Present Value Excel Template

Present Value Excel Template - The adjusted present value is a modified version of the net present value (npv) that incorporates the benefits and costs of borrowing. In other words, $100 is the present value of $110 that are expected to be received in the future. Web the tutorial explains what the present value of annuity is and how to create a present value calculator in excel. Web what is the pv function in excel? Net present value ( npv) is a core component of corporate budgeting.

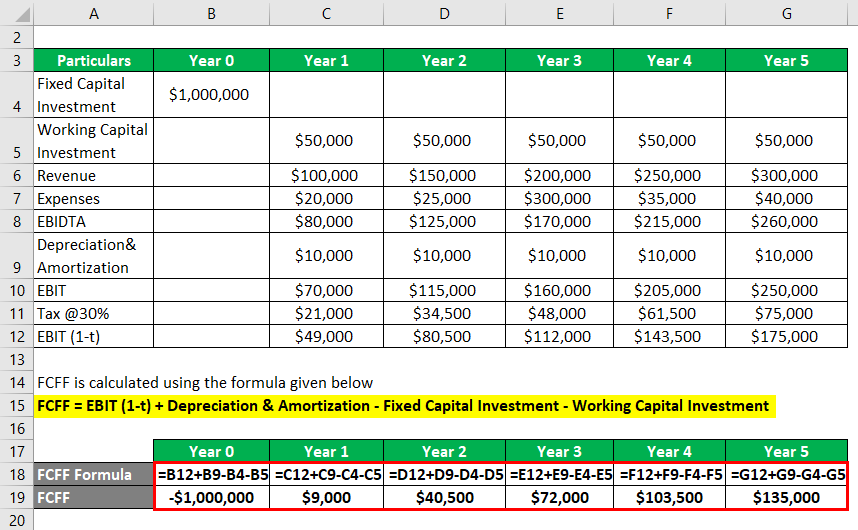

Here is a screenshot of the net present value template: Web pv function overview. Net present value (npv) adds up the present values of all future cashflows to bring them to a single point in present. Web the tutorial explains what the present value of annuity is and how to create a present value calculator in excel. The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007. This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project and pv of debt financing. Present value (pv) calculation example.

10 Excel Net Present Value Template Excel Templates Excel Templates

Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. Pv formula examples for a single lump sum and a series of regular payments. It’s widely used in the financial world and is considered a robust way to make accurate investment decisions. Present.

Present Value Calculator »

Web updated december 20, 2023. Here is a screenshot of the net present value template: Understand the difference between the two and how to compare multiple projects for profitability. Present value (pv) is the current value of a future cash flow, given a specific rate of return. Present value (pv)—also known as a discount value—measures.

Professional Net Present Value Calculator Excel Template Excel TMP

Present value is the current value of an investment now with a projected income stream as per the set interest rate. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Equalizing the rate and the period. Web net present.

Net Present Value Formula Examples With Excel Template Images

The pv function calculates the present value. In other words, $100 is the present value of $110 that are expected to be received in the future. Here is a screenshot of the net present value template: The net present value (npv) of an investment is the present value of its future cash inflows minus the.

How to calculate Present Value using Excel

This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project and pv of debt financing. Present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web updated may 31, 2021. Web pv is an excel financial function that.

Net Present Value Formula Examples With Excel Template

Below is a preview of the adjusted present value template: The pv function calculates the present value. Web fact checked by. In other words, $100 is the present value of $110 that are expected to be received in the future. “nper”, “pmt” and “rate” calculation. If we choose to invest money in a single payment.

Net Present Value Calculator Excel Templates

Syntax of the pv function. Present value (pv) is the current value of a future cash flow, given a specific rate of return. It is a comprehensive way to. Web use the excel formula coach to find the present value (loan amount) you can afford, based on a set monthly payment. The pv function is.

Present Value Calculator Excel Templates

It is commonly used to determine the value of. How to calculate present value in excel. Pv (rate, nper, pmt, [fv], [type]) Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. This net present value template helps you calculate net.

6 Net Present Value Excel Template Excel Templates Excel Templates

To get the present value of an annuity, you can use the pv function. Web pv function overview. The pv function calculates the present value. It’s widely used in the financial world and is considered a robust way to make accurate investment decisions. It is commonly used to evaluate whether a project or stock is.

