How To Find Payback Period In Excel

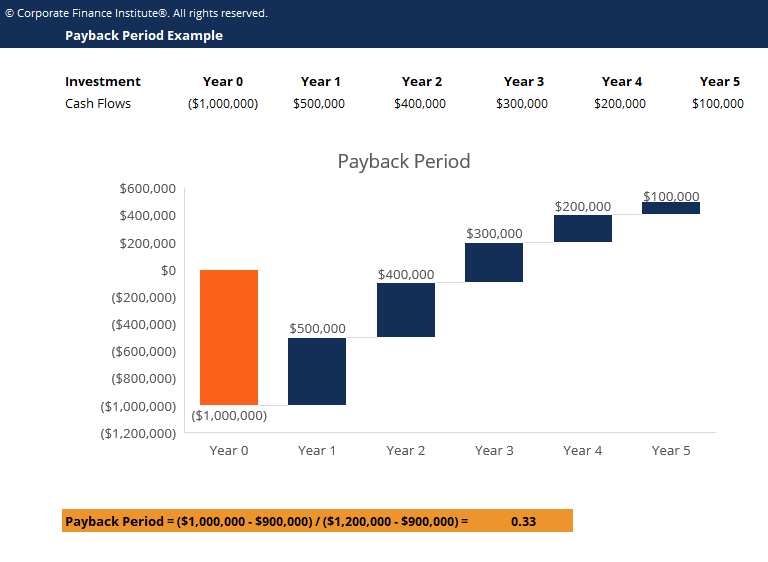

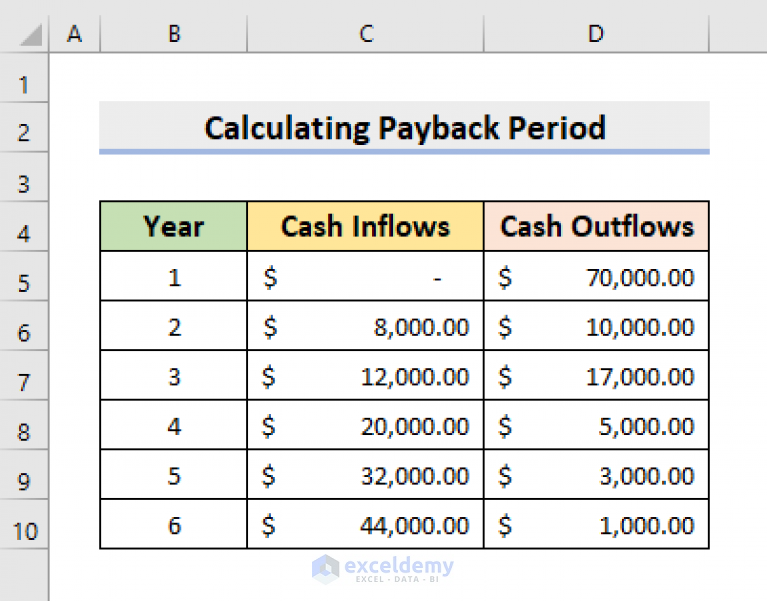

How To Find Payback Period In Excel - For example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5. Web written by durjoy paul. Time value of money is neglected 2. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or “cumulative cash flow” by applying the. If you invested $8,000 and the cash flow remains $2,000 per year, the payback period reduces to 4 years:

