How To Compute Effective Interest Rate In Excel

How To Compute Effective Interest Rate In Excel - Let's look at examples of how real interest is considered. Effective annual interest rate is the interest rate actually earned due to compounding. You have set up your excel worksheet to look like the one below. Web excel is a powerful tool for calculating the effective interest rate, as it can easily handle complex formulas and provide immediate results. • in excel, you use the function effect.

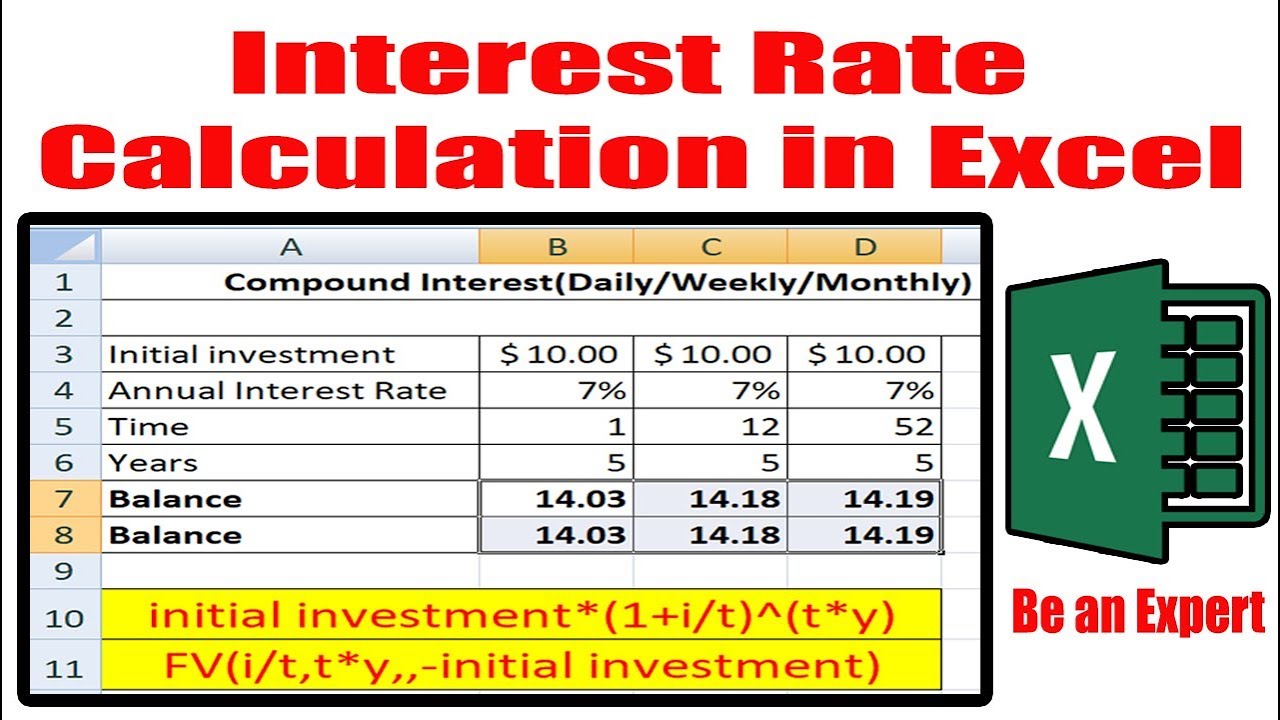

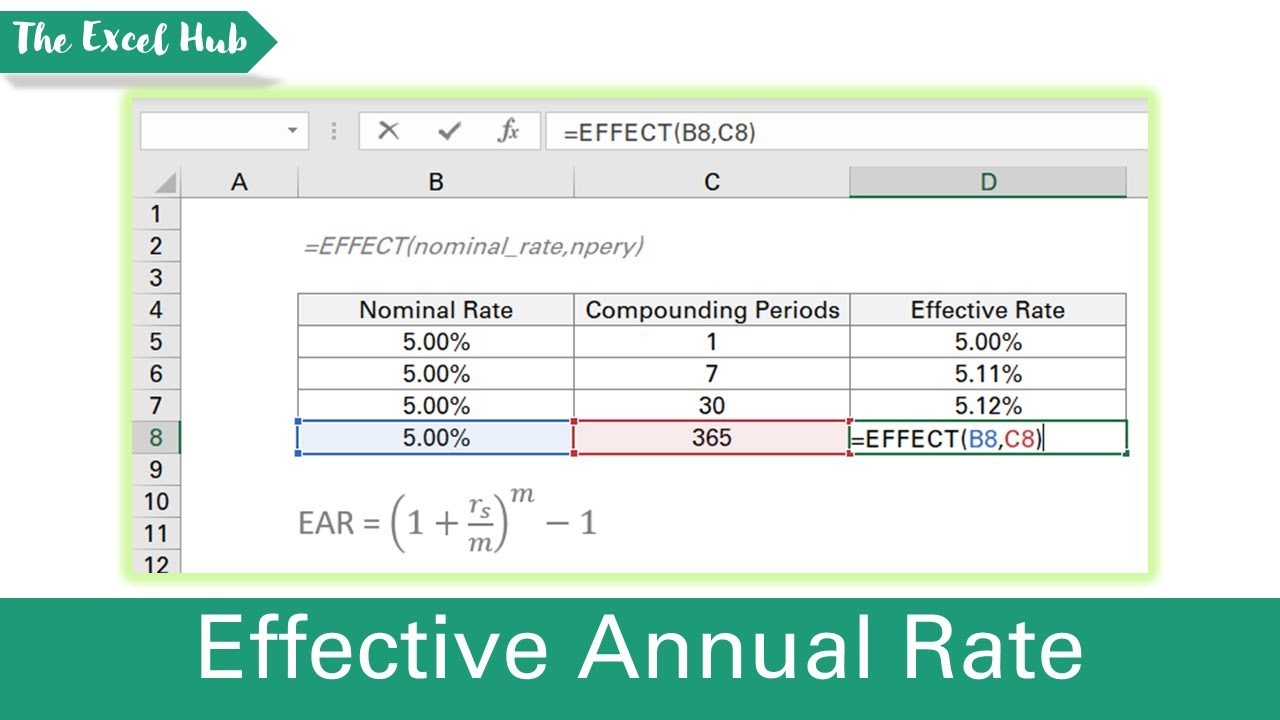

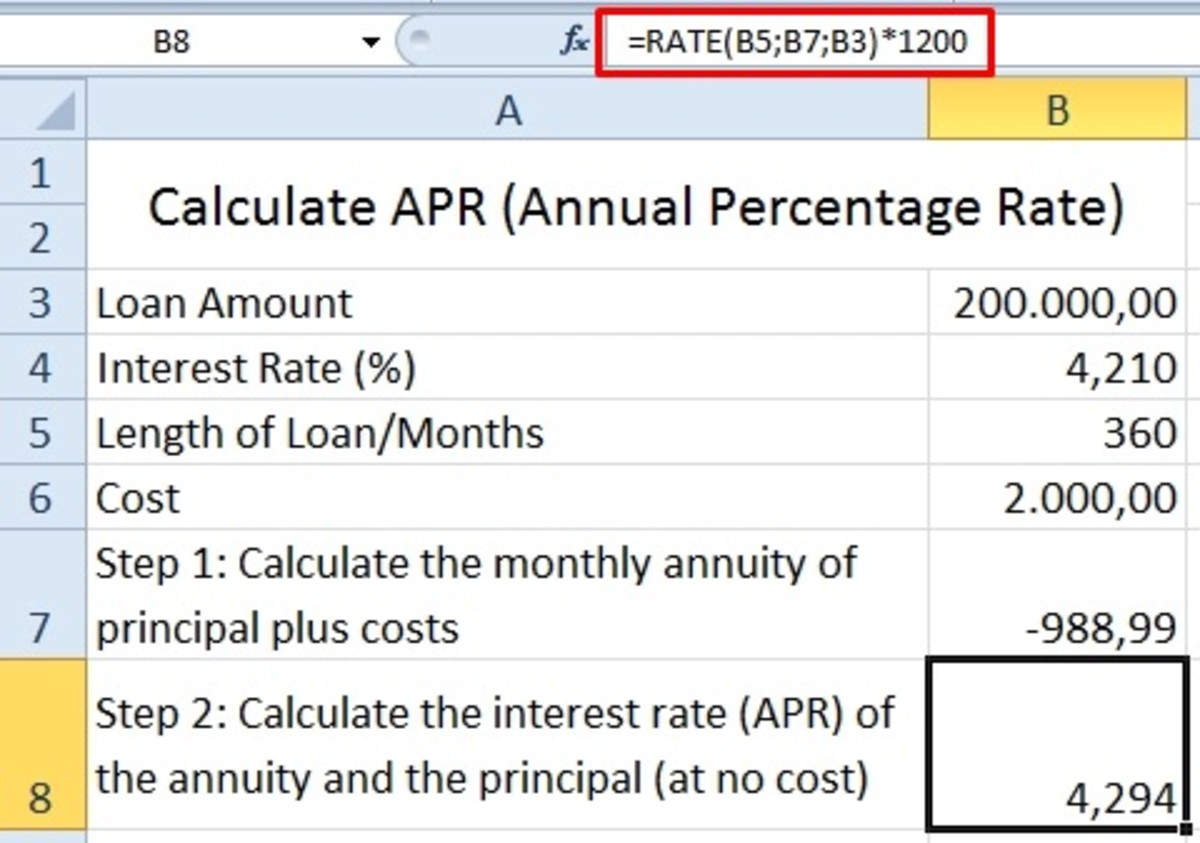

Offer examples to illustrate the calculation process. To accomplish the task, we will apply several functions including the irr , xirr, and effect functions. Calculating the effective annual rate (ear) is crucial in financial analysis as it provides the true annual interest rate when compounding is taken into account. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan. The syntax is as follows: Web enter the formula =effect (nominal_interest_rate, npery), where nominal_interest_rate is the annual nominal interest rate and npery is the number of compounding periods per year. Here we discuss how to calculate effective interest rates along with practical examples.

How to Calculate Effective Interest Rate Using Excel ToughNickel

Effective annual interest rate calculator. The effective interest rate describes the full cost of borrowing. Then we will go for the effect function to calculate the effective interest. I will use the effect function to do so. Now, let’s see how to calculate the effective interest rate. Effect(nominal_rate, npery) the effect function syntax has the.

Interest Rate Calculation in Excel YouTube

Effect(nominal_rate, npery) the effect function syntax has the following arguments: Let's look at examples of how real interest is considered. Now, let’s see how to calculate the effective interest rate. Let’s play around with the effective annual interest rate in excel, to understand the ear concept and see the impact of the effective rate versus..

