Irs Penalty Abatement Templates

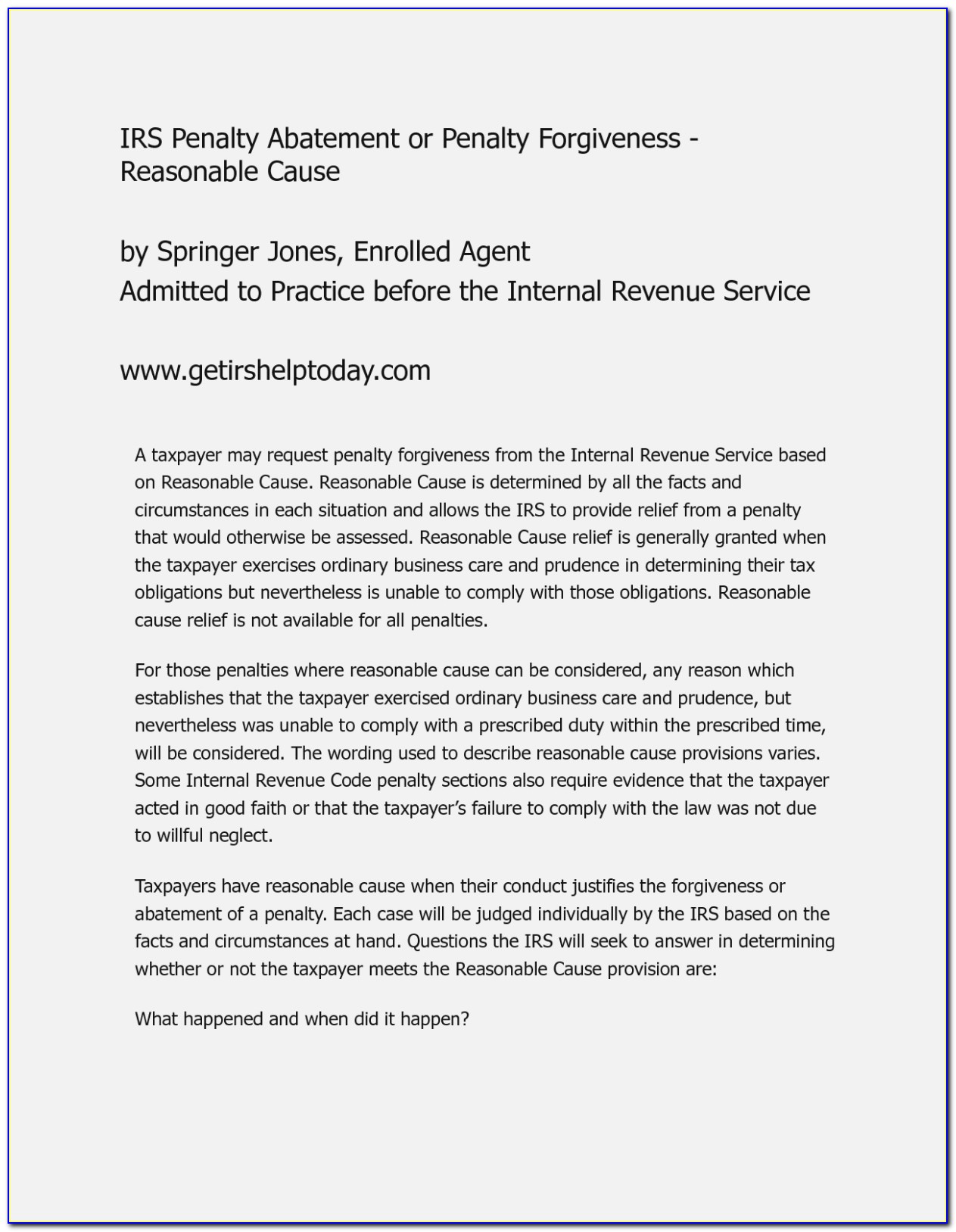

Irs Penalty Abatement Templates - Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. (91596) what did you think of this? Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a.

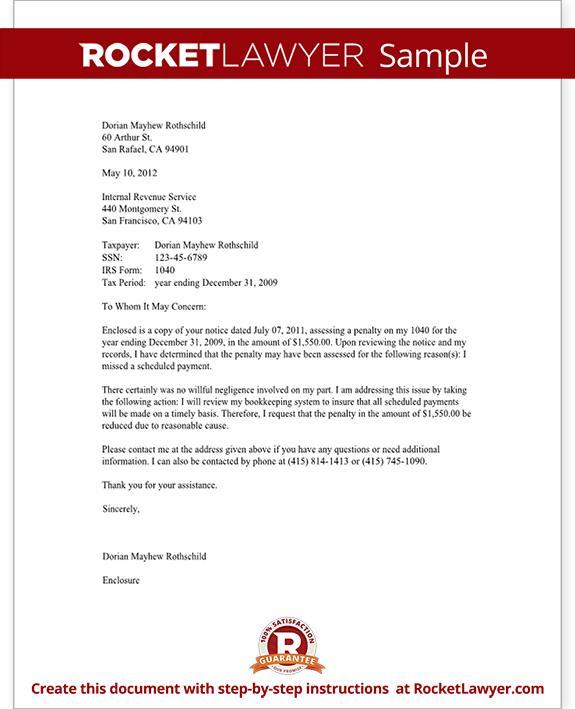

Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of.

