Employee Retention Credit Template

Employee Retention Credit Template - Web thus, the maximum employee retention credit available is $7,000 per employee per calendar quarter, for a total. Web for each 2021 quarter, an eligible employer can credit up to $10,000 in qualified wages per employee. Web the employee retention credit is a complex credit that requires careful review before applying. A nonprofit with 20 employees example 2: Web get started with the ey employee retention credit calculator.

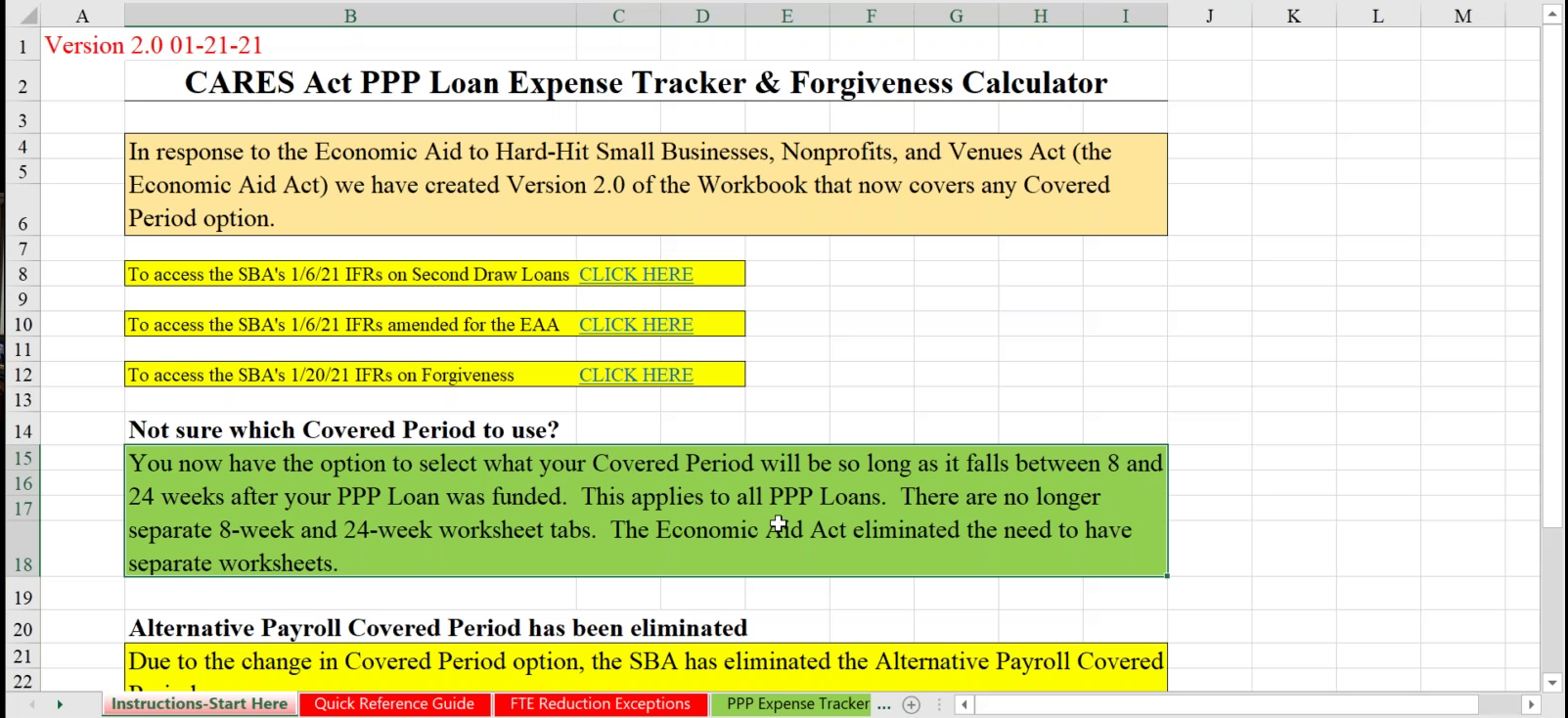

Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Web level 1 posted october 02, 2020 05:44 am last updated october 02, 2020 5:44 am employee retention credit worksheet. Determine if you had a qualifying closure step 4: A nonprofit with 20 employees example 2: These programs provide a tax deferral or tax credit against employer. Web this is a completely adaptable powerpoint template design that can be used to interpret topics like mitigate, mobilize, maintain,. The following tools for calculating erc were.

Employee Retention Credit Form MPLOYME

Web level 1 posted october 02, 2020 05:44 am last updated october 02, 2020 5:44 am employee retention credit worksheet. Calculate the erc for your business step 7: Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Web employee retention credit financial reporting & disclosure.

