How To Calculate Yield To Maturity Excel

How To Calculate Yield To Maturity Excel - The yield function calculates the bond yield. Web let us enter the corresponding values of our example in column b. Inputs required include settlement date, maturity date, and bond price;. Web this article describes the formula syntax and usage of the yield function in microsoft excel. All of the bonds have a par value of $1.000 and pay semiannual coupons.

Web how do you calculate yield to maturity? Web this article describes the formula syntax and usage of the yieldmat function in microsoft excel. In the final part of our bond rate of. Web this article describes the formula syntax and usage of the yield function in microsoft excel. Values is the range of cells that contains the cash flows for the bond. You can replace these values with your own. \qquad \small {\rm bond\ price} = \sum_ {k=1}^ {n} \frac {cf} { (1+r)^k}, bond.

YIELD Function in Excel Formula + Calculator

Web to calculate the number of years until maturity, assume that it is currently may 2022. Web 5 steps to calculating yield curve. = yield (settlement, maturity, rate, pr, redemption, frequency, [basis]) where: Values is the range of cells that contains the cash flows for the bond. Web hence, the ytm formula involves deducing the.

Bond Valuation and Yield to Maturity Using Excel YouTube

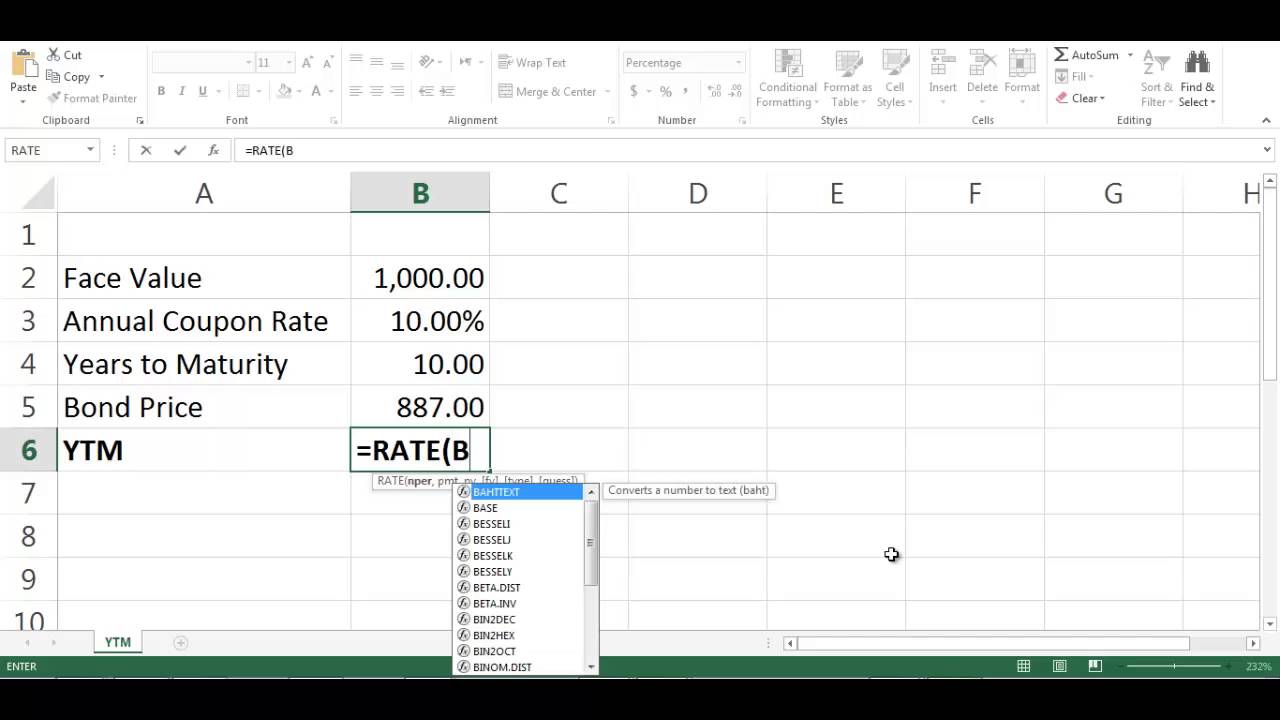

10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90,. Web how do you calculate yield to maturity? Web this article describes the formula syntax and usage of the yieldmat function in microsoft excel. Web the inputs for the yield to maturity (ytm) formula in excel are shown below. =.