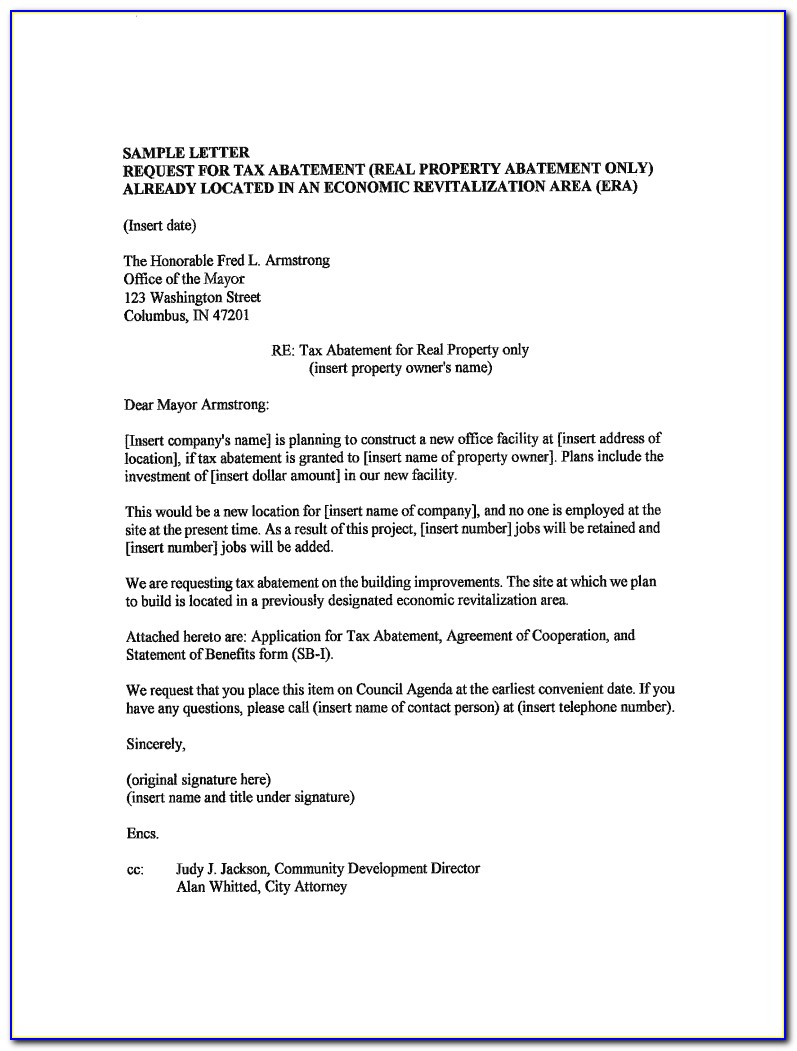

Sample Letter To Irs To Waive Penalty

Sample irs penalty abatement request. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Web the irs offers a penalty abatement on failure to file and.

How to remove IRS tax penalties in 3 easy steps. The IRS Penalty

Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of. Web here is a simplified irs letter template that you can use when writing to the irs: 0.5% per month of balance due, maximum of 25%. Web sample penalty abatement letter to irs to waive tax penalties if the irs has.

How to Write a Form 990 Late Filing Penalty Abatement Letter

Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web covid penalty relief to help taxpayers affected.

Actual IRS Penalty Abatement Letter for Betty 152k Abated Don Fitch

Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. A penalty abatement request letter asks the irs to.

Irs Penalty Abatement Letter Mailing Address

Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web the penalty is typically assessed at a rate of 5% per.

Form 14 Penalty Abatement The 14 Steps Needed For Putting Form 14

Web how to apply for penalty abatement. Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. Web sample penalty abatement letter.

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Irs penalties

(91596) what did you think of this? 0.5% per month of balance due, maximum of 25%. Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter.

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. Web the failure to pay penalty: Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. (91596) what did you think of.

Response to IRS Penalty Letter (Template With Sample)

A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Sample irs penalty abatement request. 0.5% per month of balance due, maximum of 25%. Web covid penalty.

31+ Penalty Abatement Letter Sample Sample Letter

A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Web irs penalty abatement templates (free to aicpa tax section members): Web the irs offers a penalty abatement.

Irs Penalty Abatement Templates Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Internal revenue service (use the address. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs.

Web The Penalty Is Typically Assessed At A Rate Of 5% Per Month, Up To 25% Of The Unpaid Tax When A Federal.

Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web the failure to pay penalty:

(91596) What Did You Think Of This?

Sample irs penalty abatement request. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits.

Internal Revenue Service (Use The Address.

Web here is a simplified irs letter template that you can use when writing to the irs: Web irs penalty abatement templates (free to aicpa tax section members): A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of.

In 2019, These Penalties Made Up.

Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. 0.5% per month of balance due, maximum of 25%. Web how to apply for penalty abatement.