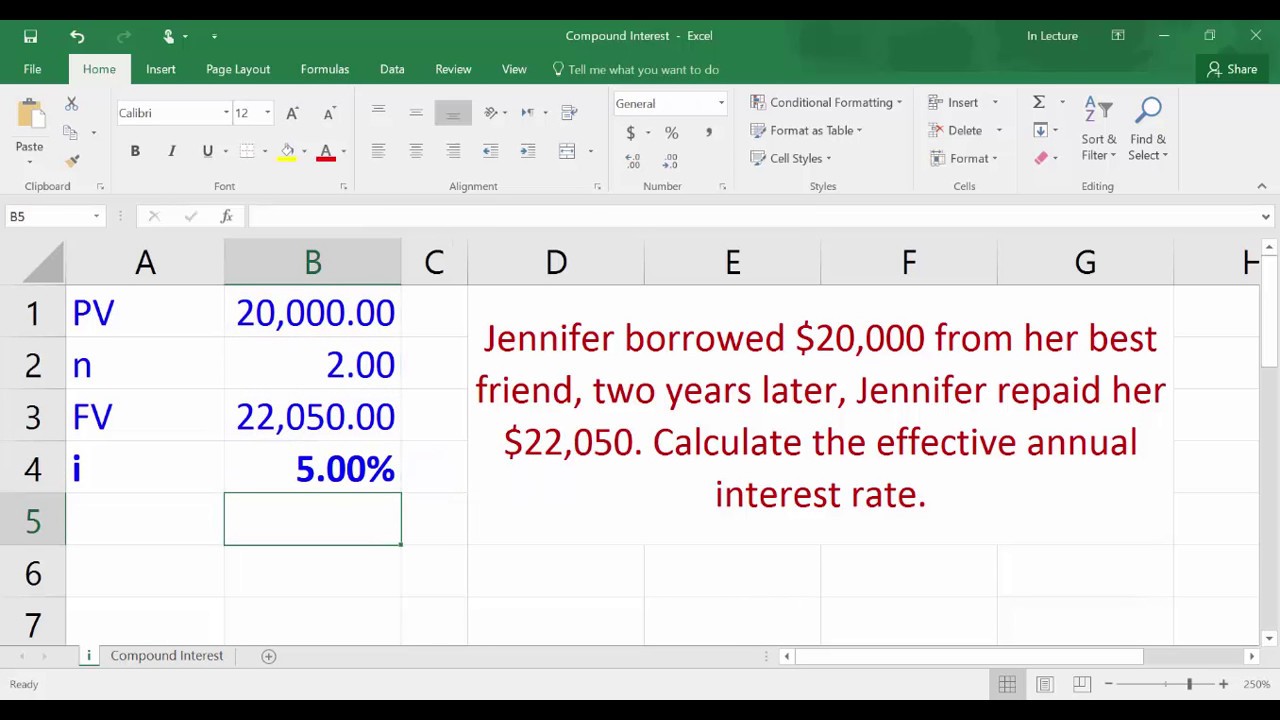

Compound Interest Calculating effective interest rate using Excel YouTube

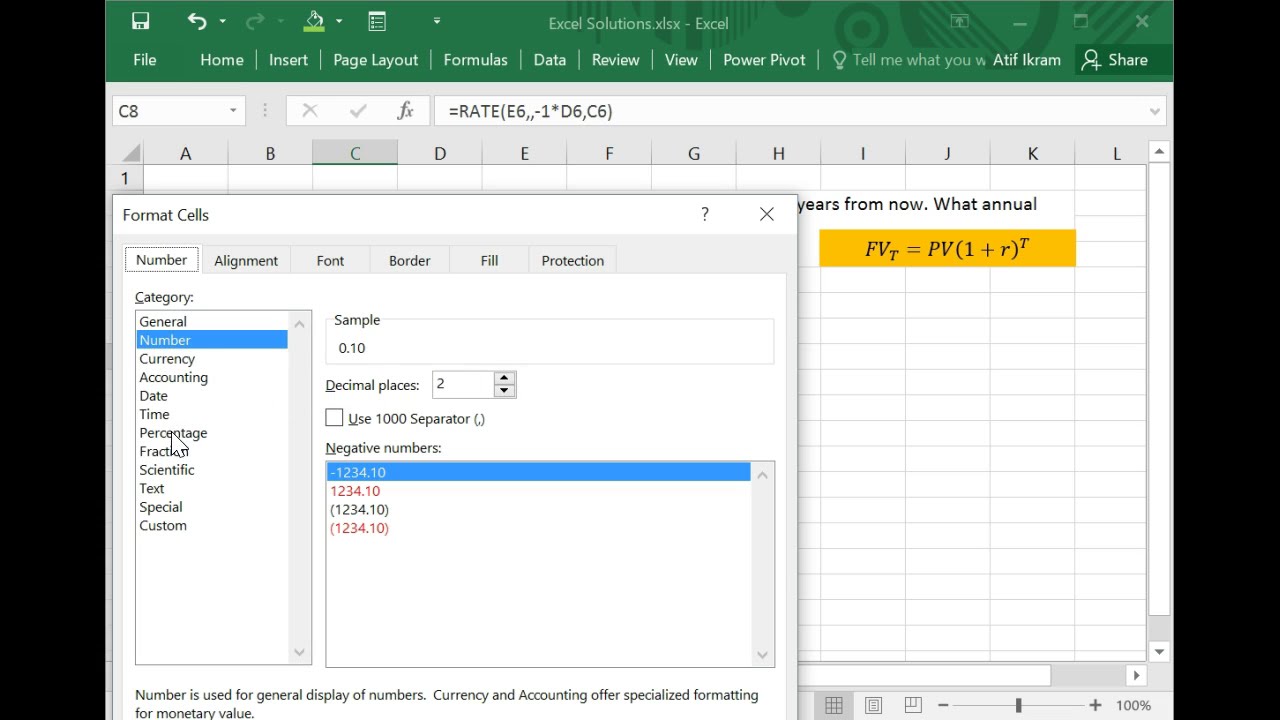

Nominal interest rate is the stated rate on the financial product. Web calculation of the effective interest rate on the loan, leasing and government bonds is performed using the functions effect, irr, xirr, fv, etc. Web use of effect function to calculate effective interest rate in excel. For example, it can calculate interest rates in.

