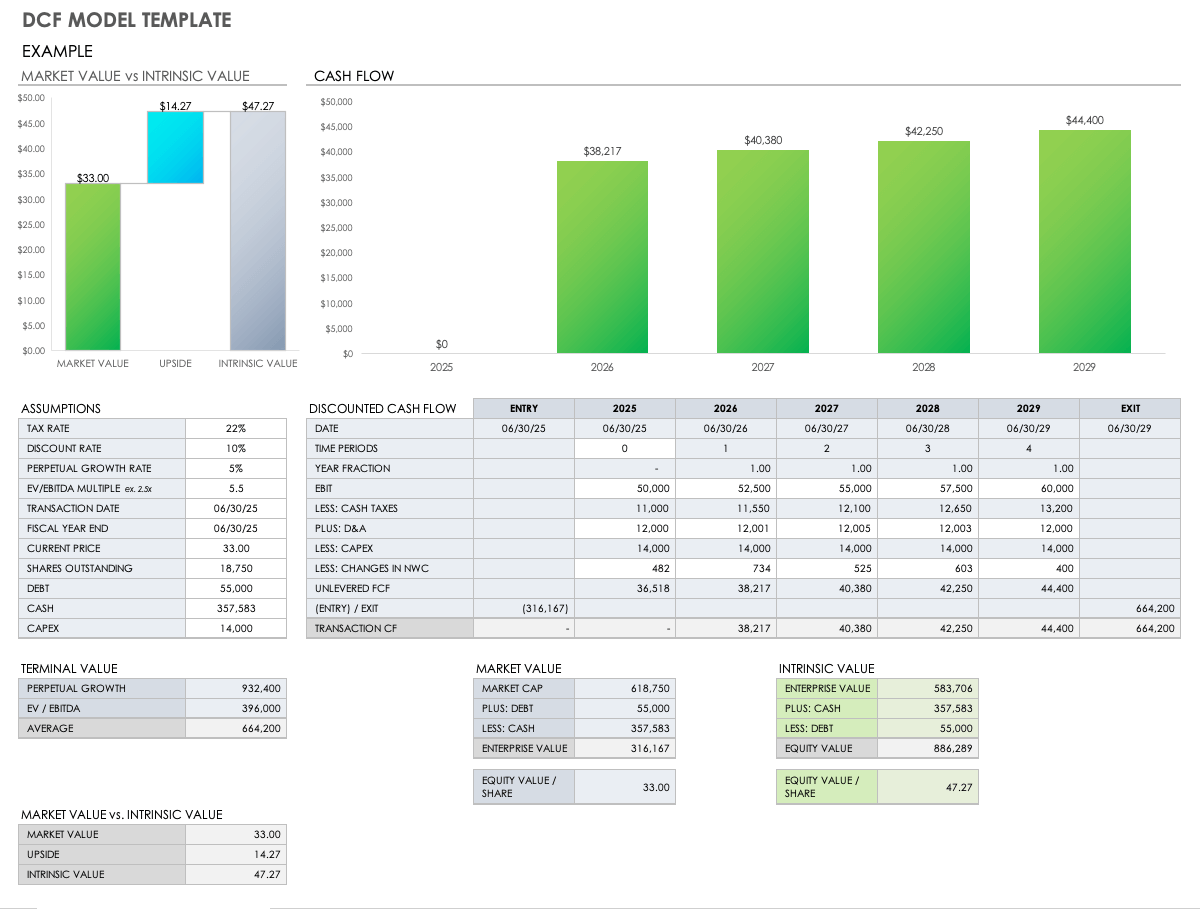

Discounted Cash Flow Excel Template

