How To Calculate Effective Interest Rate Using Excel

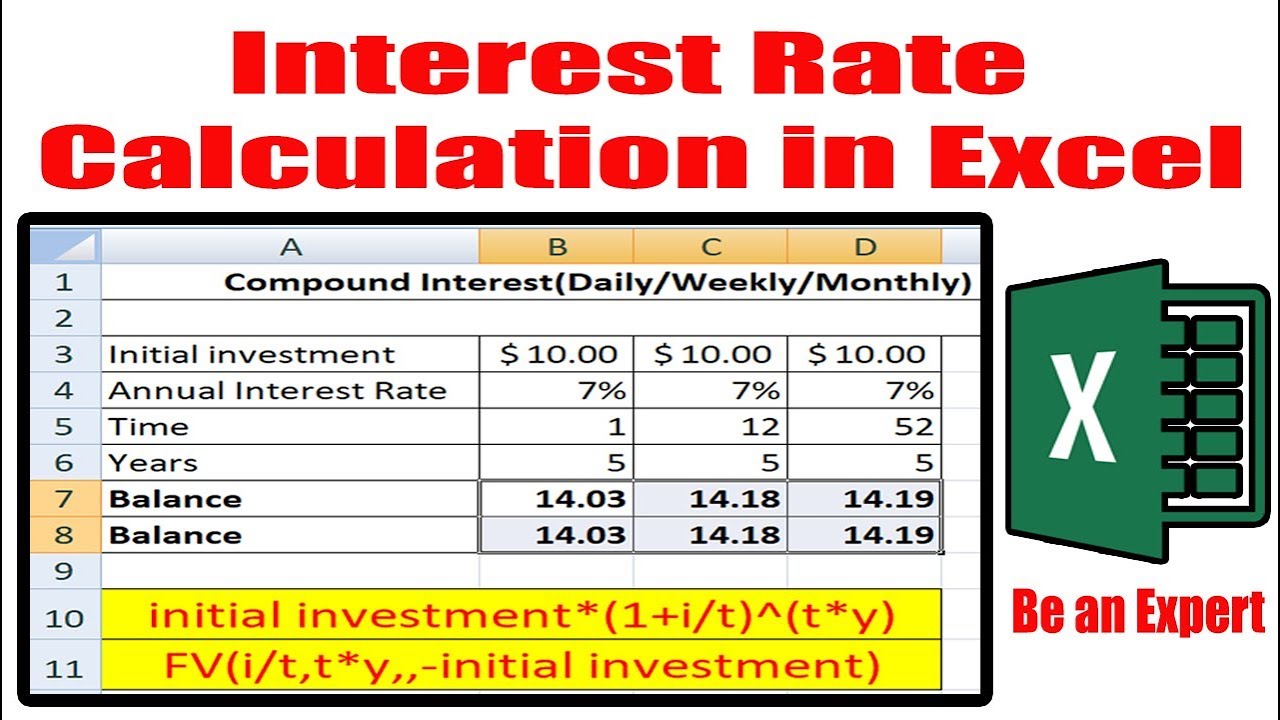

How To Calculate Effective Interest Rate Using Excel - Suppose you want to figure out the effective interest rate (apy) from a 12% nominal rate (apr) loan that has monthly compounding. Web use excel’s effect formula. Web this is determined by multiplying the compounding frequency by the number of years. Following best practices and avoiding common mistakes is important for accurate and reliable calculations. First of all, i will show you how to calculate the nominal interest rate.

