Discounted Cash Flow Model Excel Template

Discounted Cash Flow Model Excel Template - Web discounted cash flow (dcf) model template. Estimate value of future cash flows. Capm & actual dividend methods. Contact information can also be included here. It looks at the present value of annual cash flows, allowing you to adjust the template for the discount rate.

Web discounted cash flow (dcf) model template. Utilize our google sheets discounted cash flow (dcf) template to perform comprehensive. Capm & actual dividend methods. Use our dcf model template for your financial valuations. Web the sections of this model template are as follows: The best way to calculate the present value in. So what does a dcf entail and why do we.

discounted cash flow excel template —

The discount rate used is typically the company’s weighted average cost of capital (wacc). Gather the cash flow data. This includes identifying the time periods for. Web download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Capm & actual dividend methods. Forecast future cash flows and determine.

DCF Discounted Cash Flow Model Excel Template Eloquens

What is it and how to calculate it? Estimate value of future cash flows. Use the form below to get the excel model template to follow along with this lesson. Contact information can also be included here. Web mastering the discounted cash flow (dcf) model in excel empowers you to make informed financial decisions. With.

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Web download excel templates for valuing a company, a project, or an asset based on future cash flows. Web download a free excel template to build your own dcf model with different assumptions. Web before we begin, download the dcf template. Web mastering the discounted cash flow (dcf) model in excel empowers you to make.

Free Discounted Cash Flow Templates Smartsheet

Web download excel templates for valuing a company, a project, or an asset based on future cash flows. Web get insights into the discounted cash flow (dcf) model excel technique. Web free download discounted cash flow excel template. Web this file allows you to calculate discounted cash flow in excel. Web a discounted cash flow.

DCF Discounted Cash Flow Model Excel Template Eloquens

This includes identifying the time periods for. Web the sections of this model template are as follows: Web download excel templates for valuing a company, a project, or an asset based on future cash flows. The first step in calculating discounted cash flows is to gather the necessary cash flow data. Utilize our google sheets.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

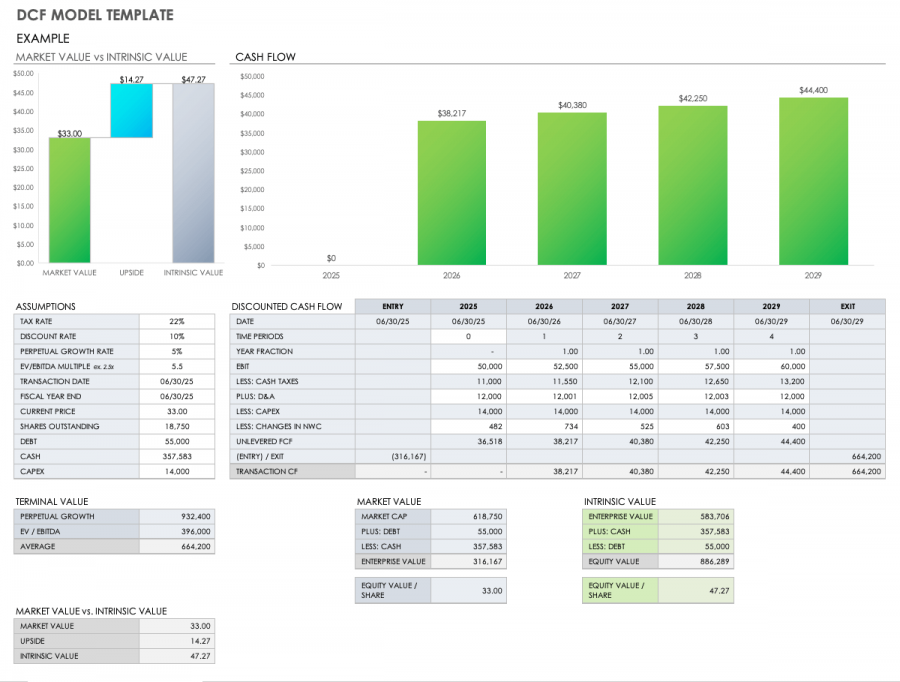

Web a discounted cash flow analysis is a cornerstone technique that considers the time value of money by discounting expected future cash flows to their present value. Web download a free excel template to build your own dcf model with different assumptions. Use the form below to get the excel model template to follow along.

