How To Find Ytm In Excel

How To Find Ytm In Excel - The settlement date, maturity date, rate, price, and redemption value. Web with all these values available, excel will calculate for you the ytm value using the rate function. Web the inputs entered in our yield function formula to compute the yield to maturity (ytm) are as follows. To use this function, here are the steps: Returns the yield on a security that pays periodic interest.

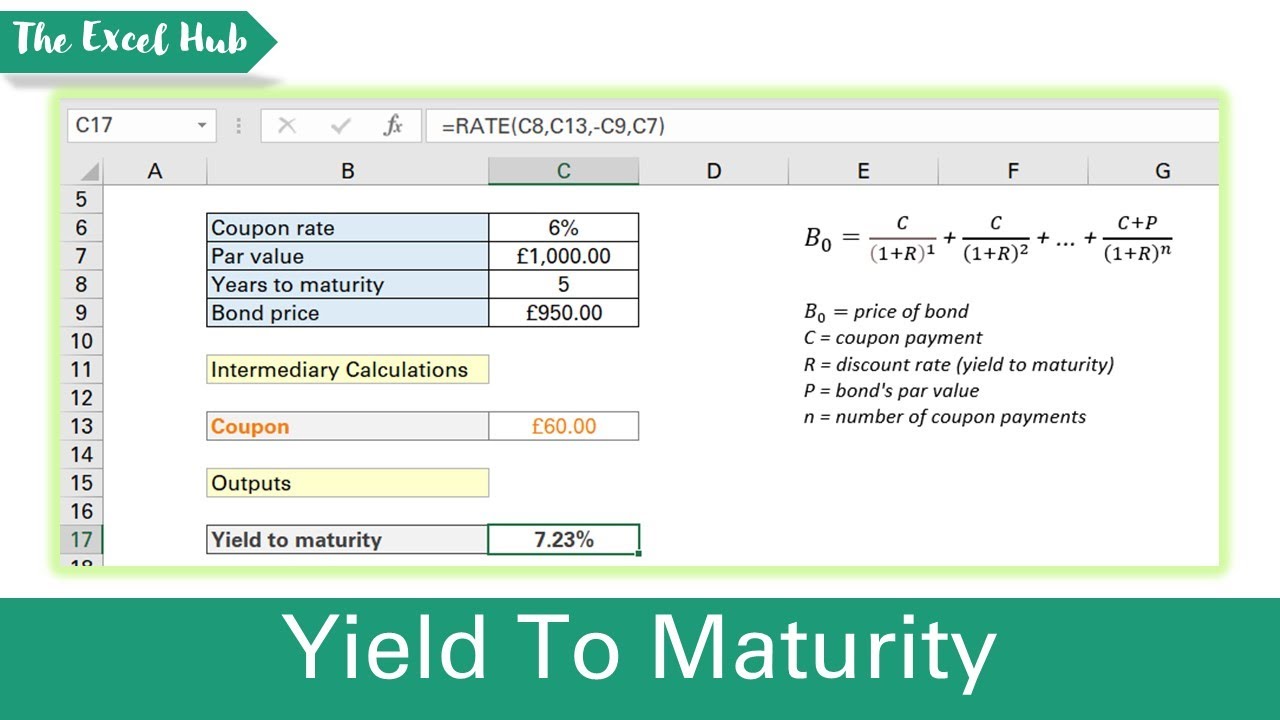

To use this function, here are the steps: Web with your excel sheet set up, calculating ytm is straightforward. Web to calculate ytm in excel, use the yield function, which requires five arguments: Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. The formula to price a traditional bond is: Web below is the formula: How to use =rate in.

Calculating bond’s yield to maturity using excel YouTube

Web to calculate ytm in excel, use the yield function, which requires five arguments: Web this article describes the formula syntax and usage of the yield function in microsoft excel. C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to.

How to calculate YTM in Excel Basic Excel Tutorial

=yield (f4, f7 ,f15,f12, f8 ,f14) the implied yield to. You’ll need to use the following formula: Web with your excel sheet set up, calculating ytm is straightforward. =ytm(n,c1:cn,p,fv) where n is the number of periods,. Web to calculate ytm in excel, use the yieldmat function. C = annual coupon payment f = face value.