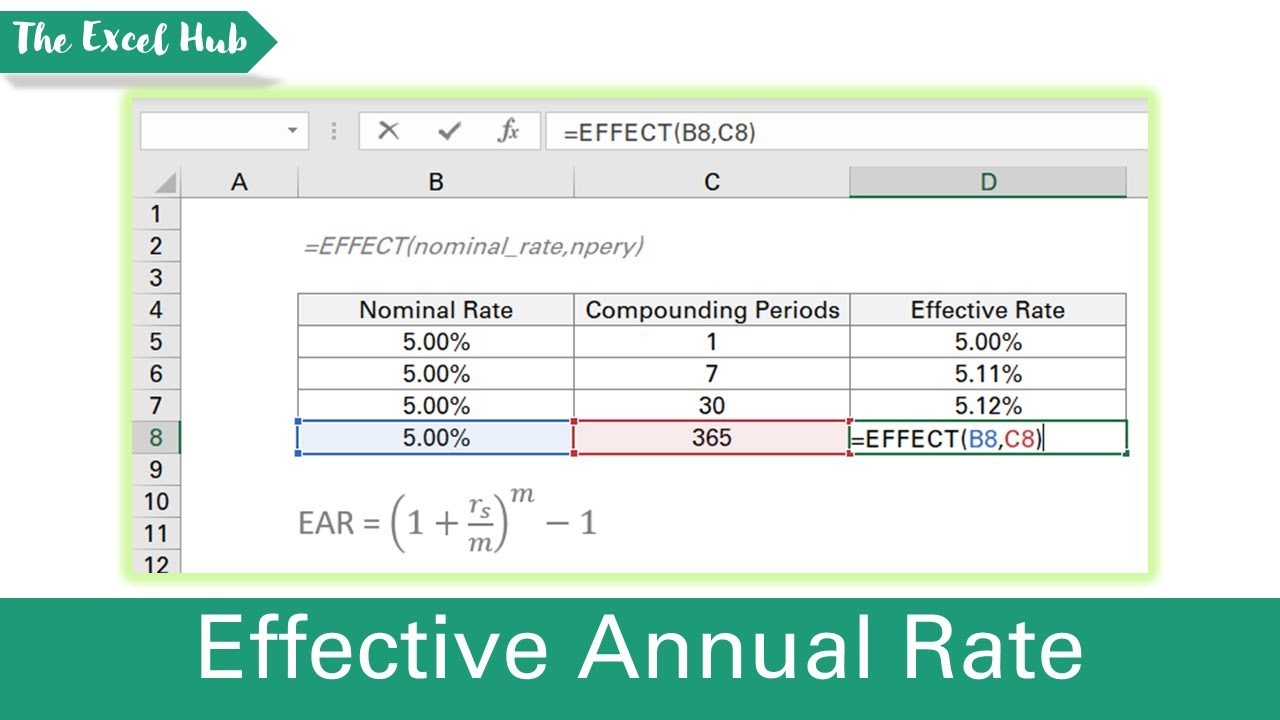

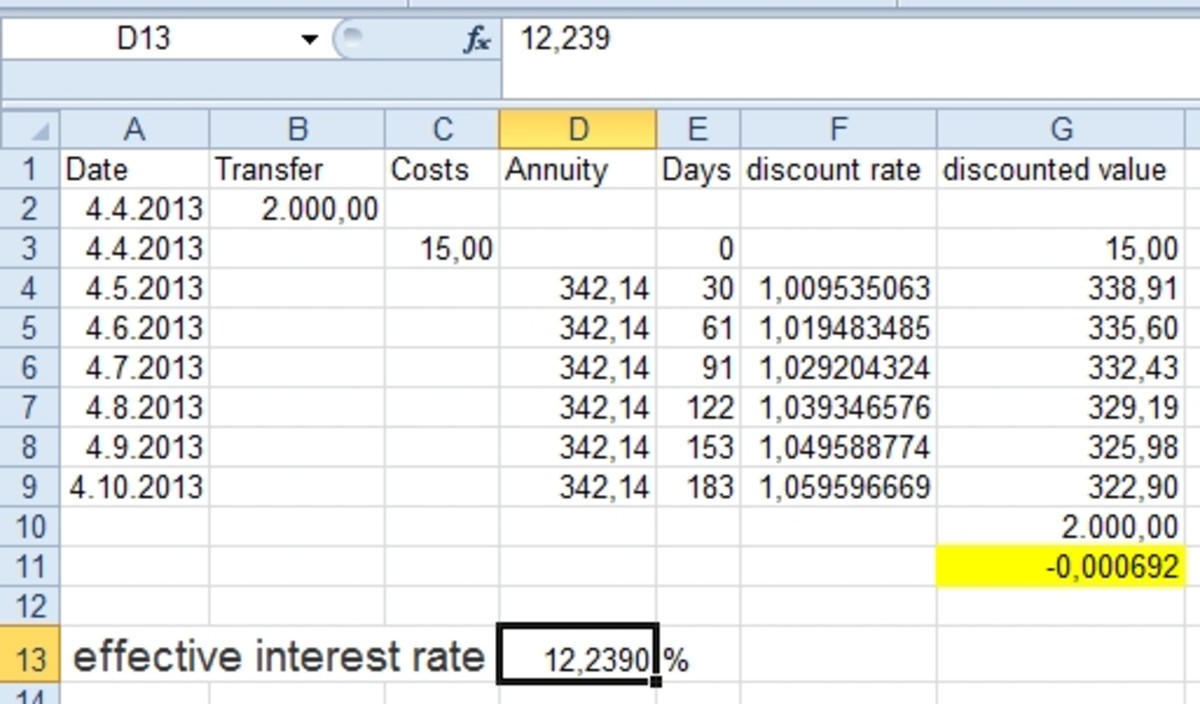

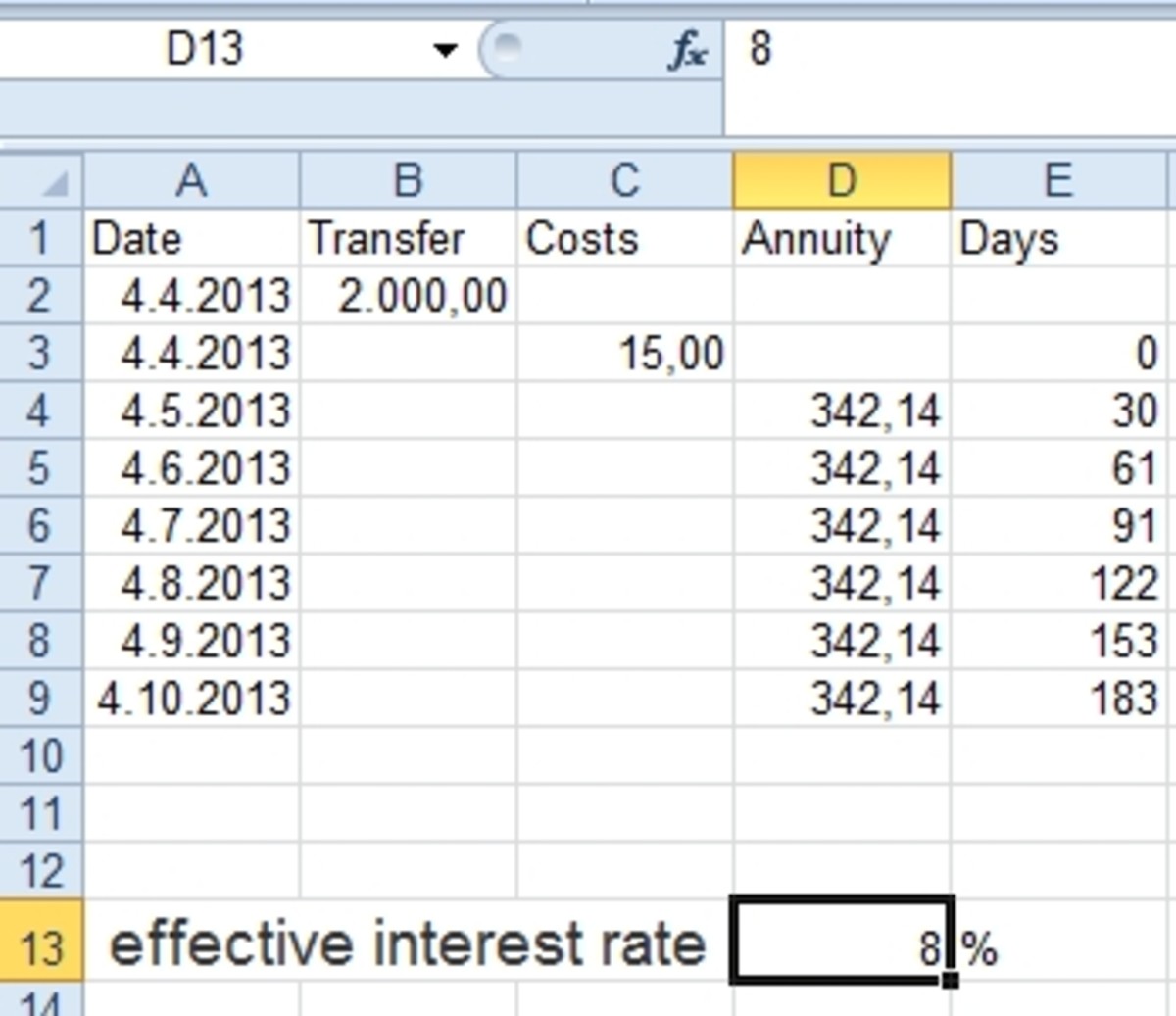

Web here i show you how to calculate the effective interest rate and the discount rate. =nominal(c4,c5) then, press enter to get the output. To calculate the effective annual interest rate, when the nominal rate and compounding periods are given, you can use the effect function. It takes into account the effect of compounding interest, which is left out of the nominal or stated interest rate. Let`s recalculate the effective interest percent: Go to c6 and write down the following formula. % interest rate per period.