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

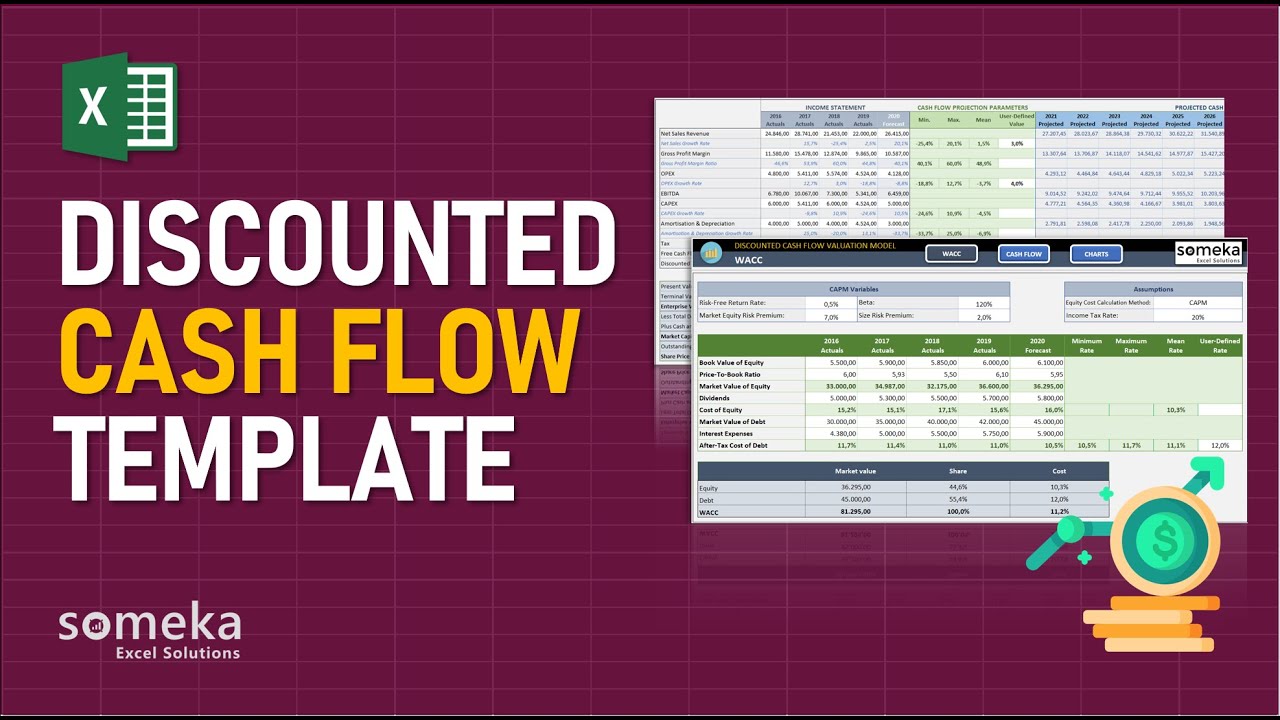

Web before we begin, download the dcf template. Web this video alongside dcf model template in excel will teach you how to build a basic discounted cash flow model. Web maximize investment decisions with our discounted cash flow template. Web download excel templates for valuing a company, a project, or an asset based on future.

Free Discounted Cash Flow Templates Smartsheet

Web this file allows you to calculate discounted cash flow in excel. The discount rate used is typically the company’s weighted average cost of capital (wacc). The best way to calculate the present value in. In step 3 of this dcf walk through it’s time to discount the forecast period (from step 1) and the.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Gather the cash flow data. Web download a free excel template to build your own dcf model with different assumptions. The first step in calculating discounted cash flows is to gather the necessary cash flow data. Learn how to use dcf models, analysis, and valuation. So what does a dcf entail and why do we..

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Forecast future cash flows and determine the. Gather the cash flow data. Contact information can also be included here. Learn how to use dcf models, analysis, and valuation. Capm & actual dividend methods. Web this video alongside dcf model template in excel will teach you how to build a basic discounted cash flow model. Web.