How to Make a Yield to Maturity Calculator in Excel ExcelDemy

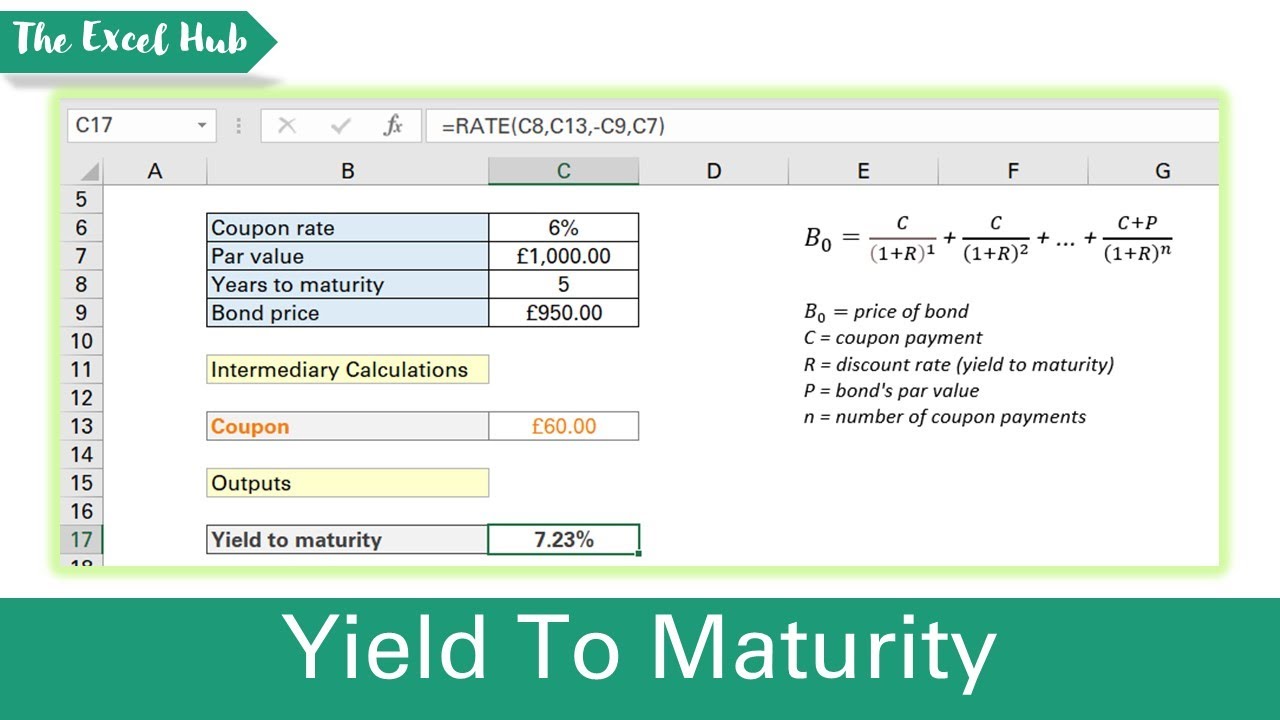

Web how to use the yield function in excel? Web yield function overview. Web the inputs for the yield to maturity (ytm) formula in excel are shown below. Use direct formula to calculate the ytm of a bond. Web 6.2k views 3 years ago. This video covers how to calculate the bond's yield to maturity.

