How To Calculate Sharpe Ratio In Excel

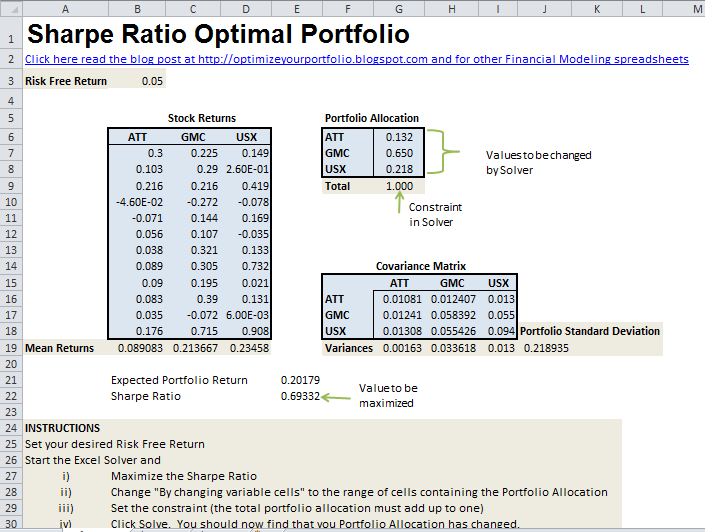

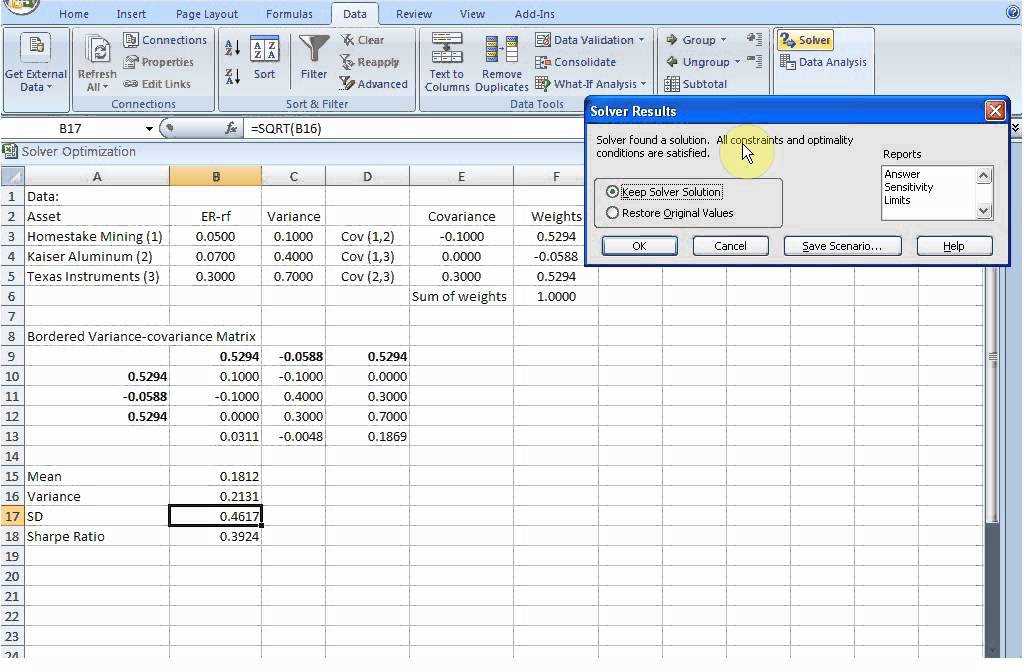

How To Calculate Sharpe Ratio In Excel - Compare the sharpe ratio of our mean reversion strategy with that of dia. The rate of return of the portfolio for a given period. This excel spreadsheet will calculate the optimum investment weights in a portfolio of three stocks by maximizing the sharpe ratio of the portfolio. Interpreting the sharpe ratio in corporate finance. This ratio helps to measure the investment.