How to calculate YTM in Excel Basic Excel Tutorial

35k views streamed 6 years ago. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. Web below is the formula: To use this function, here are the steps: =yield (f4, f7 ,f15,f12, f8 ,f14) the implied yield to. Web the first step in finding the yield to maturity in.

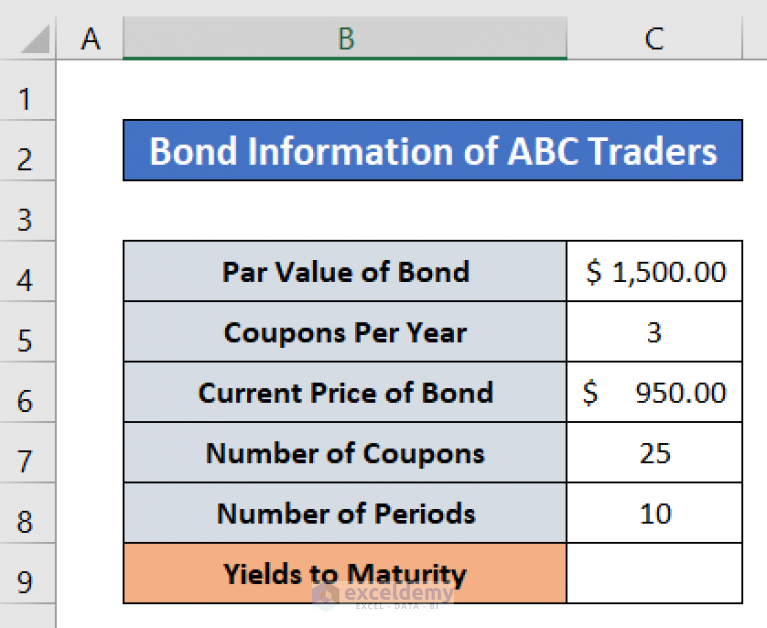

How to Calculate YTM of a Bond in Excel (4 Suitable Methods)

C = it appears as an annual coupon amount. The settlement date, maturity date, rate, price, and redemption value. Web below is the formula: C = annual coupon payment f = face value of the bond p = price paid for the bond n = number of years to maturity. Web to calculate ytm in.

How to Calculate YTM of a Bond in Excel (4 Suitable Methods)

To use this function, here are the steps: Returns the yield on a security that pays periodic interest. How to use =rate in. Web specifically i show how students can use =rate and =irr functions in excel to calculate the yield of a bond making annual coupon payments, and then a bond. The settlement date,.

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

Web this article describes the formula syntax and usage of the yield function in microsoft excel. Web the inputs entered in our yield function formula to compute the yield to maturity (ytm) are as follows. The settlement date, maturity date, rate, price, and redemption value. Web with all these values available, excel will calculate for.

Finding Yield to Maturity using Excel YouTube

Web the inputs entered in our yield function formula to compute the yield to maturity (ytm) are as follows. This function calculates the yield to maturity of a bond based on its par value, price, coupon. C = it appears as an annual coupon amount. Returns the yield on a security that pays periodic interest..

