How To Calculate The Wacc In Excel

How To Calculate The Wacc In Excel - Determine the market value of the company’s equity (e). Web the formula for wacc is as follows: The cost of debt to the debt’s portion of the total capital. Web you can calculate wacc in excel by using parameters like cost of equity, cost of debt, total market debt, and total market equity. Web this is a video tutorial on how to calculate the weighted average cost of capital, otherwise known as the wacc.

The weighted average cost of capital (wacc) is the average rate that a firm is expected to pay to all creditors, owners, and other capital providers. Below we present the wacc formula, it is necessary to understand the intuition behind the formula and how to arrive at each calculation. Determine the market value of the company’s debt (d). The weighted average cost of capital wacc is known to be a financial metric that lets you find out the cost of a firm in combination with the cost of debt and cost of equity structure collectively. Being able to calculate the weighted average cost of capital in excel is a. Web how to calculate wacc in excel + template. Web this is a video tutorial on how to calculate the weighted average cost of capital, otherwise known as the wacc.

How to Calculate WACC in Excel Sheetaki

Determine the market value of the company’s equity (e). Essentially, wacc calculates the rate of return a company needs to pay its debt and stakeholders. Mastering these techniques can save time and increase accuracy. Web when it comes to calculating weighted average cost of capital (wacc) in excel, it's important to set up your spreadsheet.

How to Calculate WACC in Excel Sheetaki

Web how to calculate wacc in excel. A closer look into the formula reveals that we are multiplying. It is also known as a simple cost of capital. Web the wacc can be used as the discount rate when calculating the value of a company. Total market value of the company's equity and debt. Mastering.

How to Calculate WACC in Excel Sheetaki

The weighted average cost of capital wacc is known to be a financial metric that lets you find out the cost of a firm in combination with the cost of debt and cost of equity structure collectively. We use it as a discount rate when calculating the net present value of an investment. 88k views.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

This guide dives into advanced excel methods that simplify wacc analysis. Web this blog post will guide you through the steps of calculating wacc on excel, providing clear instructions and practical examples. In this tutorial, i'm using excel. Web the formula for wacc in excel is: A closer look into the formula reveals that we.

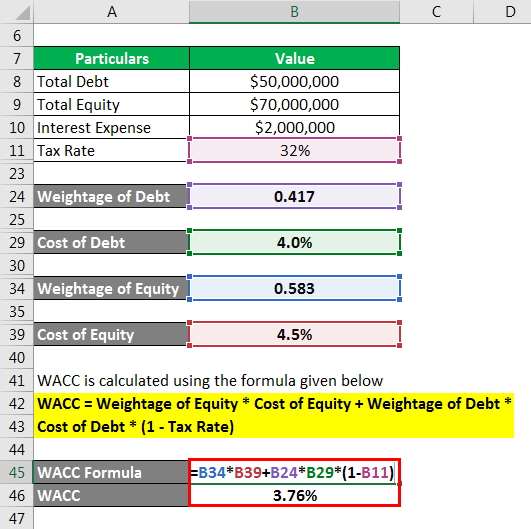

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

It is the company’s total number of outstanding shares multiplied by the current market price per share. Web this blog post will guide you through the steps of calculating wacc on excel, providing clear instructions and practical examples. Wacc can be calculated by multiplying. Web steps to calculate wacc in excel. What is wacc and.

Calculate WACC in Excel Step by Step YouTube

Determine the market value of the company’s equity (e). It is the company’s total number of outstanding shares multiplied by the current market price per share. Web the wacc can be used as the discount rate when calculating the value of a company. Determine the market value of the company’s debt (d). Web this wacc.

How to Calculate Wacc in Excel?

The weighted average cost of capital wacc is known to be a financial metric that lets you find out the cost of a firm in combination with the cost of debt and cost of equity structure collectively. Web you can calculate wacc in excel by using parameters like cost of equity, cost of debt, total.

How To Calculate The WACC Using Excel Step By Step Guide IIFPIA

Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt and tax rate. Assessing project risk a company can use the wacc to evaluate whether an internal project is worth pursuing or not. Web weighted average cost of capital (wacc) represents a company's cost of capital, with.