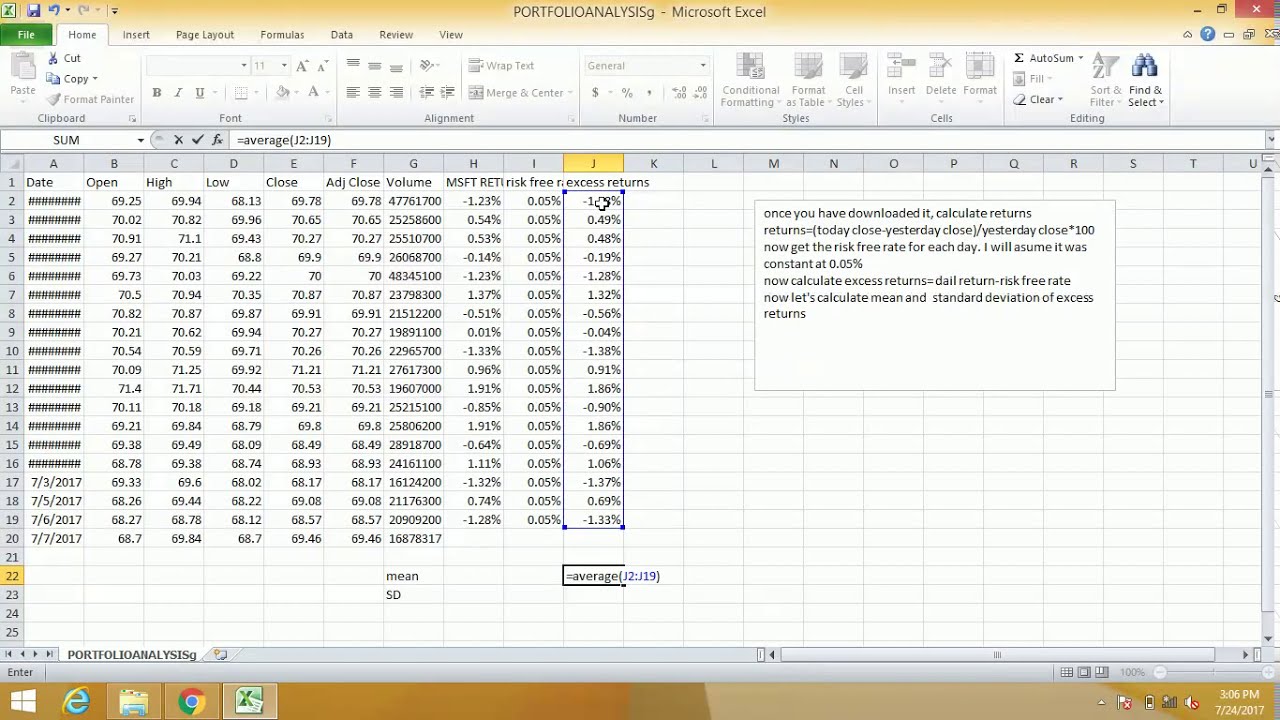

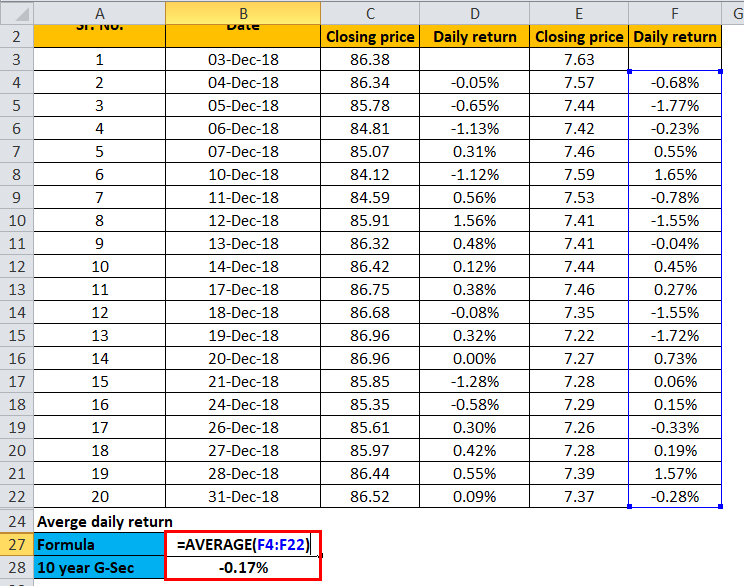

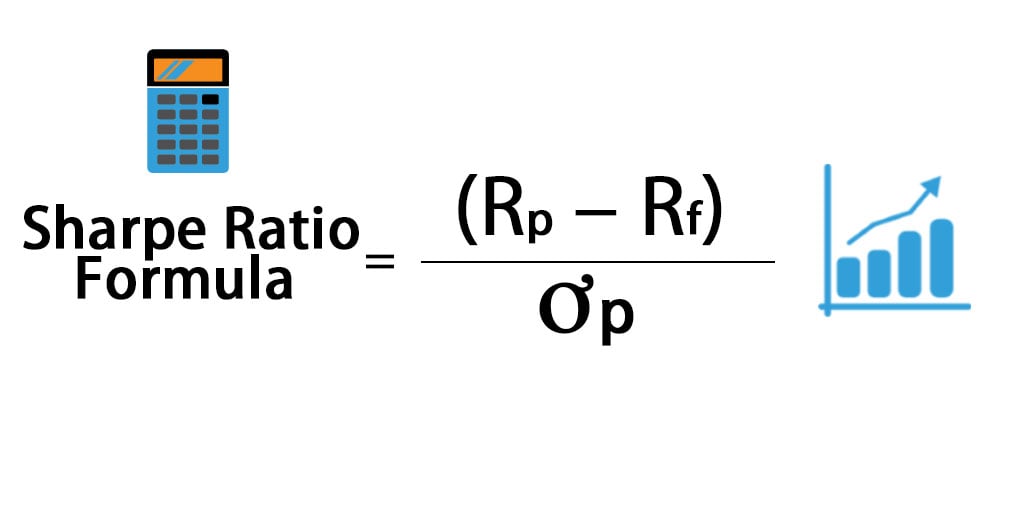

Then in the next column, insert. Follow an example using spy and tsla.intro: Common misconceptions about sharpe ratio. Ơp = standard deviation of the portfolio return. Web how to calculate the sharpe ratio in excel. We also offer a graphical interpretation of the sharpe ratio, which. 24k views 1 year ago dallas.

HOW TO CALCULATE SHARPE RATIO USING EXCEL YouTube

Web how to calculate sharpe ratio in excel? Follow an example using spy and tsla.intro: Interpreting the sharpe ratio in corporate finance. 24k views 1 year ago dallas. Each time period is usually representative of either one month or one year. Web rp = expected rate of return of the portfolio. Compare the sharpe ratio.