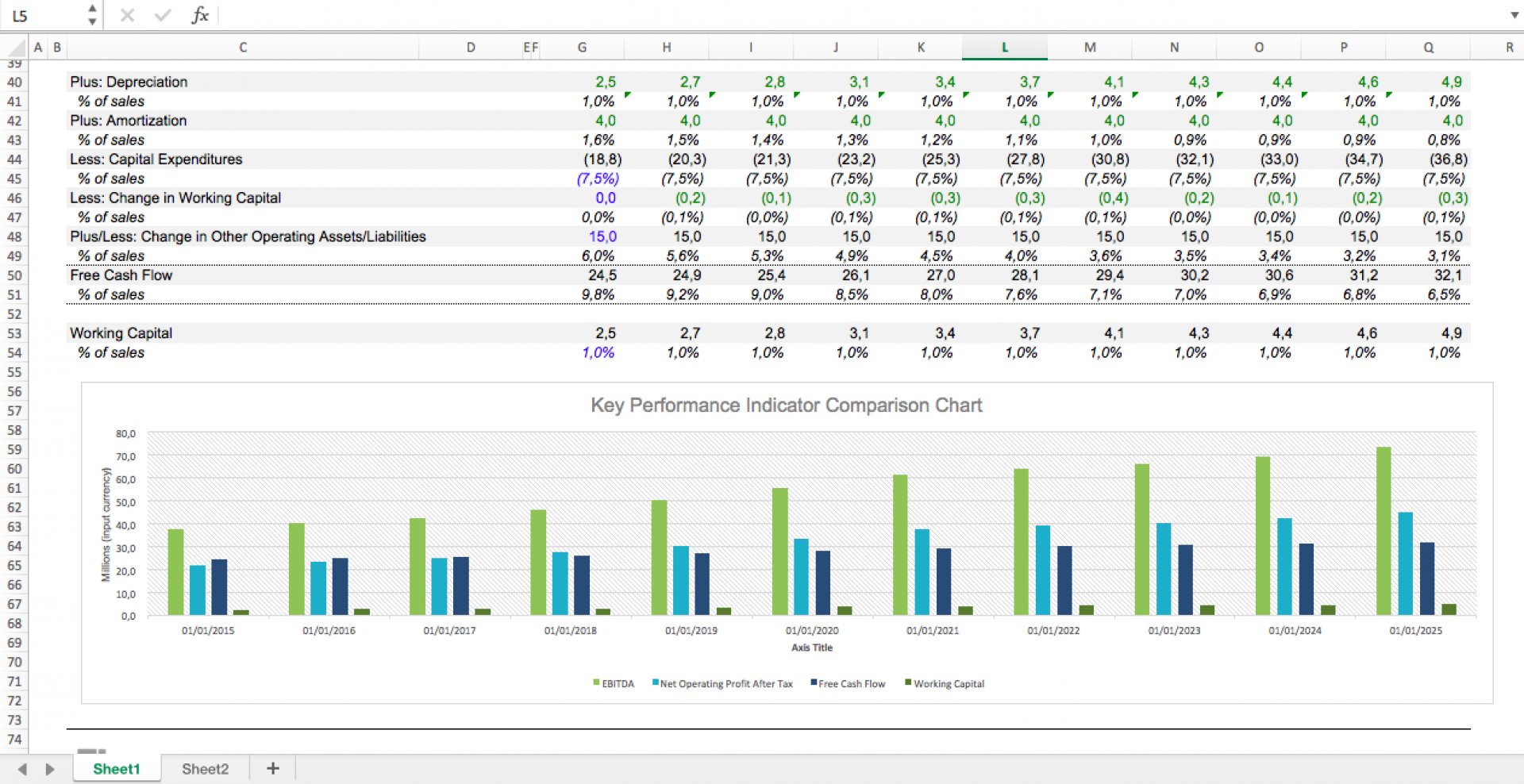

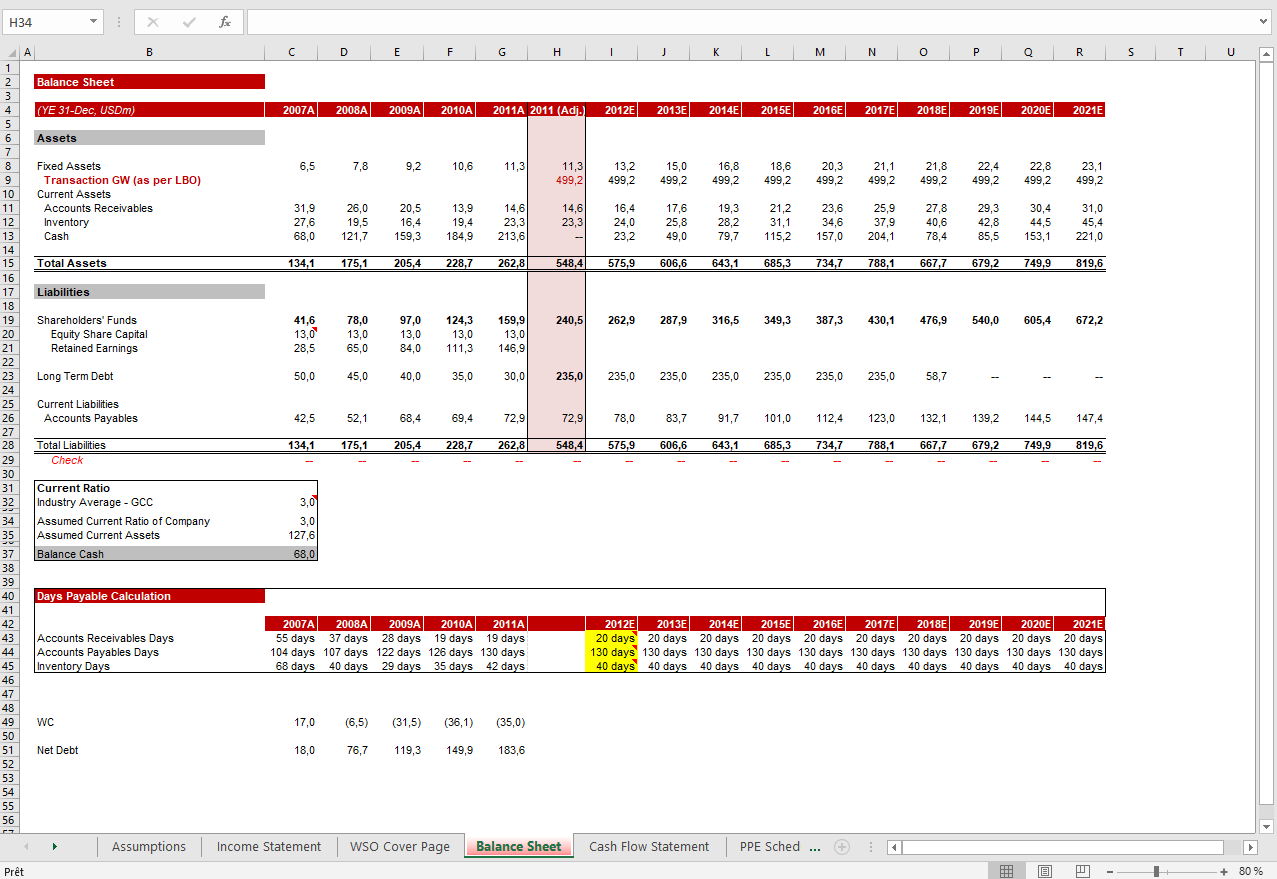

Discounted Cash Flow Model Excel Template Web the sections of this model template are as follows: Web free download discounted cash flow excel template. Web a discounted cash flow analysis is a cornerstone technique that considers the time value of money by discounting expected future cash flows to their present value. The discount rate used is typically the company’s weighted average cost of capital (wacc). It looks at the present value of annual cash flows, allowing you to adjust the template for the discount rate.

Web Download Our Free Discounted Cash Flow (Dcf) Template To Easily Estimate The Intrinsic Value Of A Company.

In step 3 of this dcf walk through it’s time to discount the forecast period (from step 1) and the terminal value (from step 2) back to the present value using a discount rate. The best way to calculate the present value in. Gather the cash flow data. Capm & actual dividend methods.

Web The Sections Of This Model Template Are As Follows:

Easy financial forecastssign up in under 1 minuteno experience necessary Web this file allows you to calculate discounted cash flow in excel. Use the form below to get the excel model template to follow along with this lesson. Use our dcf model template for your financial valuations.

Web Before We Begin, Download The Dcf Template.

Web mastering the discounted cash flow (dcf) model in excel empowers you to make informed financial decisions. The template also includes other tabs for other elements of a financial model and a. Web a discounted cash flow analysis is a cornerstone technique that considers the time value of money by discounting expected future cash flows to their present value. It looks at the present value of annual cash flows, allowing you to adjust the template for the discount rate.

The First Step In Calculating Discounted Cash Flows Is To Gather The Necessary Cash Flow Data.

Tailored for both beginners and professionals. What is it and how to calculate it? Web download a free excel template to build your own dcf model with different assumptions. A brief description of the model’s purpose.