Calculate The YTM Of A Bond With Semi Annual Coupon Payments In Excel

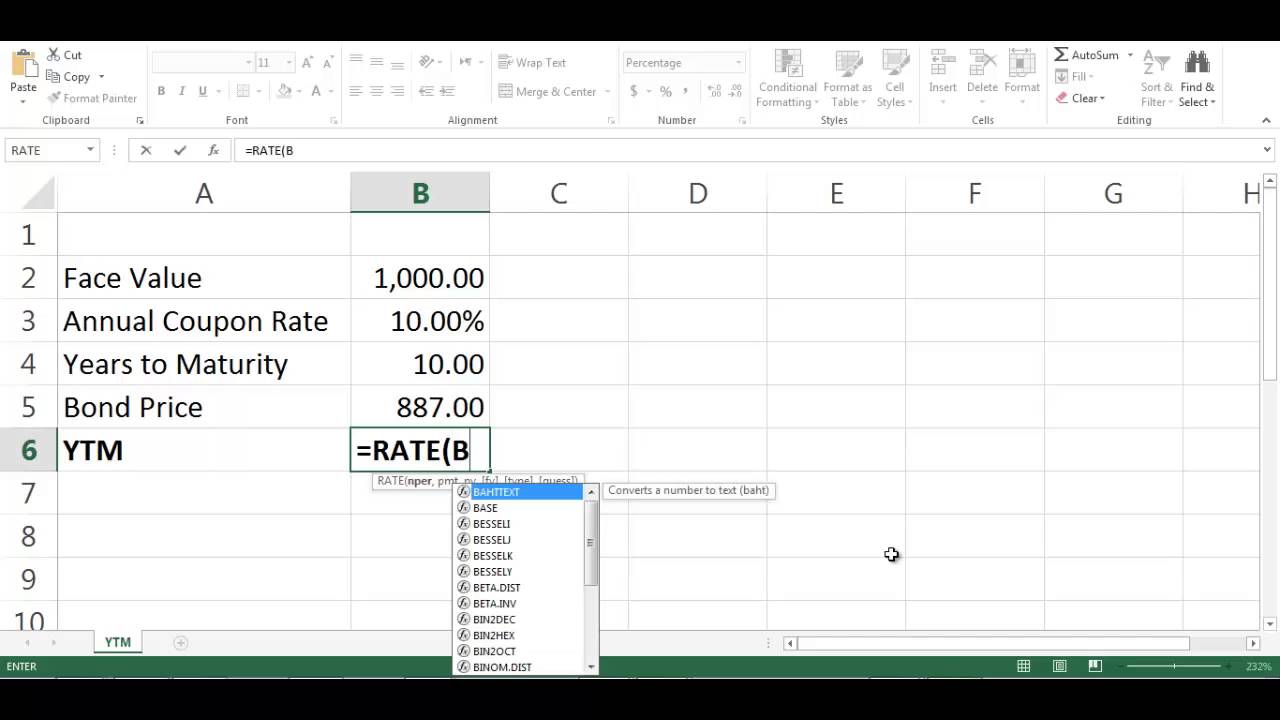

Since the yield to maturity represents the annualized return on a bond, you can also use the internal. How to use =rate in ms excel to calculate ytm for bonds. Web the first step in finding the yield to maturity in excel is to use the rate function. How to calculate the yield to maturity.

How to Make a Yield to Maturity Calculator in Excel ExcelDemy

Web specifically i show how students can use =rate and =irr functions in excel to calculate the yield of a bond making annual coupon payments, and then a bond. Web with all these values available, excel will calculate for you the ytm value using the rate function. =ytm(n,c1:cn,p,fv) where n is the number of periods,..

Calculate The Yield To Maturity Of A Bond In Excel YouTube

How to use =rate in ms excel to calculate ytm for bonds. Web to calculate ytm in excel, use the yieldmat function. The formula to price a traditional bond is: How to use =rate in. Web this article describes the formula syntax and usage of the yield function in microsoft excel. This function calculates the.

How To Find Ytm In Excel Web the inputs entered in our yield function formula to compute the yield to maturity (ytm) are as follows. Web to calculate ytm in excel, use the yield function, which requires five arguments: How to calculate the yield to maturity with the irr function. Ytm is a key metric for investors that want to understand the expected rate of. =ytm(n,c1:cn,p,fv) where n is the number of periods,.

This Function Calculates The Yield To Maturity Of A Bond Based On Its Par Value, Price, Coupon.

Web with all these values available, excel will calculate for you the ytm value using the rate function. Fv = it appears as a face value. Ytm is a key metric for investors that want to understand the expected rate of. The formula to price a traditional bond is:

C = Annual Coupon Payment F = Face Value Of The Bond P = Price Paid For The Bond N = Number Of Years To Maturity.

=ytm(n,c1:cn,p,fv) where n is the number of periods,. 35k views streamed 6 years ago. How to calculate the yield to maturity with the irr function. The settlement date, maturity date, rate, price, and redemption value.

=Yield (F4, F7 ,F15,F12, F8 ,F14) The Implied Yield To.

Returns the yield on a security that pays periodic interest. Web with your excel sheet set up, calculating ytm is straightforward. Web the inputs entered in our yield function formula to compute the yield to maturity (ytm) are as follows. You’ll need to use the following formula:

How To Use =Rate In Ms Excel To Calculate Ytm For Bonds.

Web the yield to maturity (ytm) is calculated by the following formula: Web this article describes the formula syntax and usage of the yield function in microsoft excel. Settlement date, maturity date, issue date, rate, price per $100 face value (pr), and day. Web below is the formula: