How To Calculate Interest On A Loan In Excel

How To Calculate Interest On A Loan In Excel - The second argument specifies the payment number. Pmt(rate, nper, pv) is the regular payment amount. This tutorial explains how to calculate interest rate on recurring deposit in excel by using the rate function. These schedules are commonly used when financing a major purchase like a home or car. Web this wikihow teaches you how to create an interest payment calculator in microsoft excel.

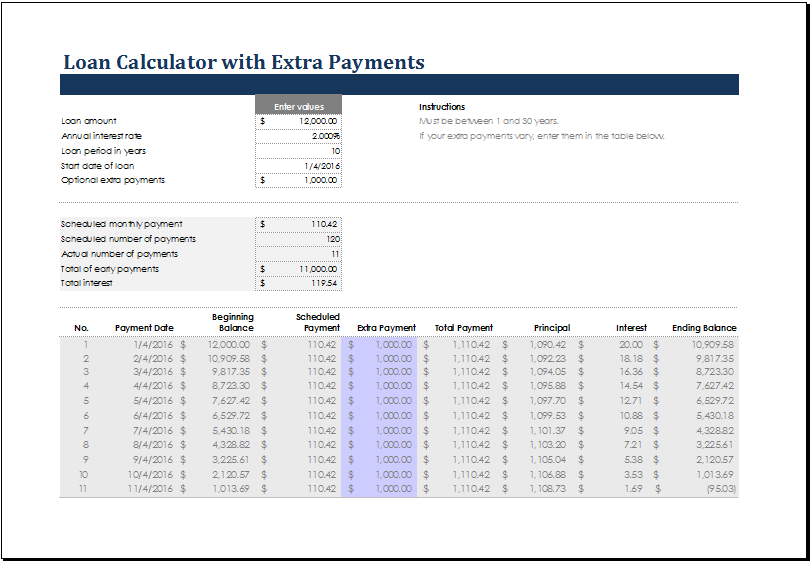

These templates cover the most common types of loans and are all available for free. Web calculate the simple interest, cumulative and compound interest on a loan in excel using functions like pmt, ipmt, ppmt, cumimpt and pv. Web we can calculate accrued interest on a loan in excel using several methods. Loans have four primary components: Walk through the steps of inputting the loan amount, interest rate, and loan term into excel. To build a loan or mortgage amortization schedule in excel, we will need to use the following functions: Pmt calculates the payment for a loan based on constant payments and a constant interest rate.

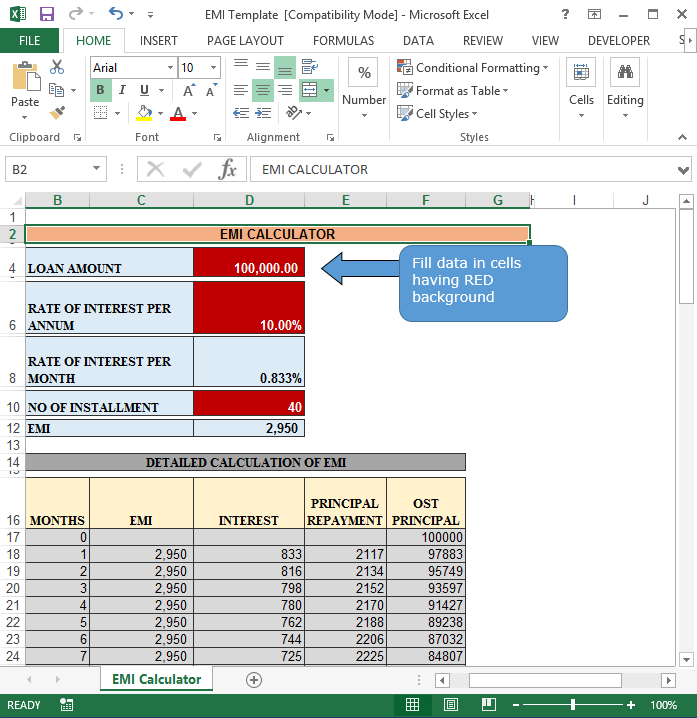

Loan Calculator in Microsoft Excel

You can then use the ipmt function to determine how much you'll have to pay in interest in each period. Pv is the principal loan amount (total loan amount). Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). The syntax of the.

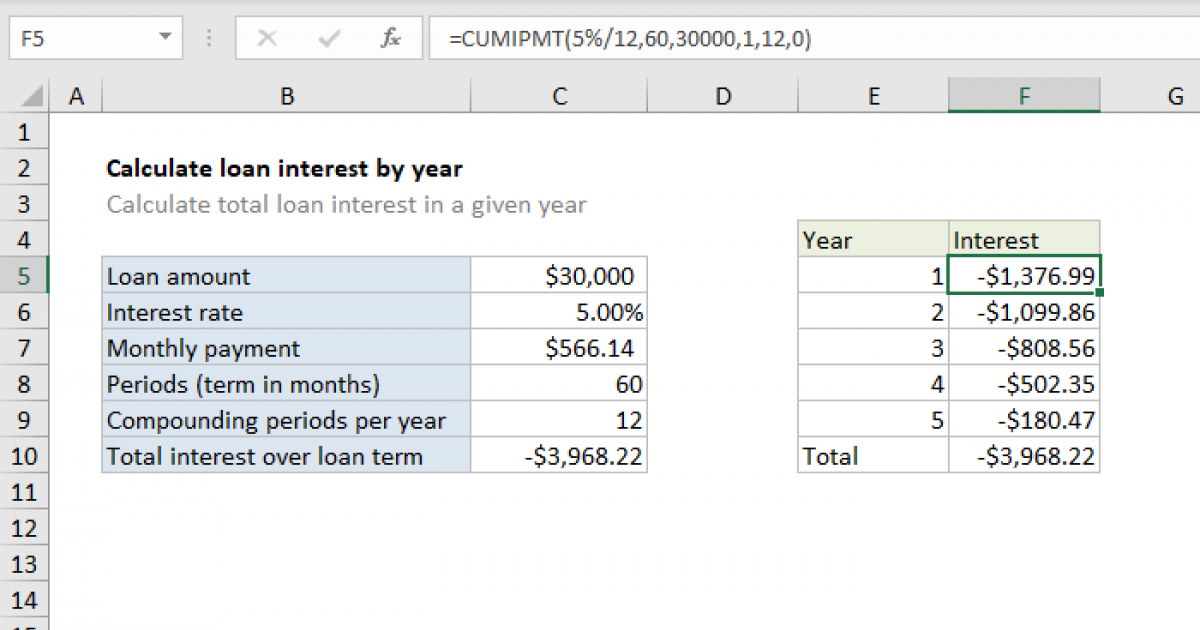

Calculate loan interest in given year Excel formula Exceljet

Loans have four primary components: These templates cover the most common types of loans and are all available for free. A loan amortization schedule typically includes the original loan amount, the loan balance at each payment, the interest rate, the amortization period, and the total payment amount. Formula examples to calculate interest rate. Pmt(rate, nper,.

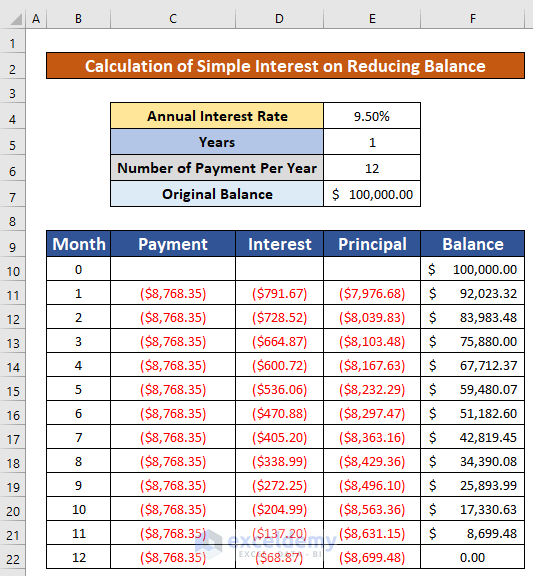

How to Calculate Simple Interest on Reducing Balance in Excel

Web to calculate the interest portion of a loan payment in a given period, you can use the ipmt function. One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. Web using rate function in excel to calculate interest rate..

How To Calculate Total Interest Paid Over The Life Of A Loan In Excel

Web using rate function in excel to calculate interest rate. By svetlana cheusheva, updated on may 3, 2023. Web calculate the simple interest, cumulative and compound interest on a loan in excel using functions like pmt, ipmt, ppmt, cumimpt and pv. Subtract your interest charge from your monthly bill and get your principal cost. Web.