How to Calculate the Interest Rate (=RATE) in MS Excel YouTube

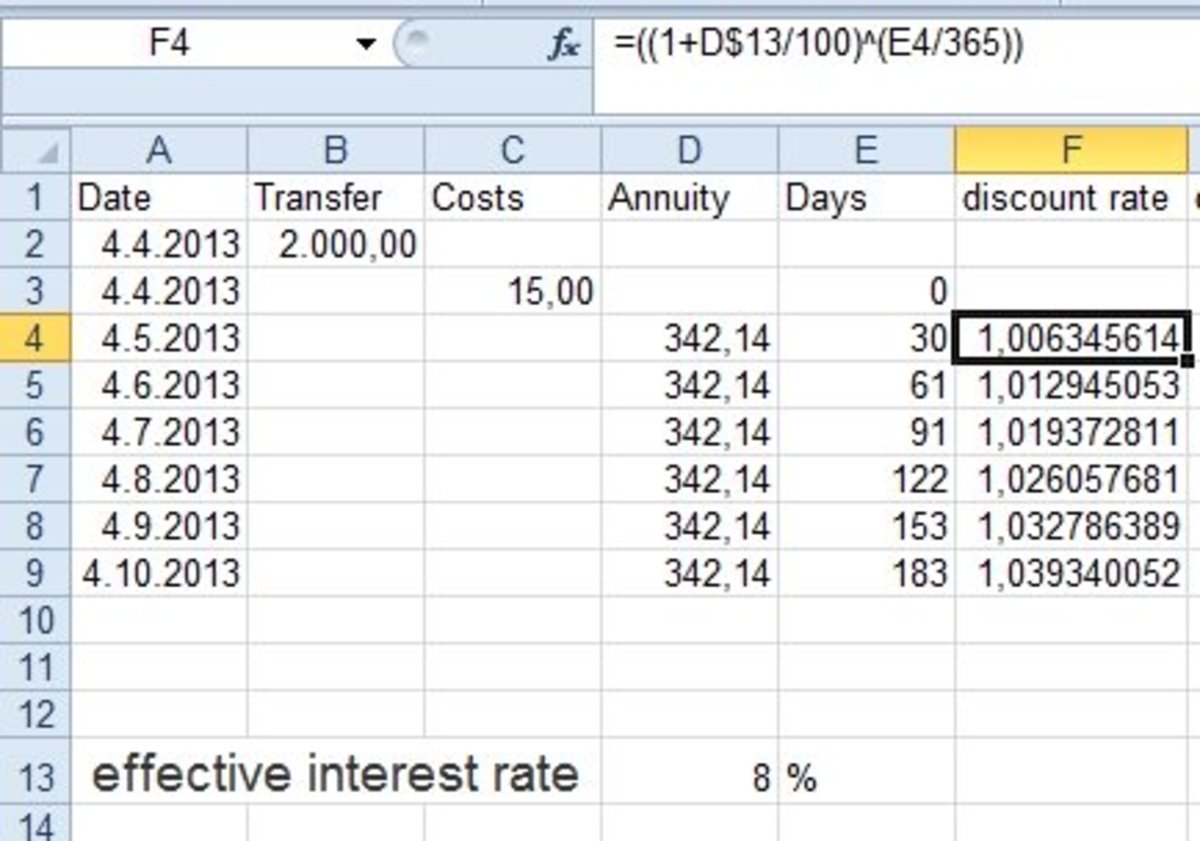

Combine components to determine the discount rate. It takes into account the effect of compounding interest, which is left out of the nominal or stated interest rate. The pmt and rate functions in excel are valuable tools for financial analysis. =effect (rate,c5) where rate is the named range h4. Familiarize yourself with the concept of.

How to Calculate Effective Interest Rate and Discount Rate Using Excel

Step 2) as the nper argument, give the number of years for loan repayment. Let's look at examples of how real interest is considered. It takes into account the effect of compounding interest, which is left out of the nominal or stated interest rate. Web calculation of the effective interest rate on the loan, leasing.

How to calculate effective interest rate in excel The Tech Edvocate

() npery is the number of compounding periods per year. =effect(c4,c5) after that, press enter to get the output. Notice that we have the nominal interest rate (apr) in cell b1 and the number of payment periods in cell b2. Web use excel’s effect formula. Go to c6 and write down the following formula. Offer.

Effective Interest Rate Method Excel Template (Free) ExcelDemy

Nominal interest rate is the stated rate on the financial product. =effect (rate,c5) where rate is the named range h4. What is the effective rate of the loan? This effective annual interest rate calculator helps you calculate the ear given the nominal interest rate and number of compounding periods. Web we can also use the.