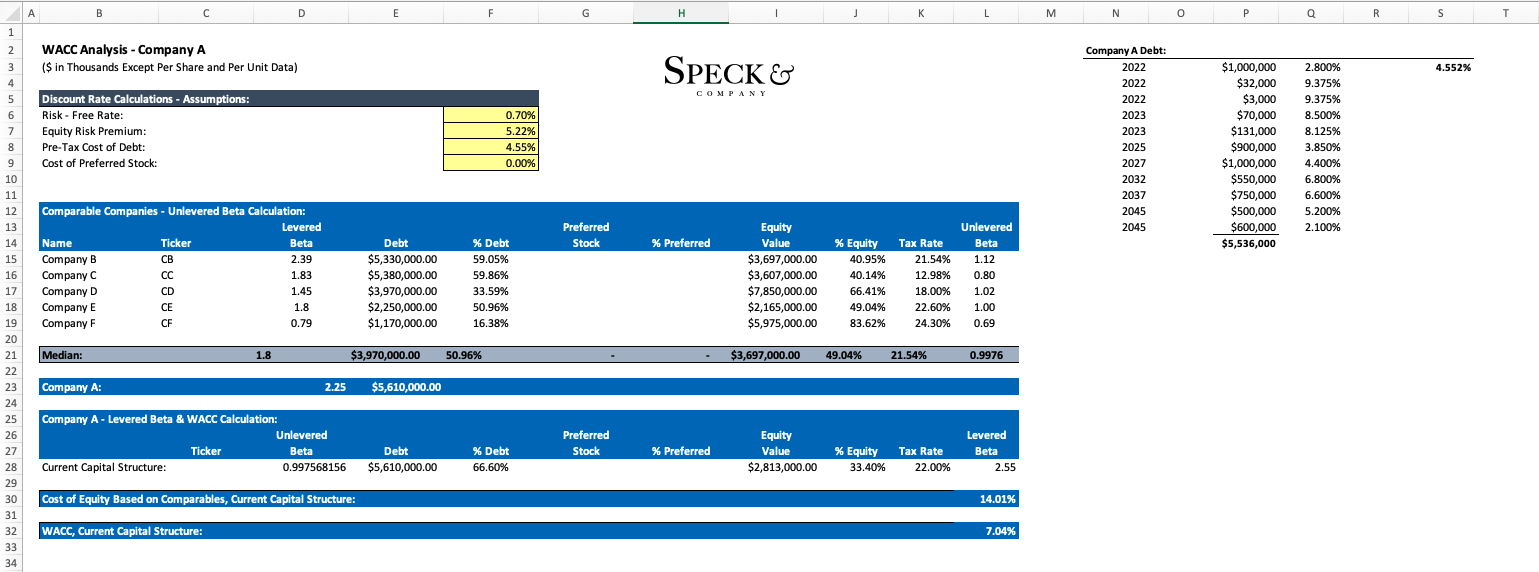

How to Calculate WACC in Excel Speck & Company

The cost of debt to the debt’s portion of the total capital. = (equity / total capital) * cost of equity + (debt / total capital) * cost of debt. Web you can calculate wacc in excel by using parameters like cost of equity, cost of debt, total market debt, and total market equity. Web.

How to Calculate the WACC in Excel WACC Formula Earn & Excel

Web the wacc can be used as the discount rate when calculating the value of a company. In this tutorial, i'm using excel. The weighted average cost of capital (wacc) is a key financial metric that helps businesses determine their cost of capital. Web how to calculate wacc in excel. You can use this as.

How To Calculate The Wacc In Excel = sumproduct (cost * weight) / sum (weight). Mastering these techniques can save time and increase accuracy. Web how to calculate wacc in excel + template. Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. Determine the market value of the company’s equity (e).

Web The Formula For Wacc In Excel Is:

Web the formula for wacc is as follows: The weighted average cost of capital wacc is known to be a financial metric that lets you find out the cost of a firm in combination with the cost of debt and cost of equity structure collectively. We will use excel to go over the wa. This will not only make the calculation process easier but also ensure accuracy in your results.

Web This Blog Post Will Guide You Through The Steps Of Calculating Wacc On Excel, Providing Clear Instructions And Practical Examples.

In this tutorial, i'm using excel. We use it as a discount rate when calculating the net present value of an investment. Web in this video, i take you step by step on how to calculate the weighted average cost of capital in excel. The cost of equity to equity’s portion within the total capital;

Wacc Can Be Calculated By Multiplying.

The cost of debt to the debt’s portion of the total capital. Essentially, wacc calculates the rate of return a company needs to pay its debt and stakeholders. Total market value of the company's equity and debt. Web steps to calculate wacc in excel.

It Is Also Known As A Simple Cost Of Capital.

Wacc stands for a weighted average cost of capital which is most commonly used in the finance field. Web in this video, we will over how to calculate the weighted average cost of capital which is also know by its acronym wacc. A closer look into the formula reveals that we are multiplying. How to calculate beta (systematic risk) industry beta approach.