Small Business Valuation Excel Template

Small Business Valuation Excel Template - Gather previous years' financial statements. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. Web are you planning on buying or selling a business? No need to spend time or money on a business valuation firm. Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities.

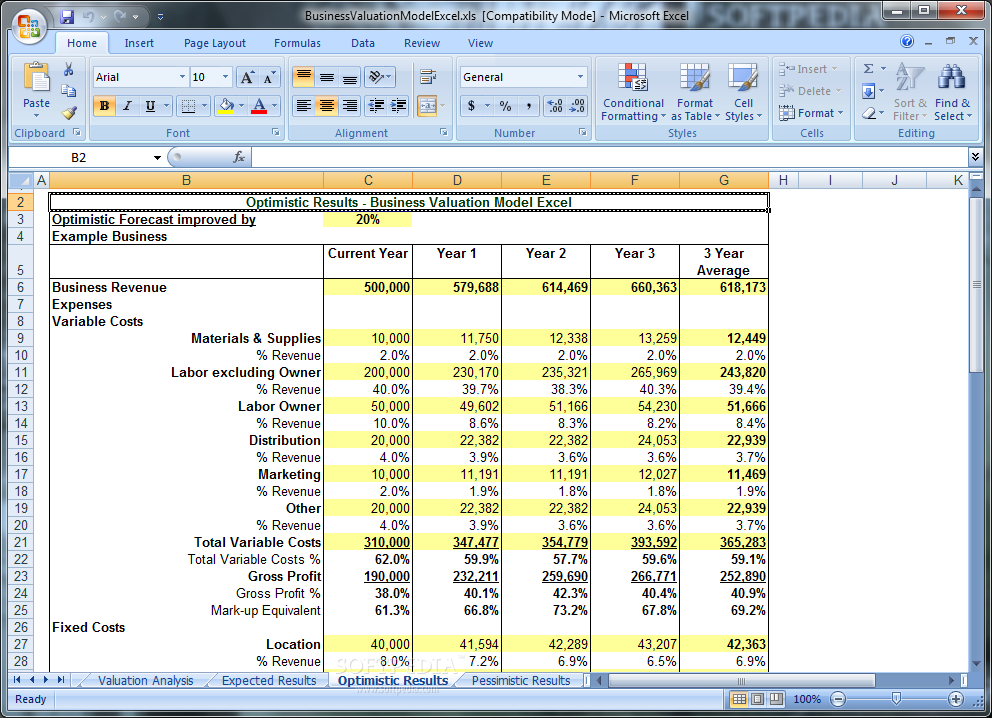

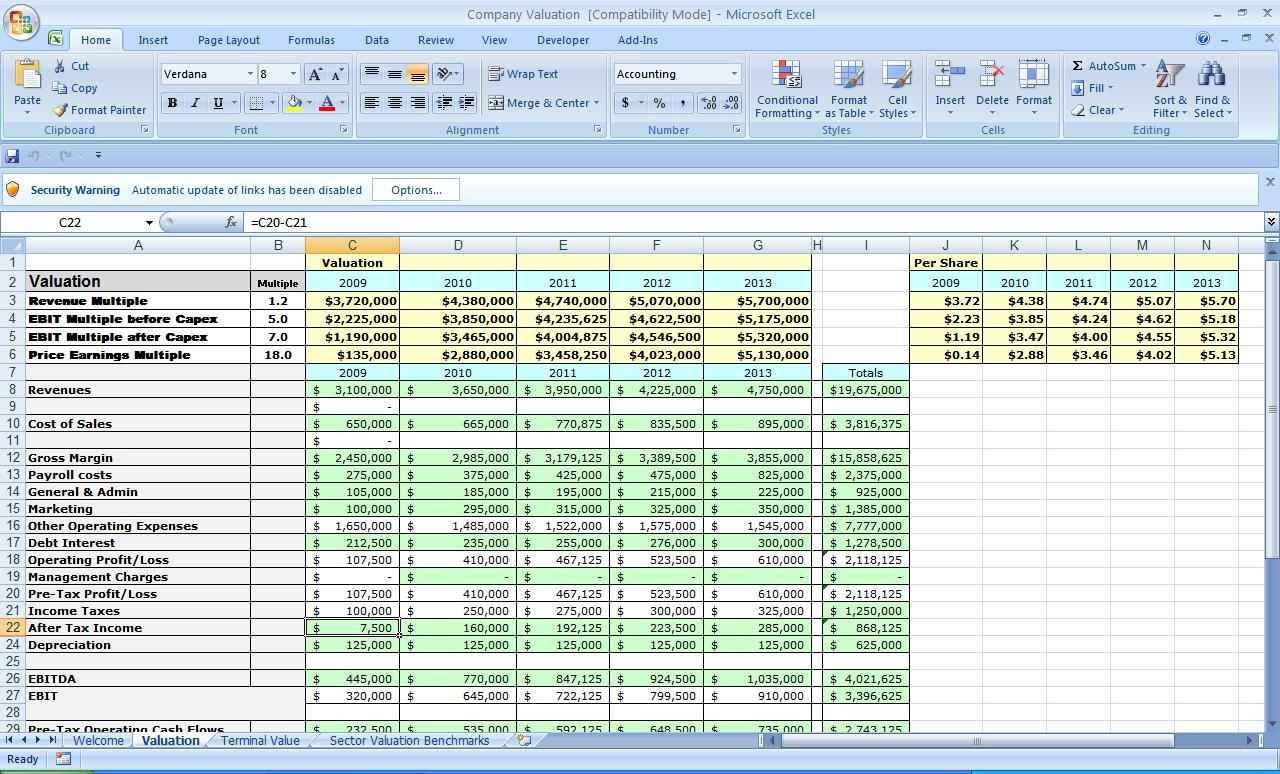

Full tutorial on how to value private companies differently, including accounting adjustments, public comps, dcf, and more. Calculate different revenue scenarios, such as pessimistic and optimistic, for insights into upside, model and risk. Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities. How much to sell your business for? Valuing your business with our comprehensive templates should not be complicated. Click here for an instructional article on how to use the template. Web download our free dcf model template.