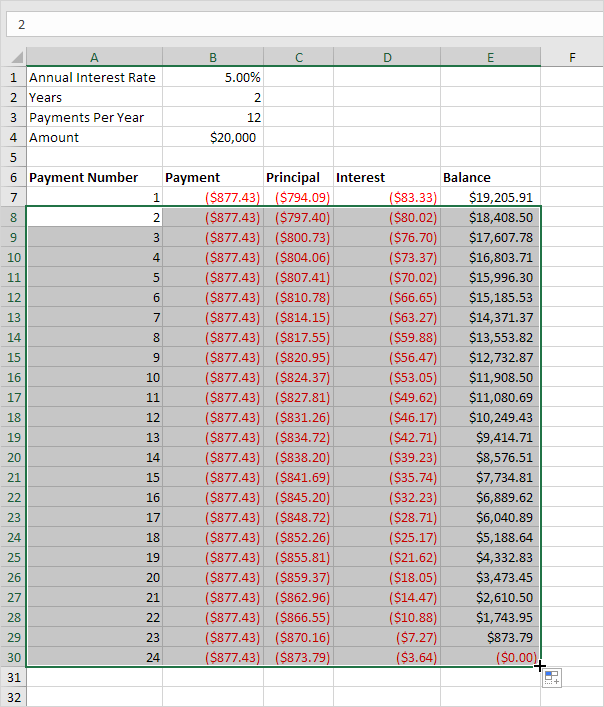

How to create a loan amortization schedule In Excel Excel Examples

Web mind your money. Web when it comes to calculating the principal and interest on a loan in excel, the first step is to set up the loan details accurately. Web the interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. Step 2) as the nper argument, give the.

How to Calculate Principal and Interest on a Loan in Excel ExcelDemy

You can calculate interest payments. Web the ppmt function in excel calculates the principal portion of a loan payment for a given period based on a constant interest rate and payment schedule. The higher your interest rate, or yield, the more your bank balance grows. Pmt(rate, nper, pv) is the regular payment amount. Pmt calculates.

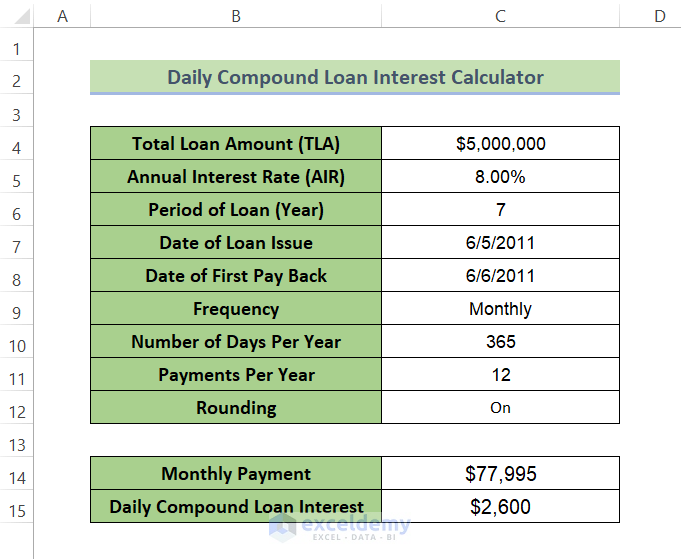

Daily Loan Interest Calculator in Excel (Download for Free) ExcelDemy

You can then use the ipmt function to determine how much you'll have to pay in interest in each period. Web to calculate the interest portion of a loan payment in a given period, you can use the ipmt function. Web when it comes to calculating the principal and interest on a loan in excel,.

How To Calculate A Loan Payment In Excel

This course boasts the highest enrollment of any excel course on udemy, with more than 1.4 million learners. Loan calculator templates for excel. This amount stays constant for the entire duration of the loan. You can enter a beginning. You can see the number of months for a loan depending on the details. Web how.

How to Use Compound Interest Formula in Excel Sheetaki

Web using rate function in excel to calculate interest rate. Let’s now find the interest rate implicit in it. Use the ppmt function to calculate the principal part of the payment. A loan amortization schedule typically includes the original loan amount, the loan balance at each payment, the interest rate, the amortization period, and the.