How to Calculate Effective Interest Rate in Excel with Formula

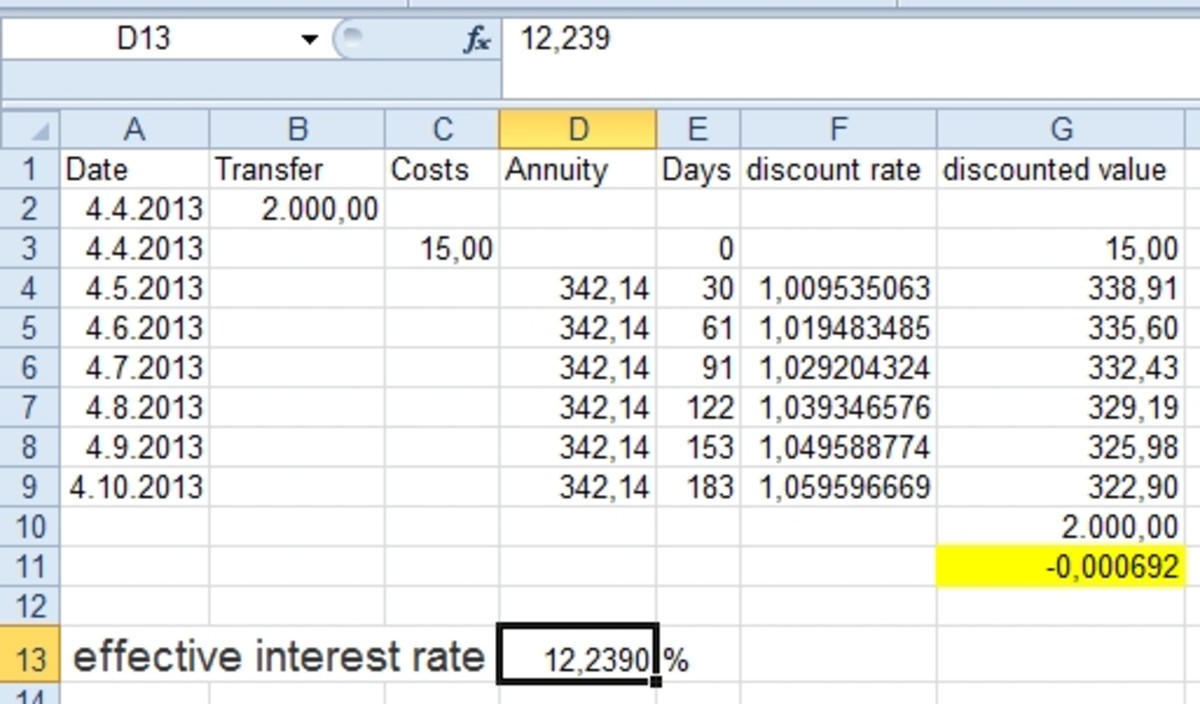

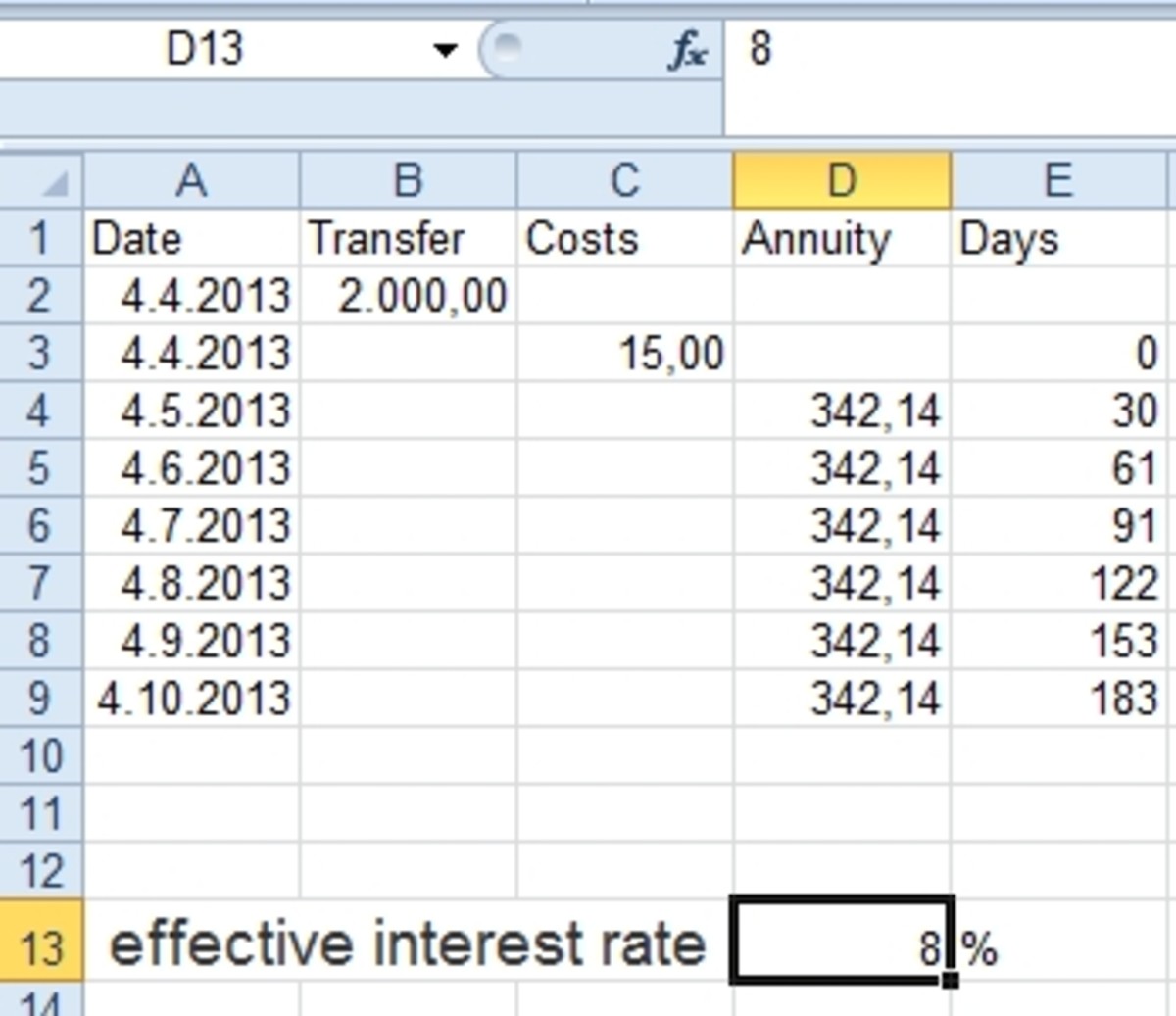

In order to calculate the effective interest rate: To calculate the interest on investments instead, use. Familiarize yourself with the concept of an effective interest rate. Offer examples to illustrate the calculation process. Web here i show you how to calculate the effective interest rate and the discount rate. To accomplish the task, we will.

How to Calculate Effective Interest Rate and Discount Rate Using Excel

We also provide an effective interest rate calculator with a downloadable excel template. Web the effect function calculates the effective annual interest rate, given a nominal interest rate and the number of compounding periods per year. Then we will go for the effect function to calculate the effective interest. Let’s now find the interest rate.

How to Calculate Effective Interest Rate Using Excel ToughNickel

() npery is the number of compounding periods per year. Here we discuss how to calculate effective interest rates along with practical examples. Suppose you want to figure out the effective interest rate (apy) from a 12% nominal rate (apr) loan that has monthly compounding. Calculating the effective annual rate (ear) is crucial in financial.

How To Compute Effective Interest Rate In Excel Let’s play around with the effective annual interest rate in excel, to understand the ear concept and see the impact of the effective rate versus. Web the effect function calculates the effective annual interest rate, given a nominal interest rate and the number of compounding periods per year. We also provide an effective interest rate calculator with a downloadable excel template. I will use the effect function to do so. Here we discuss how to calculate effective interest rates along with practical examples.