Employee Retention Bonus Agreement Template [Free PDF] Google Docs

In the event of a change of control (as defined below) occurring within 0 months of the effective. Calculate the erc for your business step 7: Web the small business employee retention credit lets employers take a 70% credit up to $10,000 of an employee’s. Web to simplify the process of calculating the retention rate,.

Employee Retention Credit Form MPLOYME

Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. The following tools for calculating erc were. Web the erc can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible. Web 1124 employee retention.

Employee Retention Credit (ERC) Calculator Gusto

Web practitioners are sure to see a lot of employee retention credit (erc) issues. Assess your qualified wages for each year step 6: Web 2021 (caa) passed in late december 2020. Web thus, the maximum employee retention credit available is $7,000 per employee per calendar quarter, for a total. The following tools for calculating erc.

COVID19 Relief Legislation Expands Employee Retention Credit

These programs provide a tax deferral or tax credit against employer. Determine if you had a qualifying closure step 4: Enter a few data points to receive a free estimate. Understand which quarters qualify step 2: Web level 1 posted october 02, 2020 05:44 am last updated october 02, 2020 5:44 am employee retention credit.

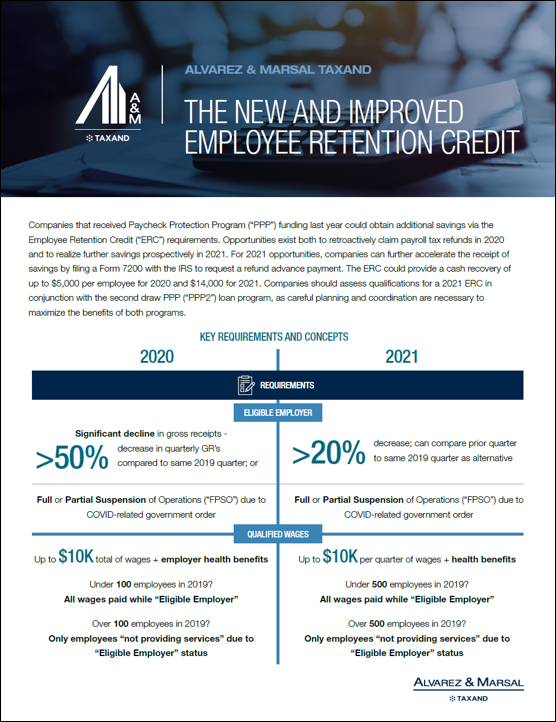

The New and Improved Employee Retention Credit Alvarez & Marsal

Web for each 2021 quarter, an eligible employer can credit up to $10,000 in qualified wages per employee. Web from march 13, 2020, through dec. Web 1124 employee retention credit: Web 2021 (caa) passed in late december 2020. Web this is a completely adaptable powerpoint template design that can be used to interpret topics like.

Employee Retention Credit Form MPLOYME

Web employee retention credit financial reporting & disclosure examples employee retention credit financial reporting & disclosure examples. Web employee retention credit examples example 1: Web the erc can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible. Enter a few data points to.

The Employee Retention Credit Report Issue 298 Gassman, Crotty

Web this is a completely adaptable powerpoint template design that can be used to interpret topics like mitigate, mobilize, maintain,. Web practitioners are sure to see a lot of employee retention credit (erc) issues. Web the employee retention credit is a complex credit that requires careful review before applying. These programs provide a tax deferral.