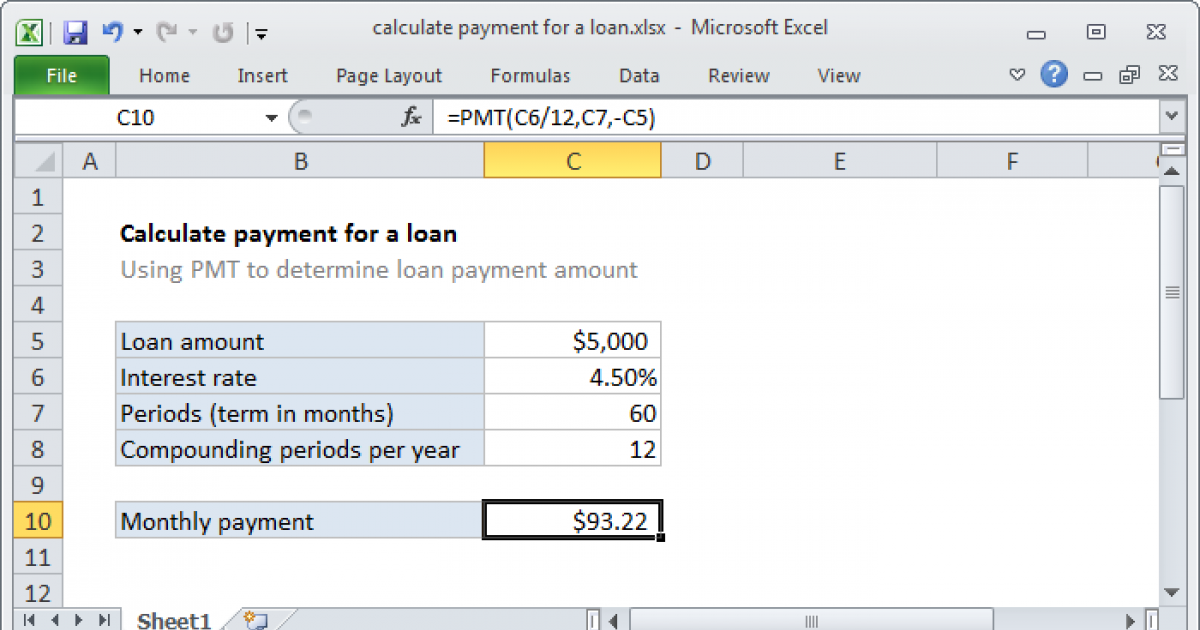

Calculate payment for a loan Excel formula Exceljet

The higher your interest rate, or yield, the more your bank balance grows. You can see the number of months for a loan depending on the details. Use the ppmt function to calculate the principal part of the payment. Web pmt, one of the financial functions, calculates the payment for a loan based on constant.

How To Calculate Interest On A Loan In Excel Web excel formulas and budgeting templates can help you calculate the future value of your debts and investments, making it easier to figure out how long it will take for you to reach your goals. Formula examples to calculate interest rate. Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). The amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. Step 2) as the nper argument, give the number of years for loan repayment.

You Can See The Number Of Months For A Loan Depending On The Details.

Pmt calculates the payment for a loan based on constant payments and a constant interest rate. Gather the annual interest rate, monthly payment, and loan amount and place them in your sheet. Loans have four primary components: Web calculate the simple interest, cumulative and compound interest on a loan in excel using functions like pmt, ipmt, ppmt, cumimpt and pv.

A Loan Amortization Schedule Typically Includes The Original Loan Amount, The Loan Balance At Each Payment, The Interest Rate, The Amortization Period, And The Total Payment Amount.

These schedules are commonly used when financing a major purchase like a home or car. Use the ppmt function to calculate the principal part of the payment. At the same time, you'll learn how to. To calculate payments, you'll just need the principal amount, interest rate, and number of payments remaining.

We Use Named Ranges For The Input Cells.

For instance, subtract your $375 interest charge from. For this step, you might want to include cells for the principal amount of the loan, your annual interest rate, how many years you plan to repay the loan, what your starting period is and what your ending period is. By svetlana cheusheva, updated on may 3, 2023. Understanding how to calculate interest on a loan in excel is crucial for effective financial management.

Web Use The Interest Calculator Below To Calculate How Much Interest Your Savings Account Can Earn.

One of the best ways to keep up with your loan, payments, and interest is with a handy tracking tool and loan calculator for excel. The second argument specifies the payment number. To calculate the interest on investments instead, use. You can calculate interest payments.