Merger Model Template

Merger Model Template - Web merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Full tutorial and sample excel model. Here we discuss the introduction and top 3 examples of merger along with a. Web merger models are used to explore the potential financial implications of putting two companies (or more) together;. Web steps to building a merger model.

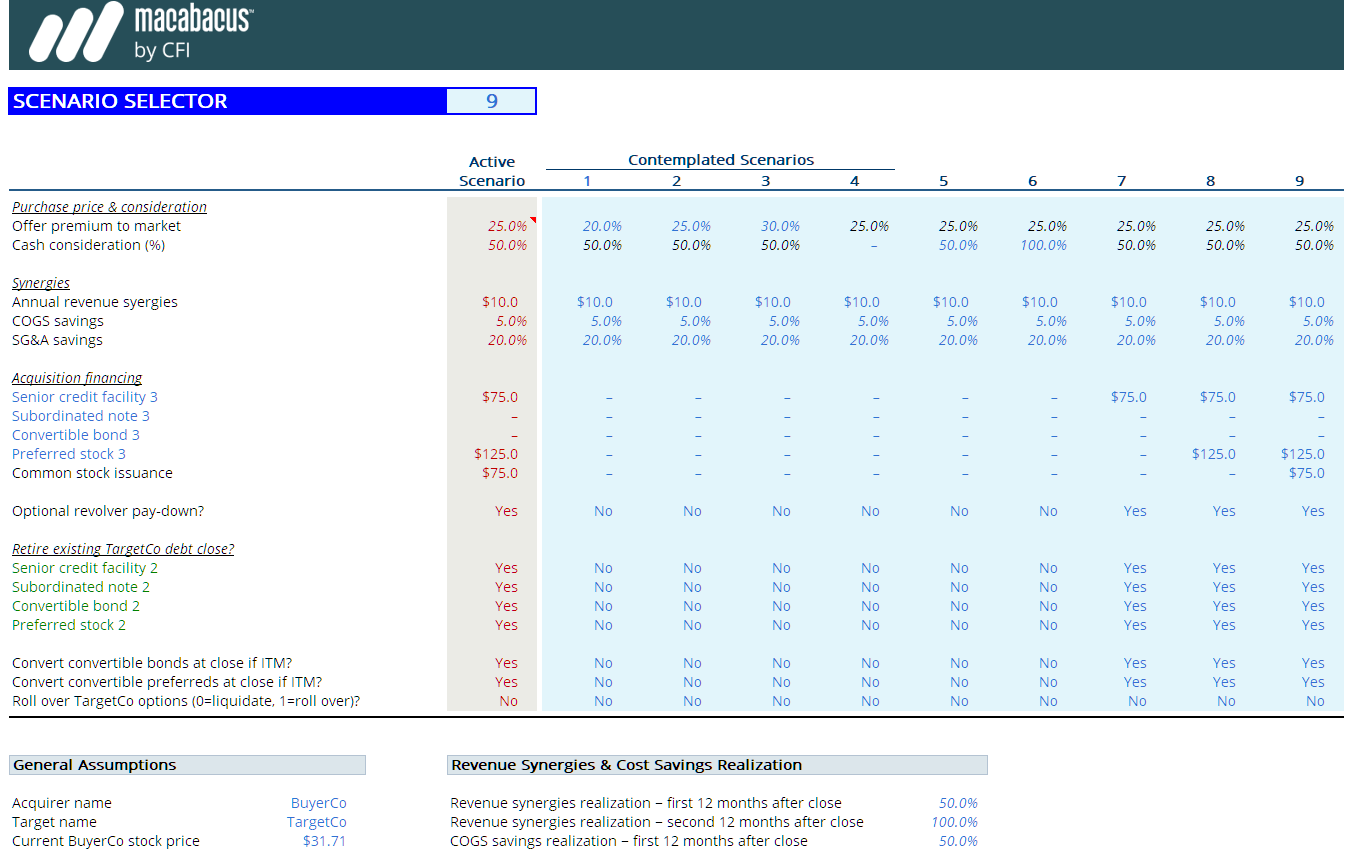

Web how to build a merger model? The modeling process begins with creating acquisition assumptions. Cash, since interest rates on cash are lower than interest rates on debt, and tend to be low in general. Web cost synergies in m&a deals and merger models: The macabacus merger model implements advanced m&a, accounting, and tax. 1) project the financial statements of. Web merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the.