Calculating a Sharpe Optimal Portfolio with Excel

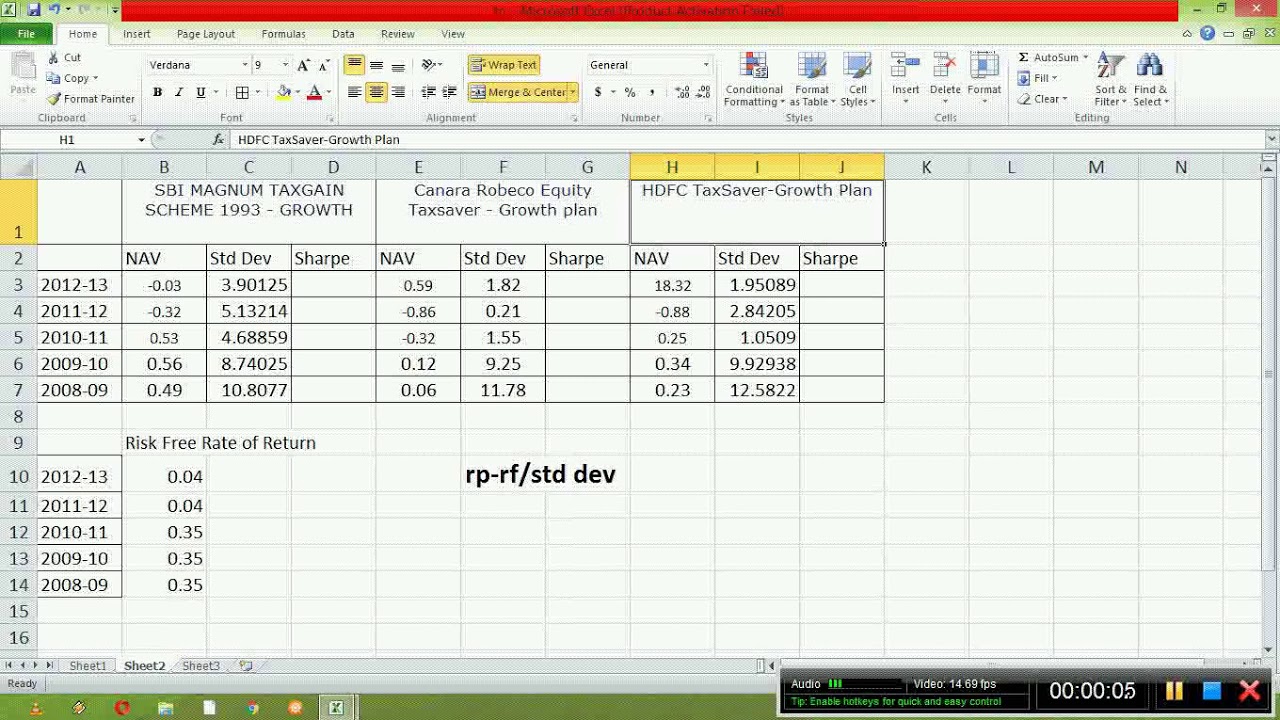

The proxy for portfolio risk). What is the sharpe ratio? First insert your mutual fund returns in a column. 4.9k views 1 year ago. Web how to calculate sharpe ratio in excel? Ryan o'connell, cfa, frm explains how to calculate sharpe ratio in excel. Web how to calculate the sharpe ratio in excel. Web to.

Sharpe Ratio Maximization with Excel Solver YouTube

Compare the sharpe ratio of our mean reversion strategy with that of dia. This excel spreadsheet will calculate the optimum investment weights in a portfolio of three stocks by maximizing the sharpe ratio of the portfolio. How to calculate sharpe ratio in python? 73k views 6 years ago. Web calculating a sharpe optimal portfolio with.

Sharpe Ratio Formula Calculator (Excel template)

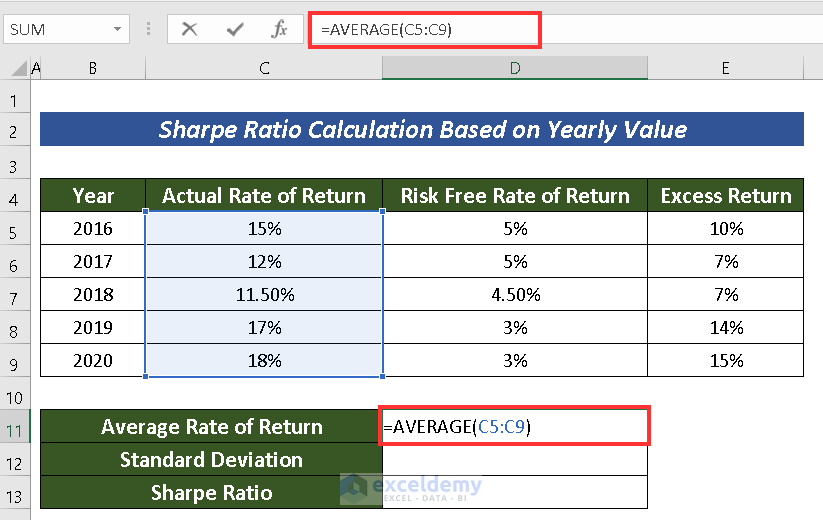

Web in this video tutorial, we teach you the basics of sharpe ratio calculations using excel. We also offer a graphical interpretation of the sharpe ratio, which. The sharpe ratio is used to evaluate the relationship between risk and return for a portfolio. How to calculate sharpe ratio in excel. First, select a cell for.

