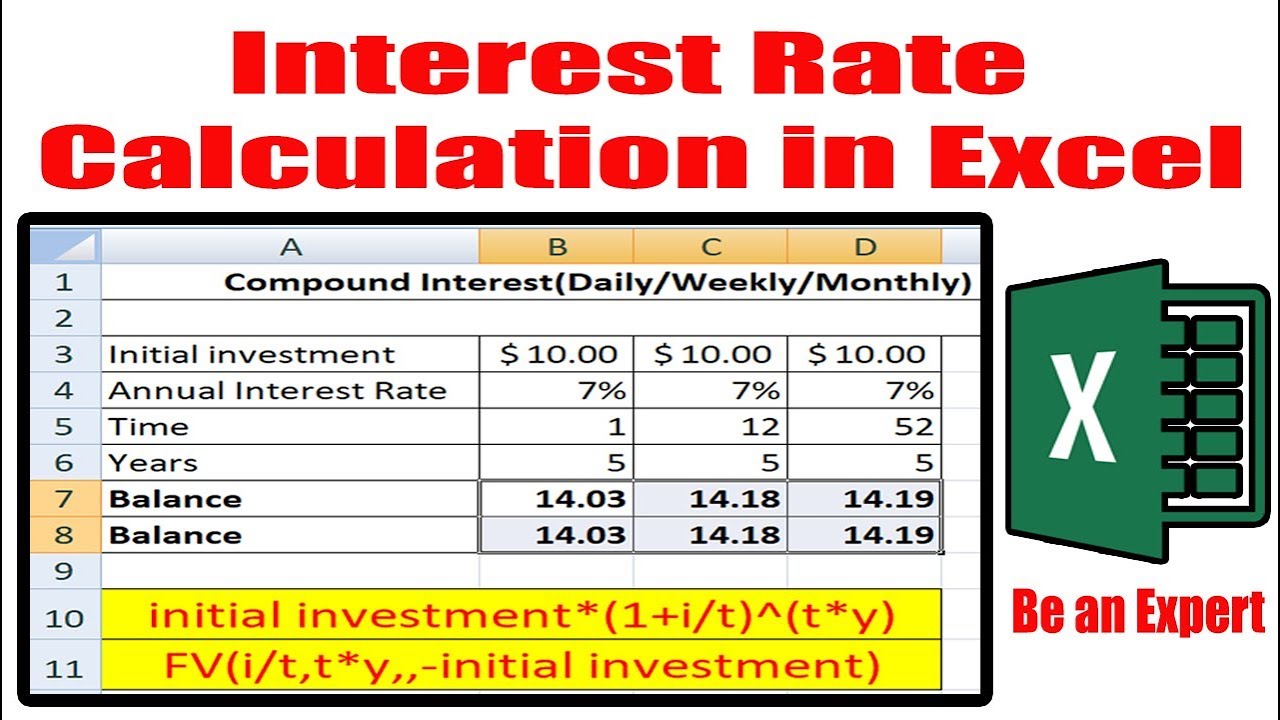

Web use the interest calculator below to calculate how much interest your savings account can earn. With a monthly payment schedule, we will need to make sure we convert any annual numbers to monthly. This function uses the following syntax: Then, c8 denotes the total payment period in terms of the year which is 5..

