How To Calculate Capm Alpha In Excel

How To Calculate Capm Alpha In Excel - Web the first step in calculating alpha is to identify the specific stock for which you want to calculate alpha, as well as the benchmark index against which you will compare the. R e = cost of equity. What is the capm beta? Web in this video we will know how to calculate capm alpha & capm beta, jensen alpha for stock / strategy in excelhow to install the data analysis toolpak in mi. Web the formula for capm:

R e = cost of equity. Replace variables with cell references and excel will calculate the asset's. Web the formula goes like this: Web the formula for calculating capm is as follow: This could be a savings account, government bond or other. Web view detailed instructions here: Web enter the capm formula into excel:

Capital Asset Pricing Model (CAPM) Excel Investing Post

R e = cost of equity. Web table of contents. Web the formula for capm: Web use the capm equation: Web view detailed instructions here: What is the capm beta? Web the formula for calculating capm is as follow: R m = expected market return.

Capital Asset Pricing Model (CAPM) Formula + Calculator

Web table of contents. Web view detailed instructions here: R represents the portfolio return. R m = expected market return. Web the capm formula is expressed as follows: Web the formula goes like this: Enter the alternative risk free investment in cell a1. R represents the portfolio return.

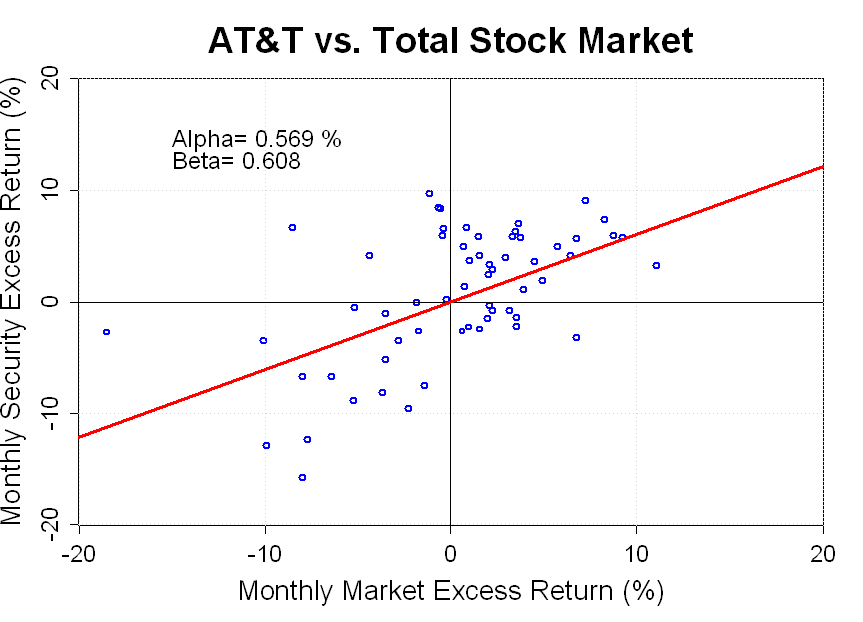

CAPM Single Factor Model with Excel EXFINSIS

According to the capm, the expected return that. Web the capm formula is expressed as follows: This step involves using excel to perform the. This could be a savings account, government bond or other. Before diving into the details, first, let’s get introduced to the term alpha. Web the first step in calculating alpha is.