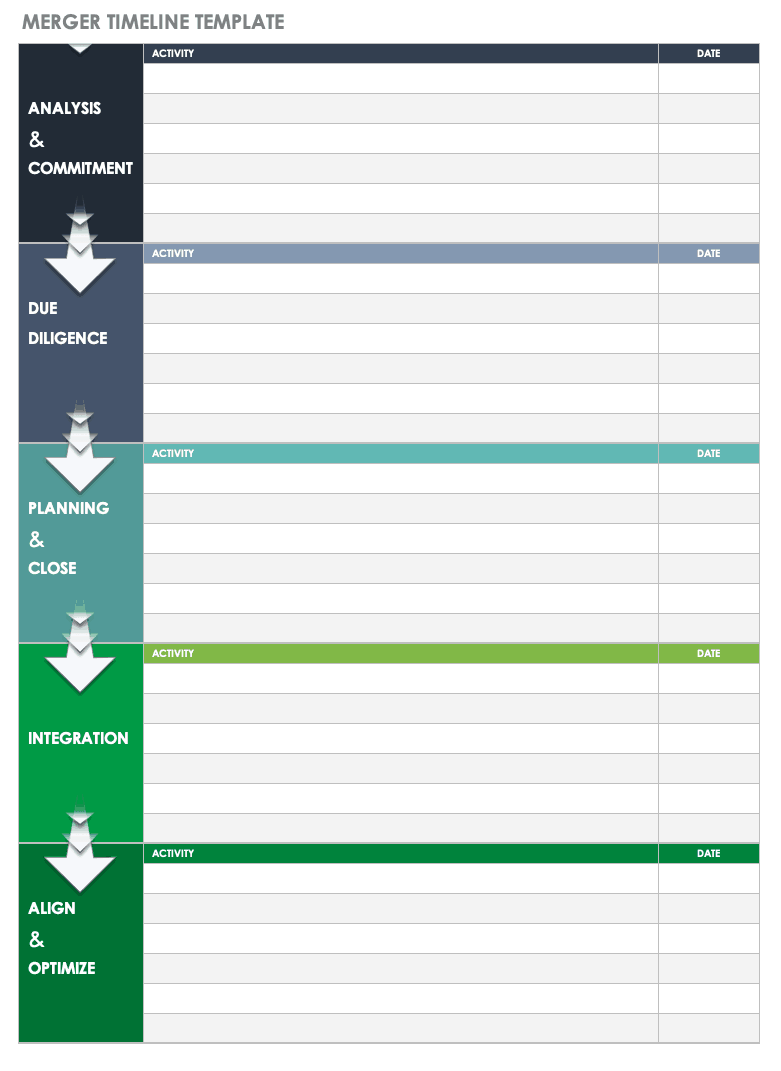

Download Free M&A Templates Smartsheet

This merger agreement (“agreement”) is made on [insert date] by and between: Web merger models are used to explore the potential financial implications of putting two companies (or more) together;. Merger agreements are generated after particular processes a company conducts in order to gain concessions as. In this section, we demonstrate how to model a.

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Here we discuss the introduction and top 3 examples of merger along with a. This merger agreement (“agreement”) is made on [insert date] by and between: Compare historical performance step 2. The macabacus merger model implements advanced m&a, accounting, and tax. Full tutorial and sample excel model. 1) project the financial statements of. In this.

Merger Model Templates Macabacus

Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal). The main steps in building a merger. 8.5 hours of video content. Step 1 → determine the offer value per share. The process of building a merger model consists of the following steps: This merger.

Merger Model M&A Acquisition Street Of Walls

Web this is a guide to merger examples. Web get started fast with ready to use templates for specific use cases, job functions, and industries. Web merger models are used to explore the potential financial implications of putting two companies (or more) together;. In this section, we demonstrate how to model a merger of. Choose.

Merger Model StepByStep Walkthrough [Video Tutorial]

Web get started fast with ready to use templates for specific use cases, job functions, and industries. Merger agreements are generated after particular processes a company conducts in order to gain concessions as. Compare historical performance step 2. The main steps in building a merger. The process of building a merger model consists of the.

Merger Model M&A Excel Template from CFI Marketplace

Web this advanced financial model template is presenting a potential merger & acquisition (m&a) transaction between two. The process of building a merger model consists of the following steps: Obviously, merger agreements involve money, like the security deposit or earnest money. Web 2 minutes read. 8.5 hours of video content. Web how to build a.

Merger Model M&A Excel Template from CFI Marketplace

Web a merger model is an analysis of the combination of two companies. Web 2 minutes read. 1) project the financial statements of. Web merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Web np 5.3 discusses the fasb’s considerations for distinguishing between.

Timeline Template of Mergers Model SlideModel

In this section, we demonstrate how to model a merger of. Cash, since interest rates on cash are lower than interest rates on debt, and tend to be low in general. Web cost synergies in m&a deals and merger models: This merger agreement (“agreement”) is made on [insert date] by and between: 8.5 hours of.

Merger Model M&A Excel Template from CFI Marketplace

Merger agreements are generated after particular processes a company conducts in order to gain concessions as. This merger agreement (“agreement”) is made on [insert date] by and between: 8.5 hours of video content. The macabacus merger model implements advanced m&a, accounting, and tax. Web how to build a merger model? Web get started fast with.

Merger Model M&A Excel Template from CFI Marketplace

Web this advanced financial model template is presenting a potential merger & acquisition (m&a) transaction between two. Web 2 minutes read. Web merger models are used to explore the potential financial implications of putting two companies (or more) together;. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates.

Merger Model Template Web 2 minutes read. Web merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Web get started fast with ready to use templates for specific use cases, job functions, and industries. Web a merger model is an analysis of the combination of two companies. Forecast impact on variable costs.

Here We Discuss The Introduction And Top 3 Examples Of Merger Along With A.

Web learn advanced financial modeling techniques and transaction analysis for mergers and acquisitions (m&a). Obviously, merger agreements involve money, like the security deposit or earnest money. Cash, since interest rates on cash are lower than interest rates on debt, and tend to be low in general. Full tutorial and sample excel model.

Choose From Over 200 Starting.

Web a merger model is an analysis of the combination of two companies. The modeling process begins with creating acquisition assumptions. Web steps to building a merger model. The macabacus merger model implements advanced m&a, accounting, and tax.

Web Get Started Fast With Ready To Use Templates For Specific Use Cases, Job Functions, And Industries.

Web cost synergies in m&a deals and merger models: Web this is a guide to merger examples. The main steps in building a merger. This merger agreement (“agreement”) is made on [insert date] by and between:

Compare Historical Performance Step 2.

Web how to build a merger model? Web this advanced financial model template is presenting a potential merger & acquisition (m&a) transaction between two. 1) project the financial statements of. Step 1 → determine the offer value per share.

![Merger Model StepByStep Walkthrough [Video Tutorial]](https://biwsuploads-assest.s3.amazonaws.com/biws/wp-content/uploads/2019/04/22161546/Merger-Model-Assumptions-1024x537.jpg)