10 Excel Net Present Value Template Excel Templates Excel Templates

This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web learn how to calculate npv (net present value) in excel using npv and xnpv functions. “nper”, “pmt” and “rate” calculation. In the example shown, the formula in c9 is: Pv formula examples for a single.

Present Value Excel Template In the example shown, the formula in c9 is: The adjusted present value is a modified version of the net present value (npv) that incorporates the benefits and costs of borrowing. Pv (rate, nper, pmt, [fv], [type]) “nper”, “pmt” and “rate” calculation. Below is a preview of the adjusted present value template:

Web Table Of Contents.

Analysts and investors are able to account for the time value of money, which states that an amount of money today is worth more than that same amount in the future (due to its future earning potential). Or, use the excel formula coach to find the present value of your financial investment goal. Web fact checked by. =pv ( 4%, 5, 0, 15000 ) for example, the spreadsheet on the right shows the excel pv function used to calculate the present value of an investment that earns an annual interest rate of 4% and has a future value of $15,000 after 5 years.

How To Calculate Present Value In Excel.

Present value (pv) of bond assumptions. Present value (pv) is the current value of a future cash flow, given a specific rate of return. The pv function calculates the present value. The pv function is a financial function that returns the present value of an investment.

Web Net Present Value (Npv) Is A Method To Analyze Projects And Investments And Find Out Whether These Would Be Profitable Or Not.

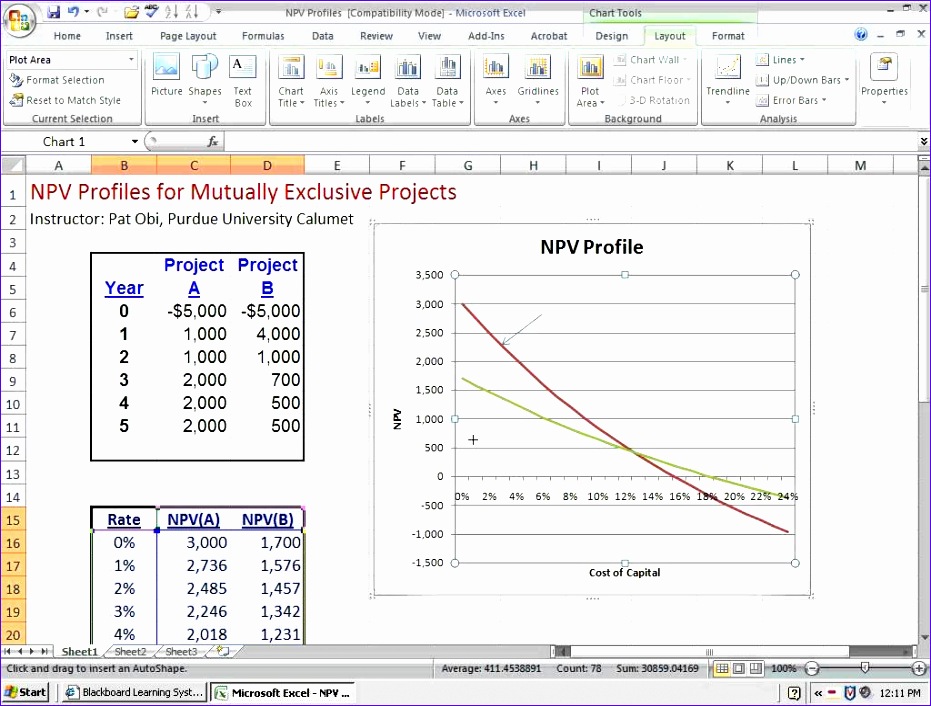

Net present value ( npv) is a core component of corporate budgeting. In the example shown, the formula in c9 is: The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web learn how to calculate npv (net present value) in excel using npv and xnpv functions.

At The Same Time, You'll Learn How To Use The Pv Function In A Formula.

“nper”, “pmt” and “rate” calculation. Web what is pv. How to calculate present value (pv) present value formula (pv) how does the discount rate affect present value? Web pv function overview.