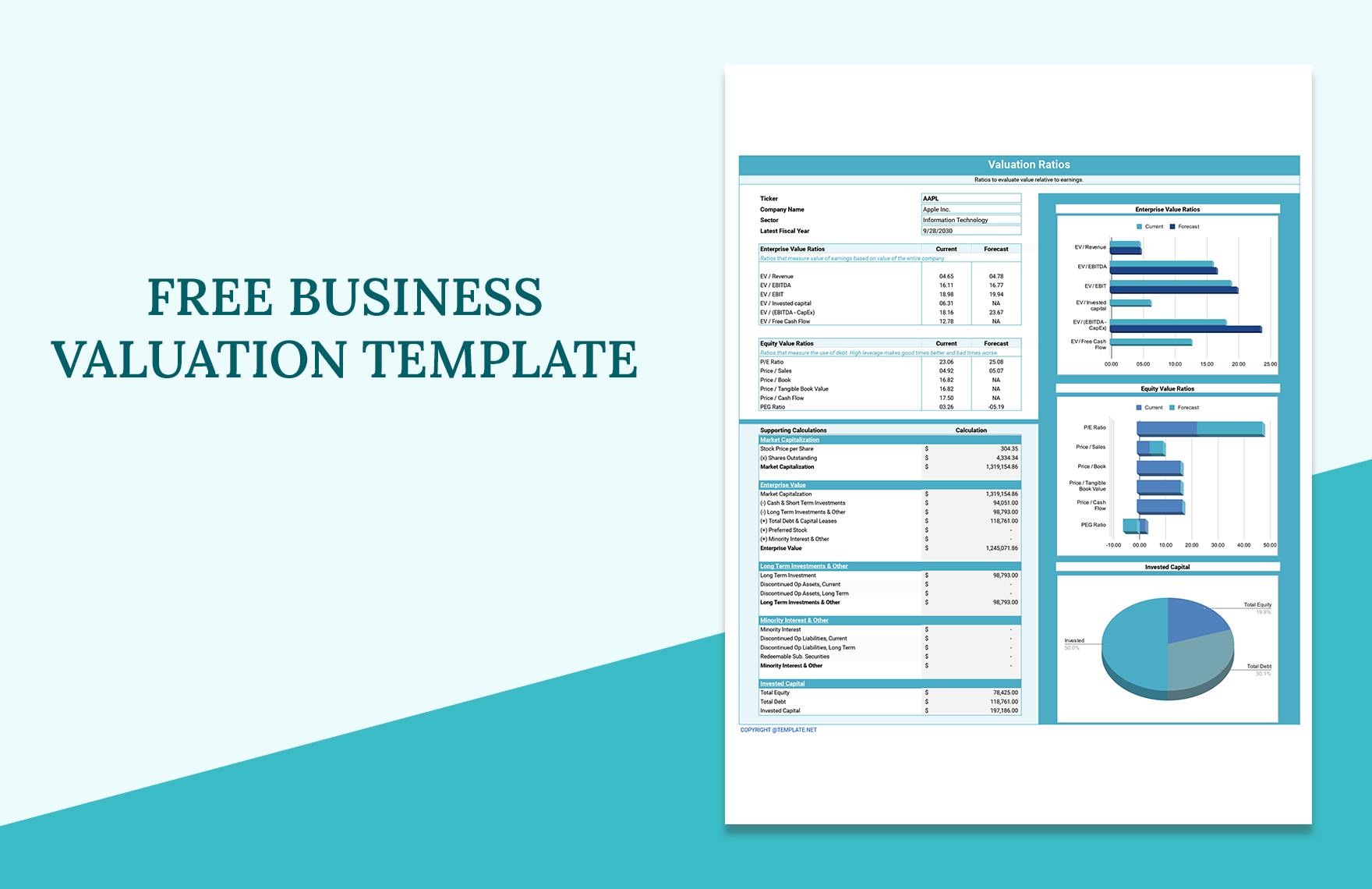

Free Business Valuation Template Google Sheets, Excel

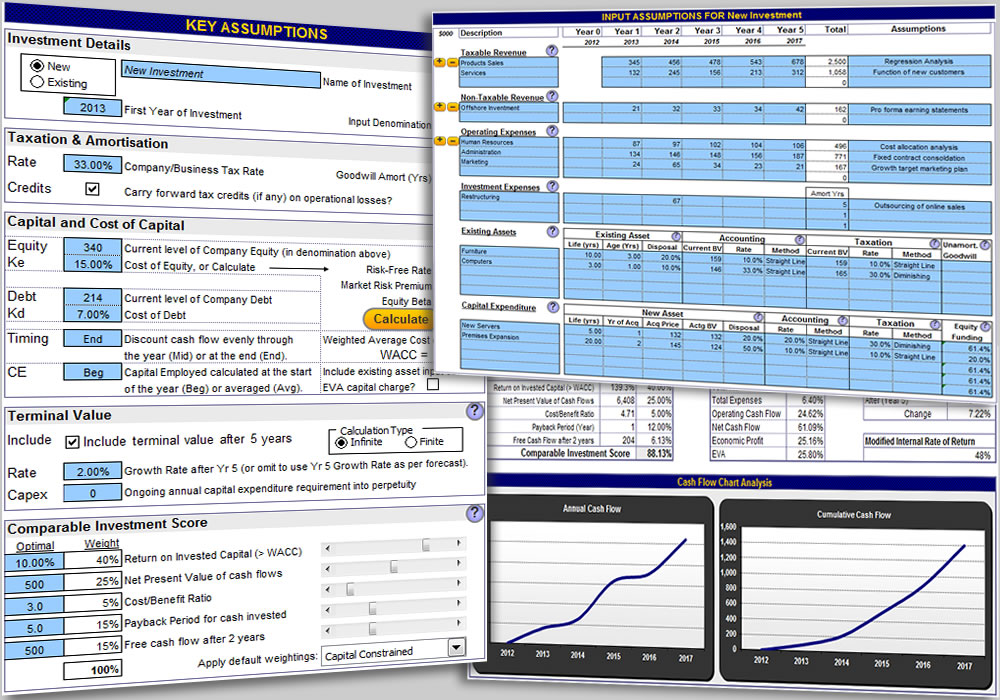

How much to sell your business for? Web the excel business valuation template provides an adaptable framework for the valuation of proposed investments and business models by analyzing net present value, economic value added and accounting impact. Web what is valuation modeling in excel? Valuing your business with our comprehensive templates should not be complicated..