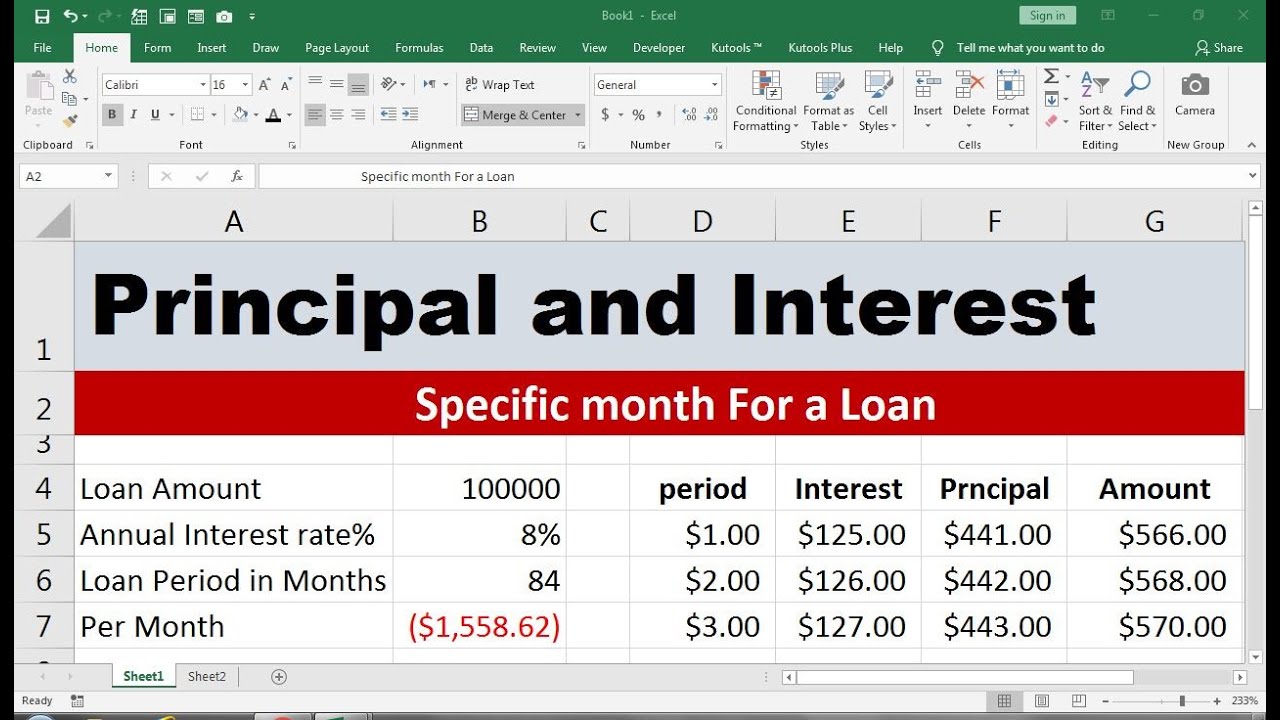

How to Calculate Principal and Interest on a Loan in Excel ExcelDemy

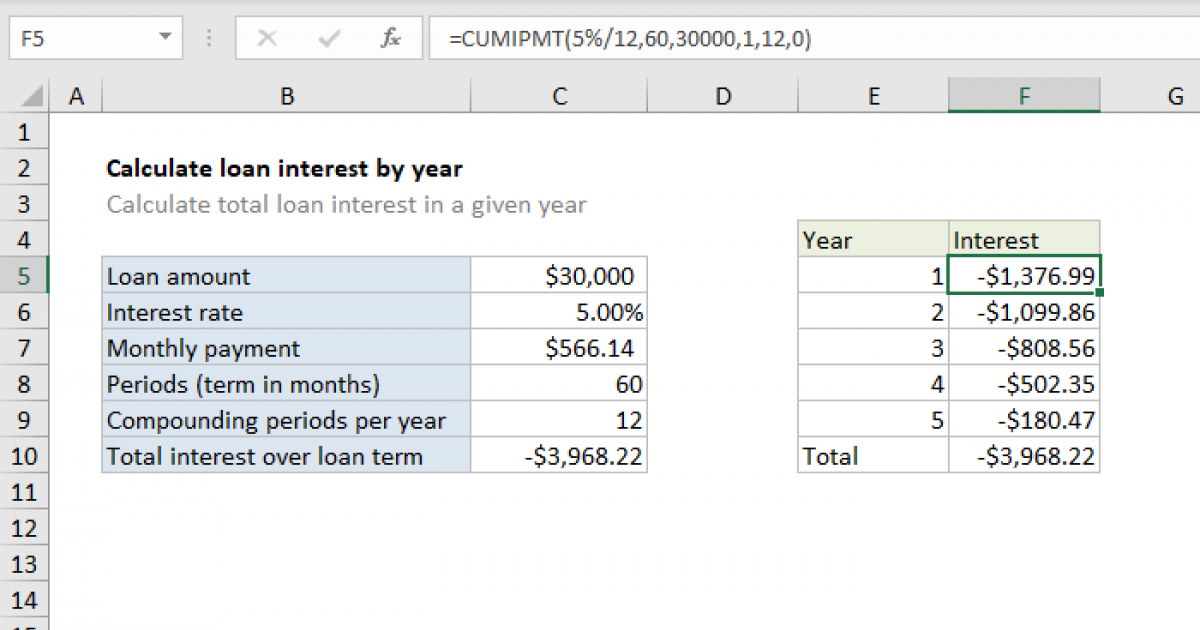

It is easy and simple to calculate apr in excel. One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. Pmt (rate, nper, pv, [fv], [type]) note: Web you can use the cumipmt function in excel to calculate the total.