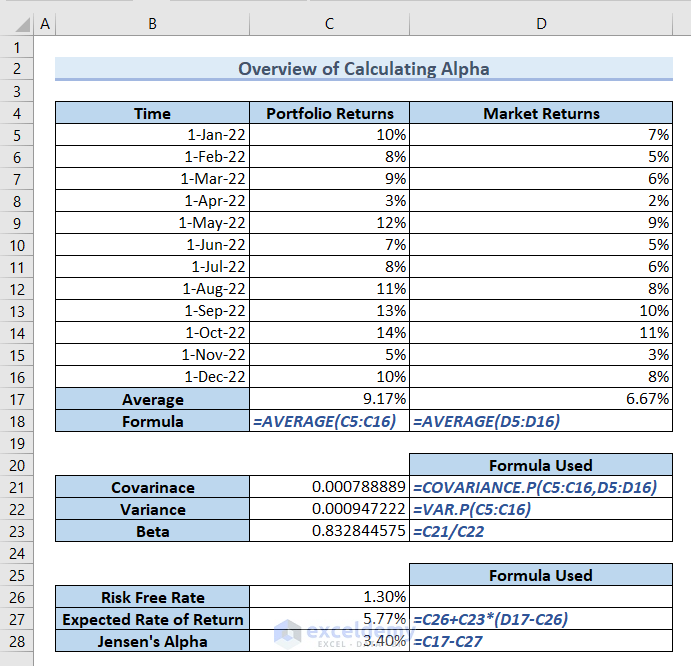

Calculate Jensen's Alpha with Excel

Web steps for capm alpha calculation. Web the capm formula is expressed as follows: Web use the capm equation: What is the capm beta? Web the formula for calculating capm is as follow: Replace variables with cell references and excel will calculate the asset's. Alpha is an indicator to describe the possibility of getting the.

How to Calculate Alpha in Excel (4 Suitable Examples)

Replace variables with cell references and excel will calculate the asset's. According to the capm, the expected return that. Alpha is an indicator to describe the possibility of getting the maximum. Web the first step in calculating alpha is to identify the specific stock for which you want to calculate alpha, as well as the.

How to Calculate CAPM Alpha & Beta for Portfolio YouTube

Web the capm formula is expressed as follows: What is the capm beta? R m = expected market return. Web the formula goes like this: This could be a savings account, government bond or other. Before diving into the details, first, let’s get introduced to the term alpha. Web table of contents. Web view detailed.

How to find expected return on a stock using the CAPM model Financial

R represents the portfolio return. Web in this video we will know how to calculate capm alpha & capm beta, jensen alpha for stock / strategy in excelhow to install the data analysis toolpak in mi. Before diving into the details, first, let’s get introduced to the term alpha. Alpha is an indicator to describe.

The Capital Asset Pricing Model (CAPM) Explained

R represents the portfolio return. Web the capm formula is expressed as follows: Web use the capm equation: Web the formula goes like this: R e = cost of equity. What is the capm beta? Web enter the capm formula into excel: R m = expected market return.

What is CAPM? Formula + Calculator

Web steps for capm alpha calculation. Web view detailed instructions here: Web the capm formula is expressed as follows: R represents the portfolio return. Web the first step in calculating alpha is to identify the specific stock for which you want to calculate alpha, as well as the benchmark index against which you will compare.

What is the formula for calculating CAPM in Excel?

Web the capm formula is expressed as follows: Web in this video we will know how to calculate capm alpha & capm beta, jensen alpha for stock / strategy in excelhow to install the data analysis toolpak in mi. R represents the portfolio return. Web the formula for calculating capm is as follow: Web the.

How To Calculate Capm Alpha In Excel R e = cost of equity. This could be a savings account, government bond or other. This step involves using excel to perform the. Enter the alternative risk free investment in cell a1. Before diving into the details, first, let’s get introduced to the term alpha.

Web The Formula For Capm:

What is the capm beta? Enter the alternative risk free investment in cell a1. Web the formula goes like this: Begin with entering the necessary inputs:

R E = Cost Of Equity.

Web enter the capm formula into excel: Alpha is an indicator to describe the possibility of getting the maximum. Web view detailed instructions here: Web table of contents.

R M = Expected Market Return.

Web the capm formula is expressed as follows: R represents the portfolio return. Web steps for capm alpha calculation. Web the capm formula is expressed as follows:

Web The First Step In Calculating Alpha Is To Identify The Specific Stock For Which You Want To Calculate Alpha, As Well As The Benchmark Index Against Which You Will Compare The.

This step involves using excel to perform the. Web in this video we will know how to calculate capm alpha & capm beta, jensen alpha for stock / strategy in excelhow to install the data analysis toolpak in mi. R represents the portfolio return. According to the capm, the expected return that.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)