Web Use Of Effect Function To Calculate Effective Interest Rate In Excel.

Effect(nominal_rate, npery) the effect function syntax has the following arguments: Here we discuss how to calculate effective interest rates along with practical examples. Rate (nper, pmt, pv, [fv], [type], [guess]) where: The pmt and rate functions in excel are valuable tools for financial analysis.

Let’s Play Around With The Effective Annual Interest Rate In Excel, To Understand The Ear Concept And See The Impact Of The Effective Rate Versus.

In this excel tutorial, we will walk you through the steps to calculate ear in excel, equipping you with the skills to make more informed financial decisions. Web excel is a powerful tool for calculating the effective interest rate, as it can easily handle complex formulas and provide immediate results. Web in this excel tutorial, we will show you how to calculate the effective interest rate, a skill that is essential for anyone working with loans, investments, or any form of financial planning. We also provide an effective interest rate calculator with a downloadable excel template.

It Takes Into Account The Effect Of Compounding Interest, Which Is Left Out Of The Nominal Or Stated Interest Rate.

This effective annual interest rate calculator helps you calculate the ear given the nominal interest rate and number of compounding periods. Step 1) begin writing the rate function. =effect (rate,c5) where rate is the named range h4. Web the function calculates by iteration and can have no or more than one solution.

In Order To Calculate The Effective Interest Rate:

Calculating the effective annual rate (ear) is crucial in financial analysis as it provides the true annual interest rate when compounding is taken into account. The syntax is as follows: In the example shown, the formula in d5, copied down, is: Familiarize yourself with the concept of an effective interest rate.