How to Calculate the Total Interest on a Loan in Excel YouTube

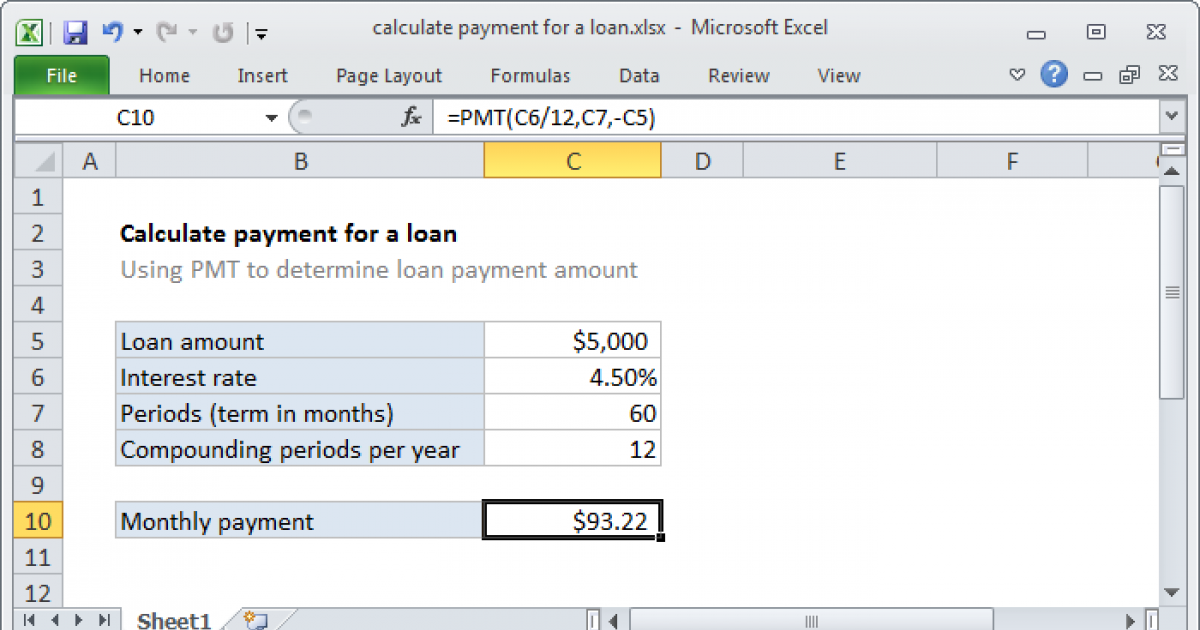

At the same time, you'll learn how to use the pmt function in a formula. Web use the interest calculator below to calculate how much interest your savings account can earn. Web the equation reads: Web use the excel formula coach to figure out a monthly loan payment. You can enter a beginning. Web to.