Small Business Valuation Template Beautiful Business Valuation for

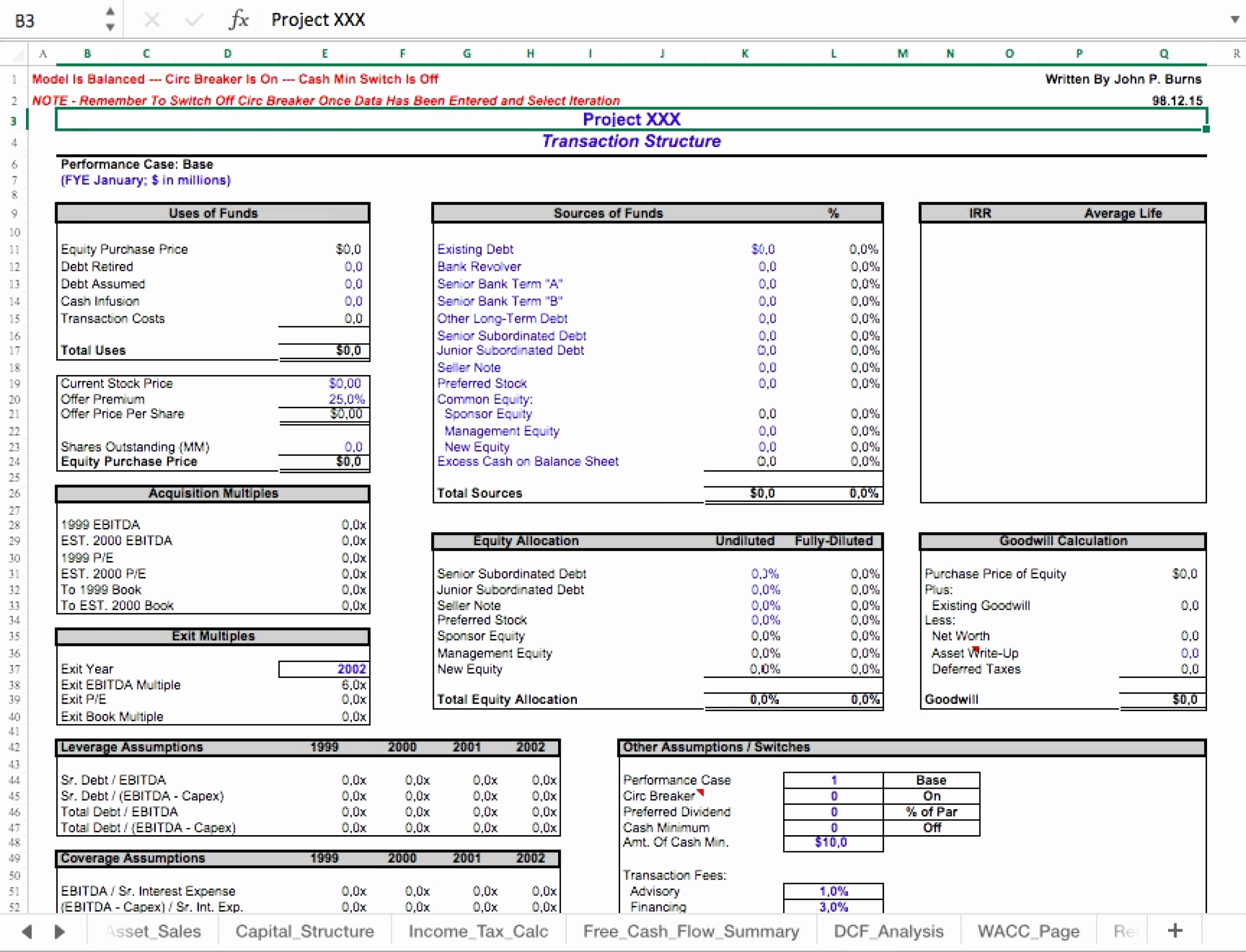

Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Web this unique business valuation template is based on discounted cash flow projections, weighted average cost of capital (wacc) and internal rate of return (irr). Web private company valuation: Web use this 100% unique business.

Small Business Valuation Template New Business Valuation Spreadsheet

How much to sell your business for? Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. Small business valuations can be subjective and it is therefore important to use a business valuation calculator with flexibility to test sensitivities. The capitalized earnings valuation method.