How to Make a Yield to Maturity Calculator in Excel ExcelDemy

Use direct formula to calculate the ytm of a bond. Guess is an optional argument that. Web to calculate the number of years until maturity, assume that it is currently may 2022. Web calculating bond’s yield to maturity using excel. Returns the annual yield of a security that pays interest at. In the final part.

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

Treasury bonds' times to maturity in cell a1 and u.s. = yield (settlement, maturity, rate, pr, redemption, frequency, [basis]) where: This video covers how to calculate the bond's yield to maturity (or the cost of debt) in excel using excel solver. The easiest method, by far, is to use the yield function in excel, which.

How to Make a Yield to Maturity Calculator in Excel ExcelDemy

To use the yield excel worksheet function, select a cell and type: You can replace these values with your own. Web how do you calculate yield to maturity? Returns the annual yield of a security that pays interest at. Web 6.2k views 3 years ago. Web how to use the yield function in excel? Web.

Calculate The Yield To Maturity Of A Bond In Excel YouTube

Web calculating bond’s yield to maturity using excel. Values is the range of cells that contains the cash flows for the bond. \qquad \small {\rm bond\ price} = \sum_ {k=1}^ {n} \frac {cf} { (1+r)^k}, bond. 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90,. This video covers how.

How to Calculate Yield to Maturity Excel YTM YIELDMAT Function Earn

= yield (settlement, maturity, rate, pr, redemption, frequency, [basis]) where: Use direct formula to calculate the ytm of a bond. To use the yield excel worksheet function, select a cell and type: Returns the annual yield of a security that pays interest at. Web the formula for using the yield function in excel is as.

Finding Yield to Maturity using Excel YouTube

Calculate the ytm of a bond using the. You can replace these values with your own. = yield (settlement, maturity, rate, pr, redemption, frequency, [basis]) where: To use the yield excel worksheet function, select a cell and type: Web the yield formula in excel helps you to calculate the yield to maturity of a bond.

Calculating bond’s yield to maturity using excel YouTube

All of the bonds have a par value of $1.000 and pay semiannual coupons. To use the yield excel worksheet function, select a cell and type: Using microsoft excel, enter u.s. Web let us enter the corresponding values of our example in column b. Web the inputs for the yield to maturity (ytm) formula in.

How To Calculate Yield To Maturity Excel All of the bonds have a par value of $1.000 and pay semiannual coupons. To understand the uses of the function, let’s. This video covers how to calculate the bond's yield to maturity (or the cost of debt) in excel using excel solver. Web 5 steps to calculating yield curve. In the final part of our bond rate of.

Web The Inputs For The Yield To Maturity (Ytm) Formula In Excel Are Shown Below.

Web this article describes the formula syntax and usage of the yieldmat function in microsoft excel. The easiest method, by far, is to use the yield function in excel, which accounts for all the assumptions mentioned. All of the bonds have a par value of $1.000 and pay semiannual coupons. Values is the range of cells that contains the cash flows for the bond.

Using Microsoft Excel, Enter U.s.

Inputs required include settlement date, maturity date, and bond price;. The yield function calculates the bond yield. To use the yield excel worksheet function, select a cell and type: Web 5 steps to calculating yield curve.

This Video Covers How To Calculate The Bond's Yield To Maturity (Or The Cost Of Debt) In Excel Using Excel Solver.

Web to calculate the number of years until maturity, assume that it is currently may 2022. Web this article describes the formula syntax and usage of the yield function in microsoft excel. Calculate the ytm of a bond using the. In the final part of our bond rate of.

As A Worksheet Function, Yield Can Be Entered As Part Of A Formula In A Cell Of A Worksheet.

Web 6.2k views 3 years ago. \qquad \small {\rm bond\ price} = \sum_ {k=1}^ {n} \frac {cf} { (1+r)^k}, bond. Use direct formula to calculate the ytm of a bond. Treasury bonds' times to maturity in cell a1 and u.s.