Calculate payment for a loan Excel formula Exceljet

Loan calculator templates for excel. Starting value of the loan) For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan. The apr comes out as 8.33%. Web use the interest calculator below to calculate how much.

Interest Rate Calculation in Excel YouTube

Web to calculate the periodic interest rate for a loan, given the loan amount, the number of payment periods, and the payment amount, you can use the rate function. 4% (expressed as a decimal, so 4% becomes 0.04) loan term: Input the repayment amount per month into cell d7. We divide the value in c6.

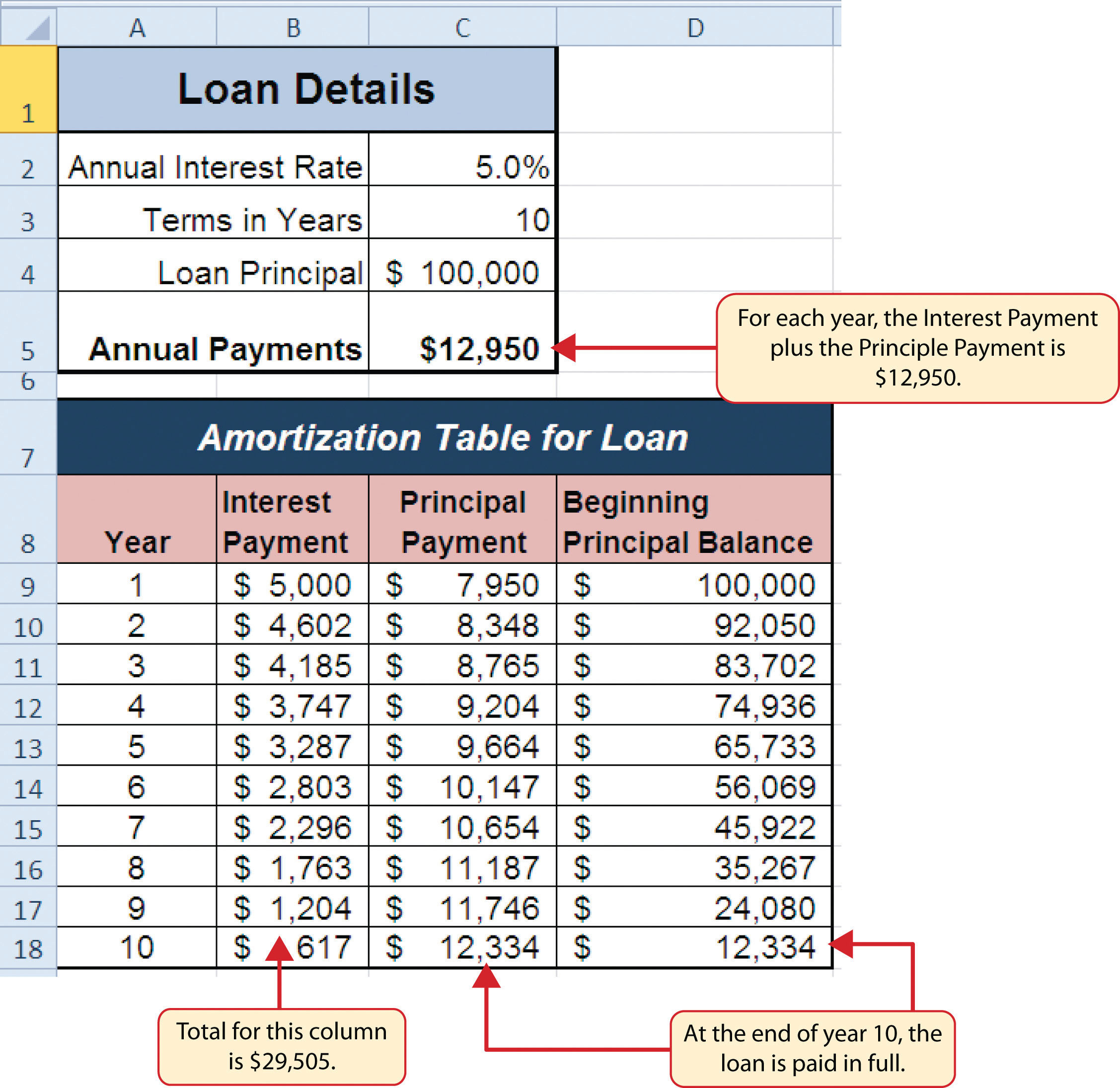

Loan Amortization Schedule Spreadsheet —

Cumipmt (rate, nper, pv, start_period, end_period, type) where: The second argument specifies the payment number. Pmt (rate, nper, pv, [fv], [type]) note: Loan calculator templates for excel. Pv is the principal loan amount (total loan amount). Step 5) divide this percentage by the number of years over which the loan is spread to calculate the.

Mortgage Loan Calculator Using Excel TurboFuture

It is easy and simple to calculate apr in excel. The first three arguments are required and what we will focus on. Web mind your money. The higher your interest rate, or yield, the more your bank balance grows. Then, c8 denotes the total payment period in terms of the year which is 5. At.

How To Calculate Loan Payments Using The PMT Function In Excel Excel

The shaded amounts in the area beneath are calculated automatically. Input the term of the loan in years in cell d5. Master finance formulas and make accurate calculations easily. Web use the excel formula coach to figure out a monthly loan payment. In this function, c7 denotes the monthly interest rate of 0.58%. Web the.

Calculate loan interest in given year Excel formula Exceljet

For example, if you received a loan of $20,000, which you must pay off in annual installments during the next 3 years with an annual interest rate of 6%, the interest portion of the 1 st year payment can be calculated with this formula: Pv is the principal loan amount (total loan amount). Pmt (rate,.

how to calculate principal and interest on a loan in excel YouTube