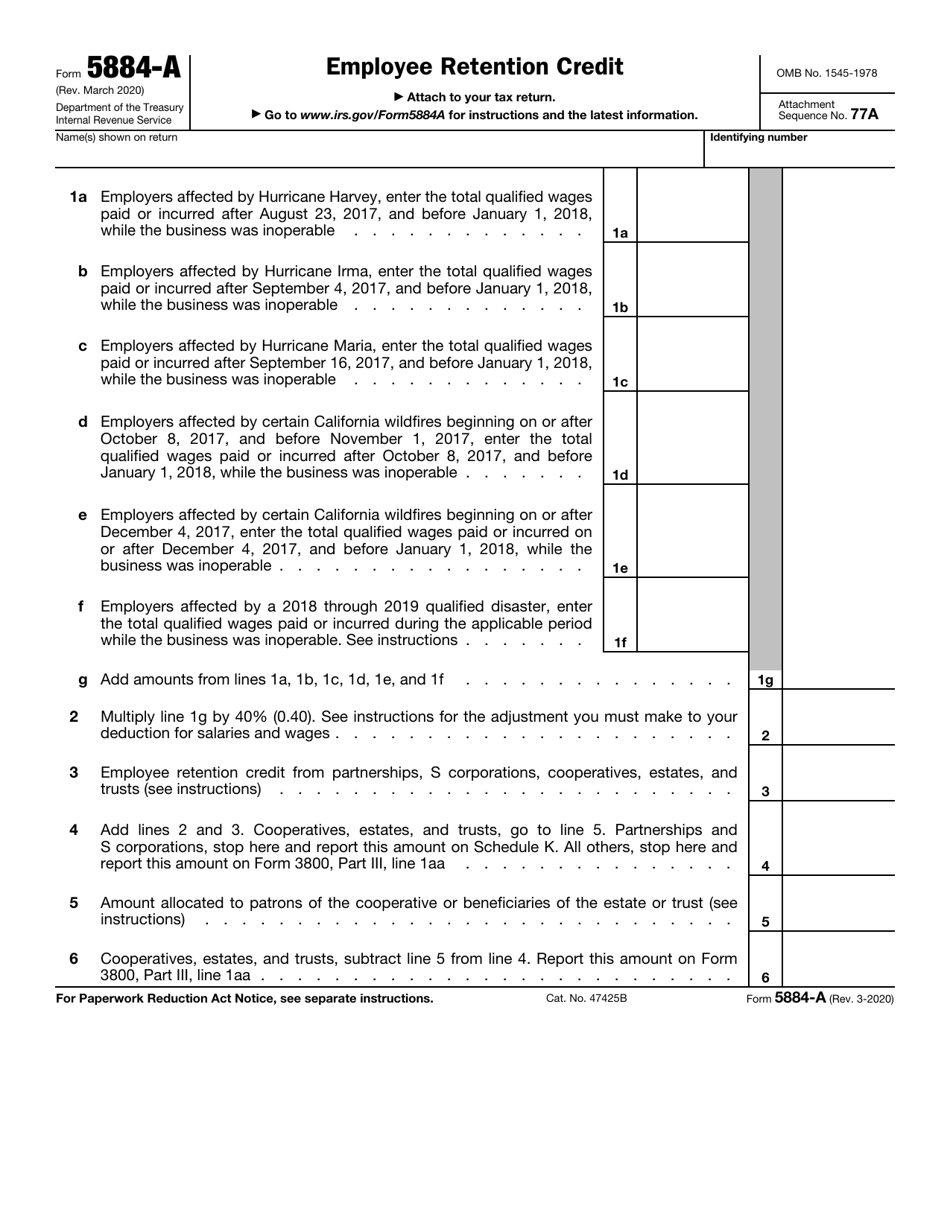

IRS Form 5884A Download Fillable PDF or Fill Online Employee Retention

Web the erc can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible. Web the employee retention and employee retention and rehiring tax credits the march 2020 coronavirus aid, relief, and. Web employee retention credit financial reporting & disclosure examples employee retention credit.

Employee Retention Credit Form MPLOYME

A nonprofit with 20 employees example 2: Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their. Understand which quarters qualify step 2: Look for advanced refund eligibility for erc worksheet assistance, contact erc today Web the employee retention credit is a complex credit that requires.

Employee Retention Credit Template The following tools for calculating erc were. 31, 2020, the credit cap was $5,000 per employee for the year. Web from march 13, 2020, through dec. Look for advanced refund eligibility for erc worksheet assistance, contact erc today Web get started with the ey employee retention credit calculator.

Enter A Few Data Points To Receive A Free Estimate.

The following tools for calculating erc were. Web to simplify the process of calculating the retention rate, we have created a simple and easy employee retention rate calculator excel template with predefined formulas. Calculate the erc for your business step 7: A nonprofit with 20 employees example 2:

Web Practitioners Are Sure To See A Lot Of Employee Retention Credit (Erc) Issues.

Web 1124 employee retention credit: Web the employee retention and employee retention and rehiring tax credits the march 2020 coronavirus aid, relief, and. Web level 1 posted october 02, 2020 05:44 am last updated october 02, 2020 5:44 am employee retention credit worksheet. Web the erc can be up to $5,000 per employee (for 2020) and up to $21,000 per employee in 2021 so long as an eligible.

Web The Employee Retention Tax Credit Is Essentially A Refundable Payroll Tax Credit That Businesses Could Claim On.

Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. These programs provide a tax deferral or tax credit against employer. Assess your qualified wages for each year step 6: Web this is a completely adaptable powerpoint template design that can be used to interpret topics like mitigate, mobilize, maintain,.

Web Employee Retention Credit Examples Example 1:

Web the small business employee retention credit lets employers take a 70% credit up to $10,000 of an employee’s. Determine business status step 5: Understand which quarters qualify step 2: Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their.

![Employee Retention Bonus Agreement Template [Free PDF] Google Docs](https://images.template.net/44646/Employee-Retention-Bonus-Agreement-Template-1.jpeg)