Effective Interest Rate Method Excel Template (Free) ExcelDemy

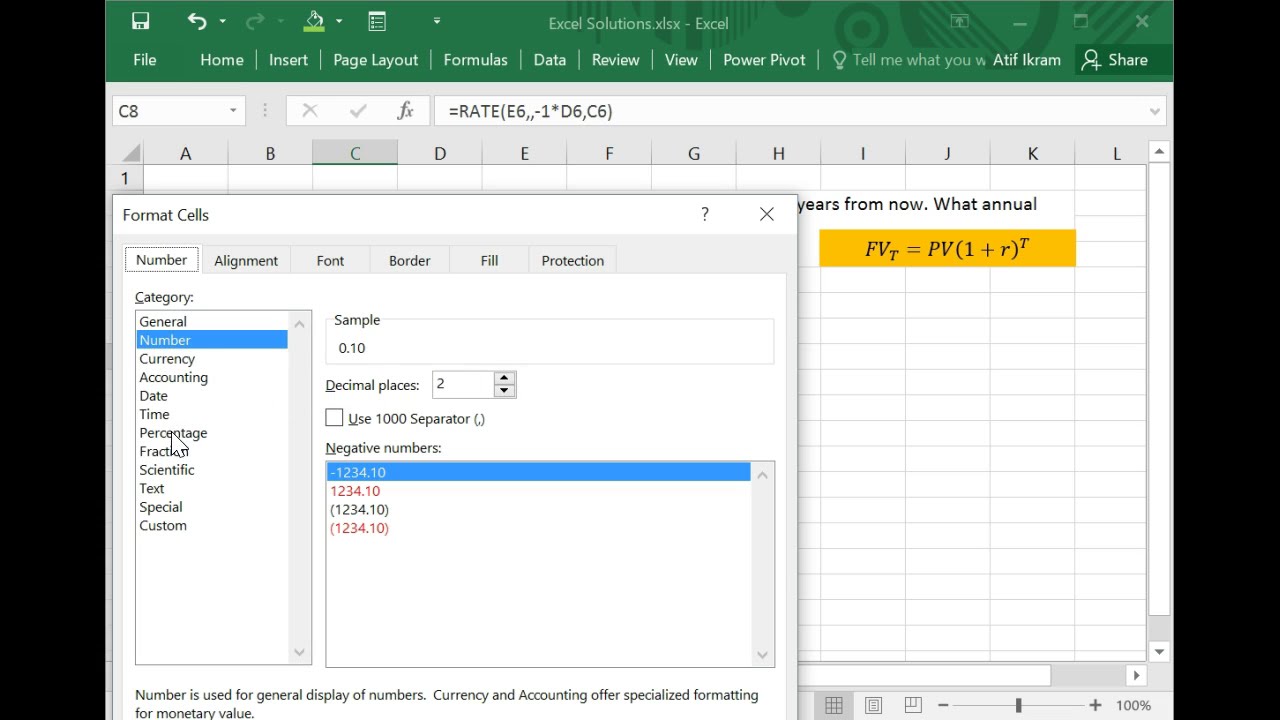

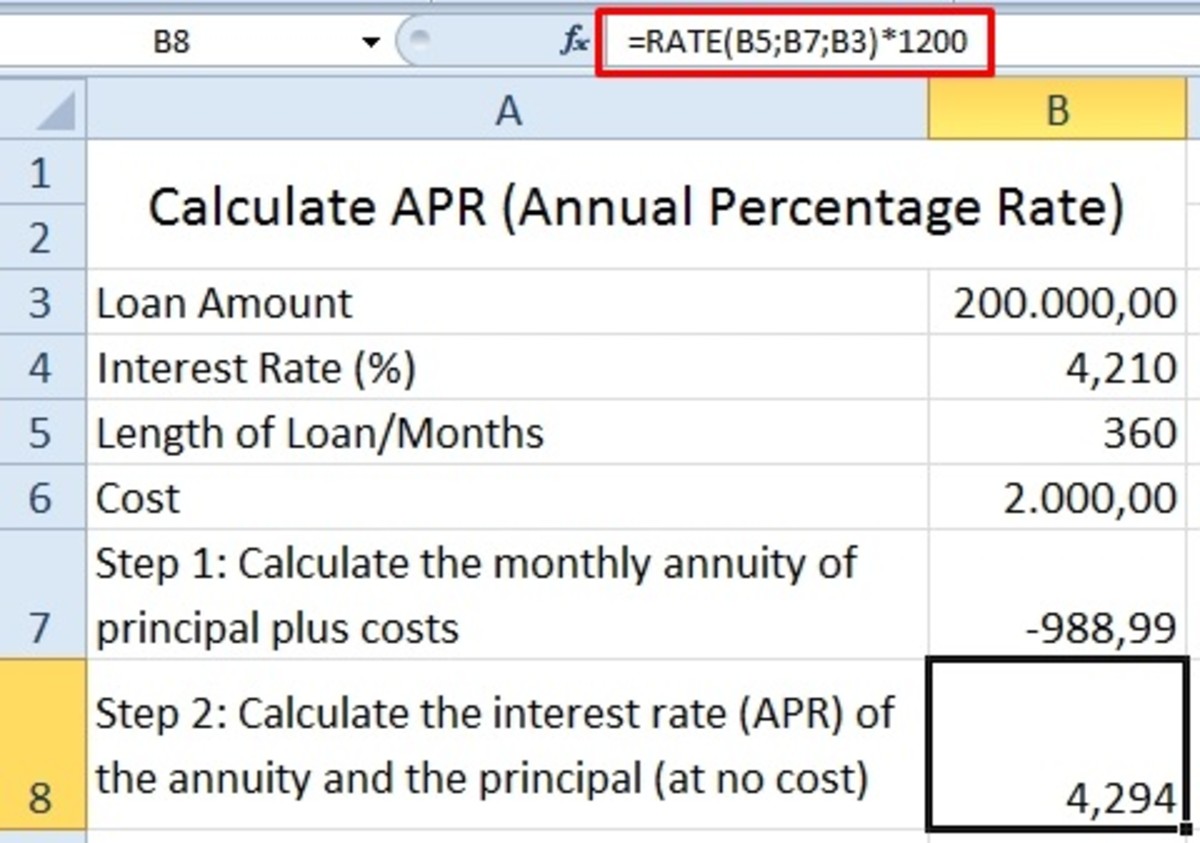

Enter the formula =rate (nper, pmt, pv, [fv], [type], [guess]) step 3: Use the following formula to calculate the effective interest rates for a given interest rate and frequencies. Web the interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. The company has received cash of amount $94,757.86. Web.

Interest Rate Calculation in Excel YouTube

Web this is determined by multiplying the compounding frequency by the number of years. In a blank cell, input the nominal interest rate as a decimal. The term “effective interest rate” refers to the investment’s true annual yield that is earned due to the result of compounding over the period of time. The effective interest.

How to calculate effective interest rate in excel The Tech Edvocate

% interest rate per period. Enter values in journal entry. Conversely, the effective interest rate can be seen as the true cost of borrowing from the point of view of. Go to c6 and write down the following formula. Web for the calculating of the nominal rate to the result need multiply by 12 (the.

How to Calculate Effective Interest Rate and Discount Rate Using Excel

Use the following formula to calculate the effective interest rates for a given interest rate and frequencies. We often pay interest on a loan or earn interest on a saving account. Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). Combine components.

How to Calculate Effective Interest Rate in Excel with Formula

Select the cell where you want the result to appear. This formula divides the nominal interest rate by the number of compounding periods per year, adds one, raises the result to the power of the number of compounding periods, and subtracts one to find the effective interest rate. 12k views 2 years ago #excel #ism..