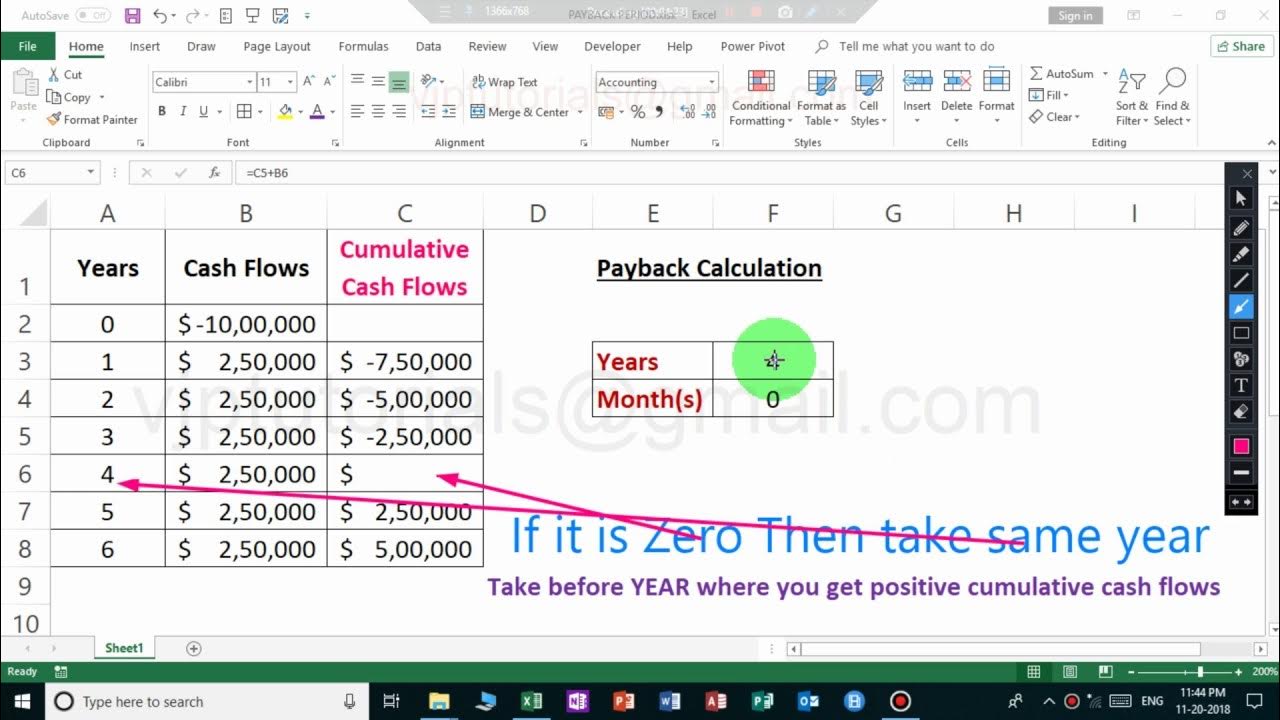

Web you can figure out the payback period by using the following formula: Without any further ado, let’s get started with calculating the payback period in excel. Let’s start with the most obvious way to calculate the discounted payback period in excel. This article will show how to calculate the payback period with uneven cash flows. Apply the match function to identify the first period where the cumulative cash flow becomes nonnegative, signaling the payback period. By following these simple steps, you can easily calculate the payback period in excel. Subtract the investment cost from the cumulative cash flows until the result is zero or positive.

How to Calculate Payback Period in Excel (With Easy Steps)

Suppose the initial investment amount of a project is $60,000, calculate the payback period if the cash inflows is $ 20,000 per year for 5 years. Calculate the net/ cumulative cash flow. Web locating the breakeven point. Without any further ado, let’s get started with calculating the payback period in excel. Web but since the.

How to Calculate the Payback Period With Excel

• the payback period is the estimated amount of time it will take to recoup an investment or to break even. The above screenshot gives you the formulae that i have used to determine the payback period in excel. The payback period is the amount of time needed to recover the initial outlay for an.

Payback Period How to Use and Calculate It BooksTime

This article will show how to calculate the payback period with uneven cash flows. The payback period calculates how much time is required to return the initial capital from an investment. Here's how you can do it: In spite of its simplicity, the payback period cannot be the sole factor in selecting a project. If.

How to Calculate Discounted Payback Period in Excel

If you invested $8,000 and the cash flow remains $2,000 per year, the payback period reduces to 4 years: It can be calculated from even or uneven cash flows. By following these simple steps, you can easily calculate the payback period in excel. Enter financial data in your excel worksheet. \begin {aligned}\text {payback period}=\frac {\text.

Payback period calculation formula NosheenRayan

Use the match function to find the period when cumulative cash. Web you can figure out the payback period by using the following formula: In general, the shorter the payback period, the better, as it means that the investment will recover. Web written by durjoy paul. Web locating the breakeven point. This marks the breakeven.

How To Calculate Payback Period In Excel Using Formula

Web you can figure out the payback period by using the following formula: Here's how you can do it: Use autofill to complete the rest. Calculate the net/ cumulative cash flow. We begin by transferring the data to an excel spreadsheet. • there are two formulas for calculating the payback period: • generally, the longer.

How to calculate PAYBACK PERIOD in MS Excel Spreadsheet 2019 YouTube

This marks the breakeven point and sets the stage for determining the payback period. In addition to other capital budgeting techniques, it can also be used independently. In spite of its simplicity, the payback period cannot be the sole factor in selecting a project. Web steps to calculate payback period in excel. Web formula for.