Pmt (rate, nper, pv, [fv], [type]) note: Pmt (rate, nper, pv, [fv], [type]). Create row headers for principal, interest, periods, and payment. For this step, you might want to include cells for the principal amount of the loan, your annual interest rate, how many years you plan to repay the loan, what your starting period.

How To Calculate Interest On A Loan Excel Pmt(rate, nper, pv) is the regular payment amount. Then, c8 denotes the total payment period in terms of the year which is 5. Web the equation reads: Input into cell d3 the amount of the loan. Here, i have used the pmt function which calculates the monthly or annual payment based on a loan with a constant interest rate and regular payment.

The Apr Comes Out As 8.33%.

Web the syntax is as follows: For example, if you received a loan of $20,000, which you must pay off in annual installments during the next 3 years with an annual interest rate of 6%, the interest portion of the 1 st year payment can be calculated with this formula: = cumipmt ( rate, nper, pv, start, end, type) explanation. Web things you should know.

(Many Of The Links In This Article Redirect To A Specific Reviewed Product.

The higher your interest rate, or yield, the more your bank balance grows. Web let’s break down how to calculate interest on a loan in excel using the pmt function. Pmt (rate, nper, pv, [fv], [type]) note: Use the ppmt function to calculate the principal part of the payment.

Web To Get The Monthly Payment Amount For A Loan With Four Percent Interest, 48 Payments, And An Amount Of $20,000, You Would Use This Formula:

Step 5) divide this percentage by the number of years over which the loan is spread to calculate the annualized percentage of expense. Total number of payments for the loan. Web the decimal will be converted into a percentage. To calculate the interest on investments instead, use.

Then, C8 Denotes The Total Payment Period In Terms Of The Year Which Is 5.

So, using cell references, we have: Web to calculate a loan payment amount, given an interest rate, the loan term, and the loan amount, you can use the pmt function. Web prior to using the goal seek function i first have to under the heading customer: Interest that is not compounded), you can use a.