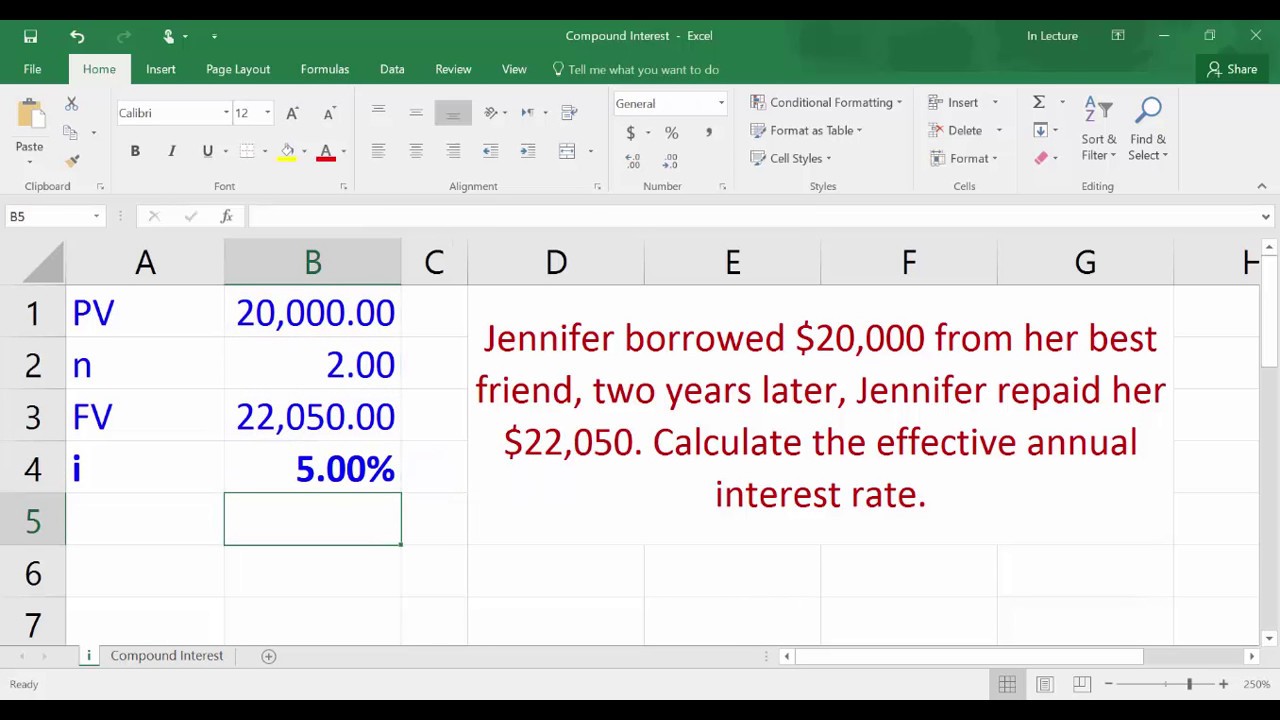

Compound Interest Calculating effective interest rate using Excel YouTube

Following best practices and avoiding common mistakes is important for accurate and reliable calculations. Offer examples to illustrate the calculation process. This formula divides the nominal interest rate by the number of compounding periods per year, adds one, raises the result to the power of the number of compounding periods, and subtracts one to find.

How to Calculate the Interest Rate (=RATE) in MS Excel YouTube

For this, i will use the nominal function. Web you know the present value of the loan ($1000) and the periodic payments to be made against it ($300 per year). Use the following formula to calculate the effective interest rates for a given interest rate and frequencies. Following best practices and avoiding common mistakes is.

How to Calculate Effective Interest Rate and Discount Rate Using Excel

In the example shown, the formula in d5, copied down, is: Use the following formula to calculate the effective interest rates for a given interest rate and frequencies. In a separate cell, input the number of compounding periods per year. Offer examples to illustrate the calculation process. Familiarize yourself with the concept of an effective.

How to Calculate Effective Interest Rate On Bonds Using Excel

We often pay interest on a loan or earn interest on a saving account. Spreadsheet template freespreadsheets for freeinvoice spreadsheets Offer examples to illustrate the calculation process. For this, i will use the nominal function. Web for the calculating of the nominal rate to the result need multiply by 12 (the term of loan): In.

How to Calculate Effective Interest Rate Using Excel ToughNickel

Press enter to calculate the result. Conversely, the effective interest rate can be seen as the true cost of borrowing from the point of view of. • in excel, you use the function effect. Web the effect function is excel’s default function to calculate the effective annual interest rate. Step 2) as the nper argument,.

How To Calculate Effective Interest Rate Using Excel Web effect is calculated as follows: Open microsoft excel and create a new spreadsheet. • in excel, you use the function effect. Web the interest rate calculator determines real interest rates on loans with fixed terms and monthly payments. As easy as it is freetry it now and you'll see

Let’s Now Find The Interest Rate Implicit In It.

As easy as it is freetry it now and you'll see In the example shown, the formula in d5, copied down, is: The higher your interest rate, or yield, the more your bank balance grows. The term “effective interest rate” refers to the investment’s true annual yield that is earned due to the result of compounding over the period of time.

For This, I Will Use The Nominal Function.

Web written by aung shine. Offer examples to illustrate the calculation process. You have set up your excel worksheet to look like the one below. I t = 17.619% rate per compounding interval:

Web For The Calculating Of The Nominal Rate To The Result Need Multiply By 12 (The Term Of Loan):

The company has received cash of amount $94,757.86. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan. > effective interest rate calculator. Press enter to calculate the effective annual interest rate.

I = 3.2989% Effective Rate For 5 Periods:

Go to c6 and write down the following formula. = effect ( rate,c5) where rate is. Web effect is calculated as follows: Web follow the steps to see how we can calculate the effective interest method of amortization for the bond sold on discount in excel.