How to Calculate Payback Period in Excel (With Easy Steps)

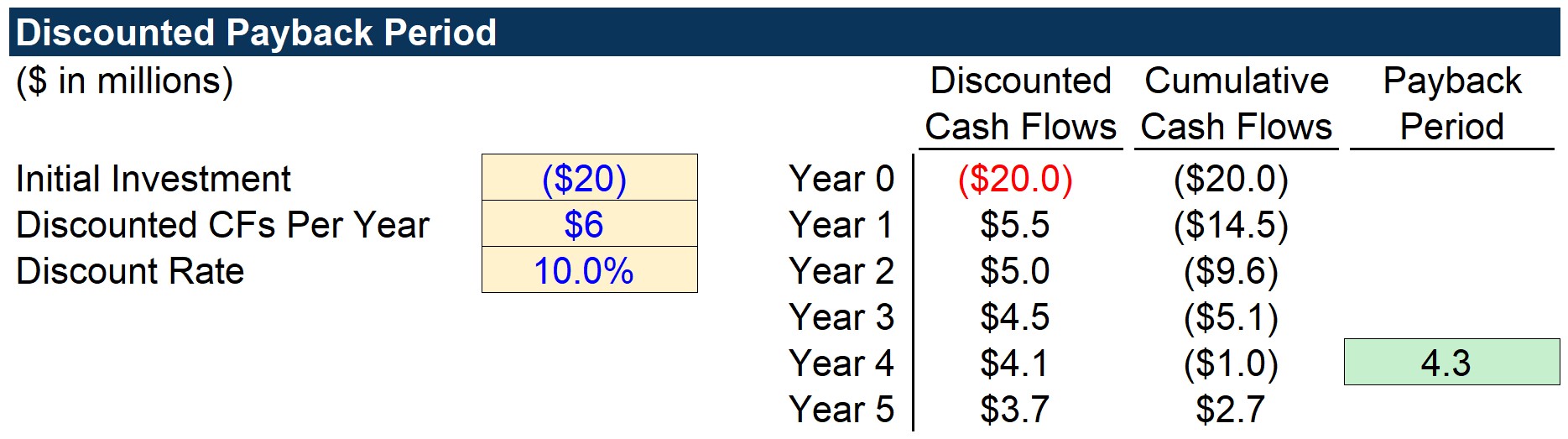

Discounted payback period example calculation. What is the discounted payback period? Here's how you can do it: Use autofill to complete the rest. This formula is used where you have a constant cash inflow. The payback period helps us to calculate the time taken to recover the initial cost of investment without considering the time.

How to Calculate Payback Period in Excel (With Easy Steps)

Web the payback period is a straightforward calculation of how long it will take for the initial investment to pay off. Web the payback period is calculated by dividing the initial investment by the cash flows generated by the investment. This one is a simple countif formula. Let’s start with the most obvious way to.

How to Calculate Payback Period in Excel? QuickExcel

This marks the breakeven point and sets the stage for determining the payback period. Without any further ado, let’s get started with calculating the payback period in excel. Web if you just want to calculate the payback period using a simple formula and your cash flow / savings is the same every year, then simply.

How To Find Payback Period In Excel Using pv function to calculate discounted payback period. Apply the match function to identify the first period where the cumulative cash flow becomes nonnegative, signaling the payback period. For example, if you invested $10,000 in a business that gives you $2,000 per year, the payback period is $10,000 / $2,000 = 5. Web table of contents. Web pp = initial investment / cash flow.

Without Any Further Ado, Let’s Get Started With Calculating The Payback Period In Excel.

Let’s start with the most obvious way to calculate the discounted payback period in excel. Web in an excel spreadsheet, list the net profit in one cell (e.g., a1) and the total investment in another cell (e.g., b1 ). Web the formula used to calculate the payback period is: The payback period is the amount of time needed to recover the initial outlay for an investment.

Here's How You Can Do It:

Use the match function to find the period when cumulative cash. Web pp = initial investment / cash flow. If your data contains both cash inflows and cash outflows, calculate “net cash flow” or “cumulative cash flow” by applying the. Web table of contents.

This Formula Divides Net Profit By Total Investment And Multiplies The Result By 100 For Percentage Representation.

Web payback period = initial investment / annual cash flow. Use autofill to complete the rest. Web the payback period is calculated by dividing the initial investment by the cash flows generated by the investment. It can be calculated from even or uneven cash flows.

Web Calculating The Payback Period In Excel Can Be Done Using The Match Function To Find The Period When Cumulative Cash Flows Reach The Initial Investment.

The above screenshot gives you the formulae that i have used to determine the payback period in excel. Web you can figure out the payback period by using the following formula: In a third cell (e.g., c1 ), input the formula = (a1/b1)*100 to calculate the roi. Web locating the breakeven point.