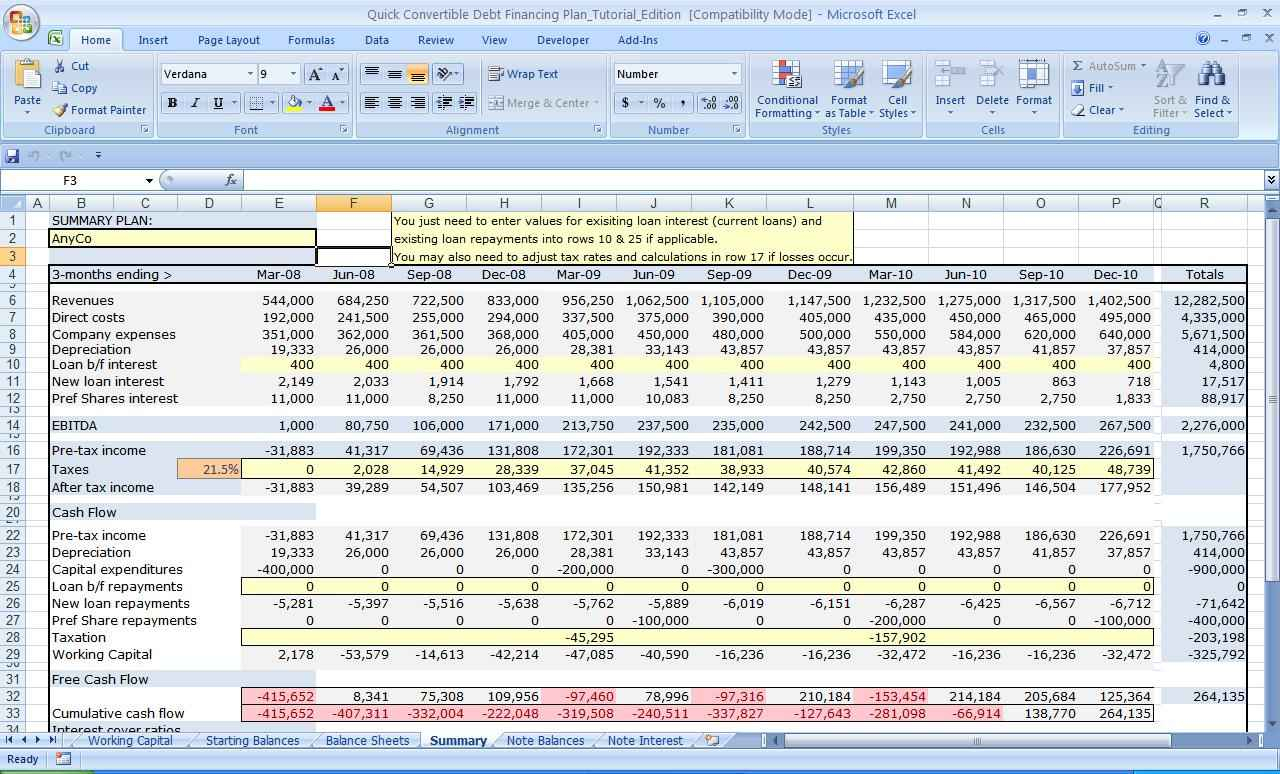

Business Valuation Model Excel Download Build a financial forecast and

Web free download this business valuation template design in excel, google sheets format. Full tutorial on how to value private companies differently, including accounting adjustments, public comps, dcf, and more. Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Valuing your business with our.

Business Valuation Excel Model with ProForma Financial Statements

Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. Small business valuations can be subjective and it is therefore important to use a business valuation calculator with flexibility to test sensitivities. Net annual.

Business Valuation Excel and Google Sheets Template Simple Sheets

Valuing your business with our comprehensive templates should not be complicated. Web identify a business' health and future based on profitability and other key metrics with our business valuation template for excel and google sheets. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading.

12 Business Valuation Excel Template Excel Templates

Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities. Web free download this business valuation template design in excel, google sheets format. Small business valuations can be subjective and it is therefore important to use a business valuation calculator with flexibility to test sensitivities. Web this fully editable simple vc.

Business Valuation Model Excel Free Download Printable Templates

Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. Valuing your business with our comprehensive templates should not be complicated. Get an accurate picture of your company’s true value — with projected future cash flows factored in — by. Web this fully editable.

Free Excel Business Valuation Spreadsheet —

Web go to our unique business valuation template! Web private company valuation: Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. Web this unique business valuation template is based on discounted cash flow projections, weighted average cost of capital (wacc) and internal rate.

Company Valuation Excel Spreadsheet Resourcesaver and Business

Web free download this business valuation template design in excel, google sheets format. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical.

Small Business Valuation Excel Template Web download our free dcf model template. Full tutorial on how to value private companies differently, including accounting adjustments, public comps, dcf, and more. A business valuation calculator helps buyers and sellers determine a rough estimate of a business’s value. How much to sell your business for? Web this unique business valuation template is based on discounted cash flow projections, weighted average cost of capital (wacc) and internal rate of return (irr).

Web We Have Created A Very Simple Startup Valuation Model In Excel Using The Discounted Cash Flow Method, One Of The More Common Methods For Company Valuations.

Gather previous years' financial statements. Web up your excel game and take your bv analysis to new heights: Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. Two of the most common business valuation formulas begin with either annual sales or annual profits (also known as seller discretionary earnings), multiplied by an industry multiple.

No Need To Spend Time Or Money On A Business Valuation Firm.

The capitalized earnings valuation method offers a simple way to quickly estimate the value of your business. Net annual cash flows are discounted at the weighted average cost of capital (wacc) to calculate net present value (npv), internal rate of return (irr) and an estimated business valuation. Web go to our unique business valuation template! Web this is a do it yourself valuation template that shows how to normalized ebitda, figure out comparable company multiples and apply a market valuation approach to determine a good estimate for the value of your business.

Web Use This 100% Unique Business Valuation Template To Compile An Estimated Valuation Of A Business Based On The Discounted Future Cash Flow Projections.

Web ever wonder what your business is worth? Web are you planning on buying or selling a business? Small business valuations can be subjective and it is therefore important to use a business valuation calculator with flexibility to test sensitivities. Web here’s how to set up a simple valuation template in excel.

Valuing Your Business With Our Comprehensive Templates Should Not Be Complicated.

Calculate different revenue scenarios, such as pessimistic and optimistic, for insights into upside, model and risk. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. A business valuation calculator helps buyers and sellers determine a rough estimate of a business’s value. Web this unique business valuation template is based on discounted cash flow projections, weighted average cost of capital (wacc) and internal rate of return (irr).