How to Calculate the Sharpe Ratio in Excel QMR

Web how to calculate the sharpe ratio for investments in excel, definition and formula explained. To annualize the sharpe ratio based on daily returns, multiply the ratio by the square root of 252, representing the number of trading days in a year. First, select a cell for the output of the sharpe ratio (i.e. Web.

How To Use The Sharpe Ratio + Calculate In Excel YouTube

The sharpe ratio formula is used to determine the excess return achieved concerning the unit of portfolio volatility by the investors. Print a message indicating whether our strategy outperformed the general dow jones based on. First insert your mutual fund returns in a column. Web how to calculate sharpe ratio in excel? Email me at.

Sharpe ratio using excel YouTube

Each time period is usually representative of either one month or one year. Ryan o'connell, cfa, frm explains how to calculate sharpe ratio in excel. Alternatives to the sharpe ratio. The formula is the following: Web how to calculate the sharpe ratio for investments in excel, definition and formula explained. Follow an example using spy.

How To Calculate The Sharpe Ratio In Excel SpreadCheaters

What is the sharpe ratio? Applicability in different market conditions. To annualize the sharpe ratio based on daily returns, multiply the ratio by the square root of 252, representing the number of trading days in a year. 4.9k views 1 year ago. Web how to calculate the sharpe ratio in excel. Common misconceptions about sharpe.

How to Calculate Sharpe Ratio in Excel (2 Common Cases) ExcelDemy

Web the steps to calculate the sharpe ratio are as follows: The rate of return of the portfolio for a given period. First, select a cell for the output of the sharpe ratio (i.e. Divide this value by the standard deviation of the portfolio returns, which can. Web rp = expected rate of return of.

Sharpe Ratio Formula Calculator (Excel template)

Email me at help@plusacademics.org this video give step by step method of how to calculate sharpe. How to calculate sharpe ratio in python? Divide this value by the standard deviation of the portfolio returns, which can. How to calculate average ratio in excel. The formula is the following: Web rp = expected rate of return.

How To Calculate Sharpe Ratio In Excel Web the steps to calculate the sharpe ratio are as follows: Thus, we can easily calculate the sharpe ratio. Web rp = expected rate of return of the portfolio. To annualize the sharpe ratio based on daily returns, multiply the ratio by the square root of 252, representing the number of trading days in a year. The sharpe ratio is used to evaluate the relationship between risk and return for a portfolio.

First, Select A Cell For The Output Of The Sharpe Ratio (I.e.

Each time period is usually representative of either one month or one year. Web in this video tutorial, we teach you the basics of sharpe ratio calculations using excel. How to calculate average ratio in excel. Where, c4 = expected rate of return.

How To Calculate Sharpe Ratio In Excel.

To annualize the sharpe ratio based on daily returns, multiply the ratio by the square root of 252, representing the number of trading days in a year. First insert your mutual fund returns in a column. Divide this value by the standard deviation of the portfolio returns, which can. Exercises and examples for sharpe ratio.

Web How To Calculate Sharpe Ratio In Excel?

Then in the next column, insert. 73k views 6 years ago. This is known as the sharpe optimal portfolio. Print a message indicating whether our strategy outperformed the general dow jones based on.

Alternatives To The Sharpe Ratio.

Web how to calculate the sharpe ratio in excel. Ryan o'connell, cfa, frm explains how to calculate sharpe ratio in excel. While the latter evaluates the fund’s performance against its benchmark. Web rp = expected rate of return of the portfolio.