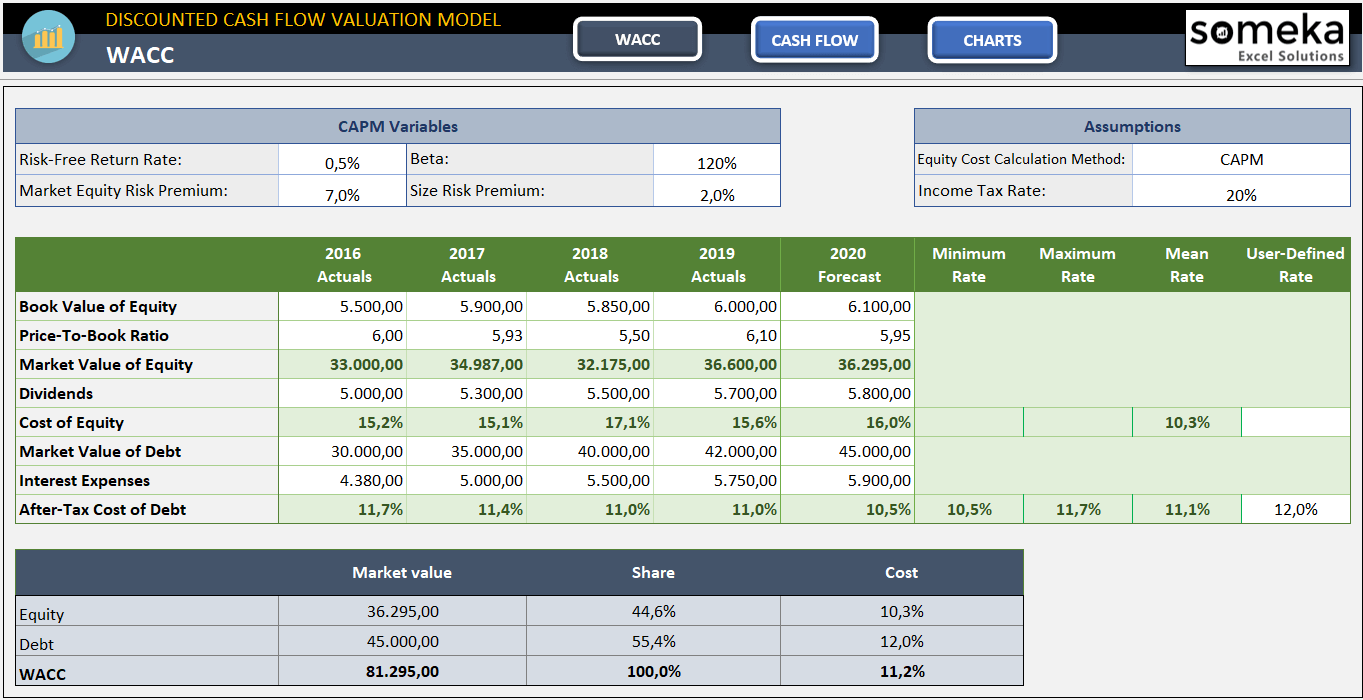

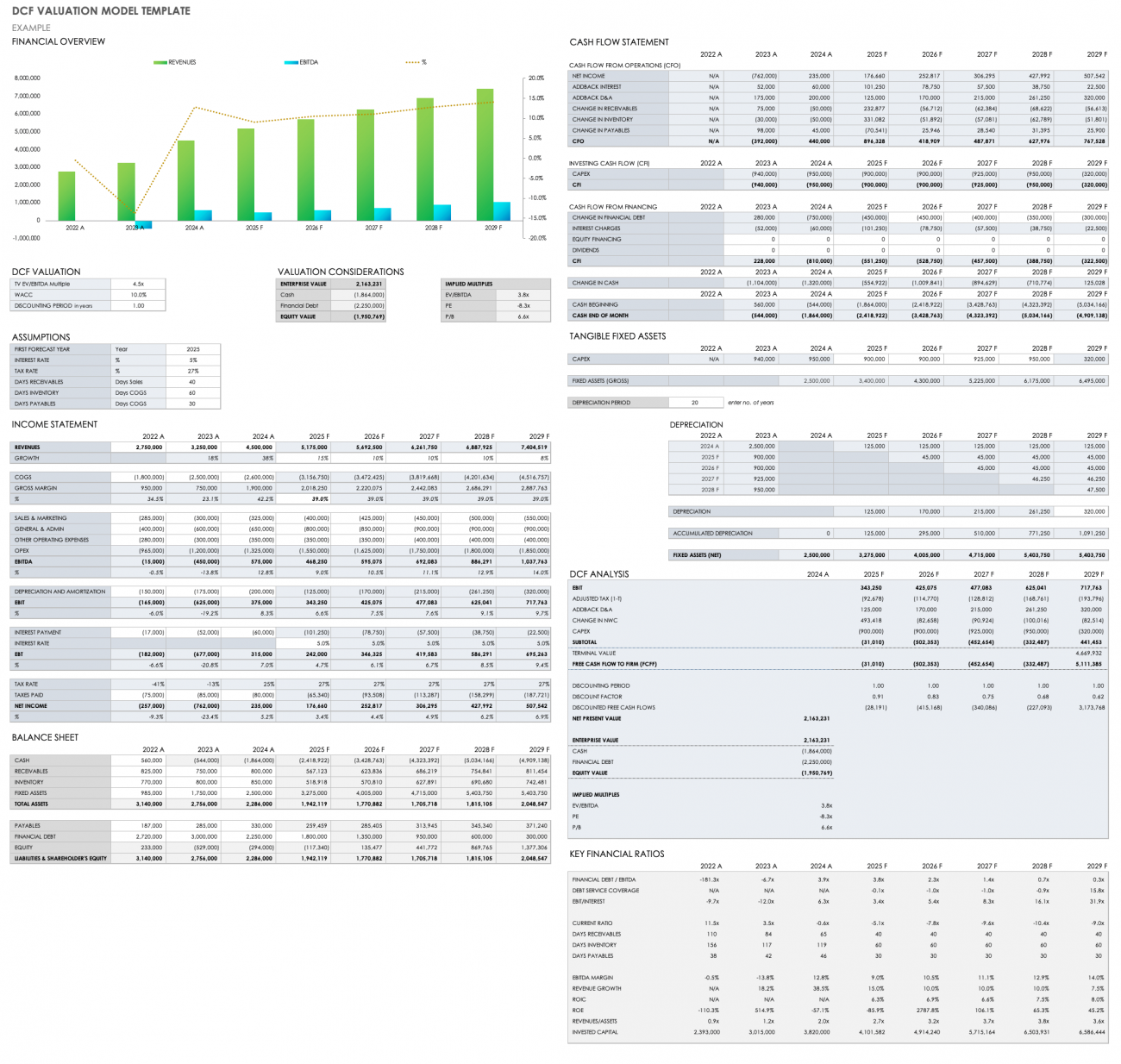

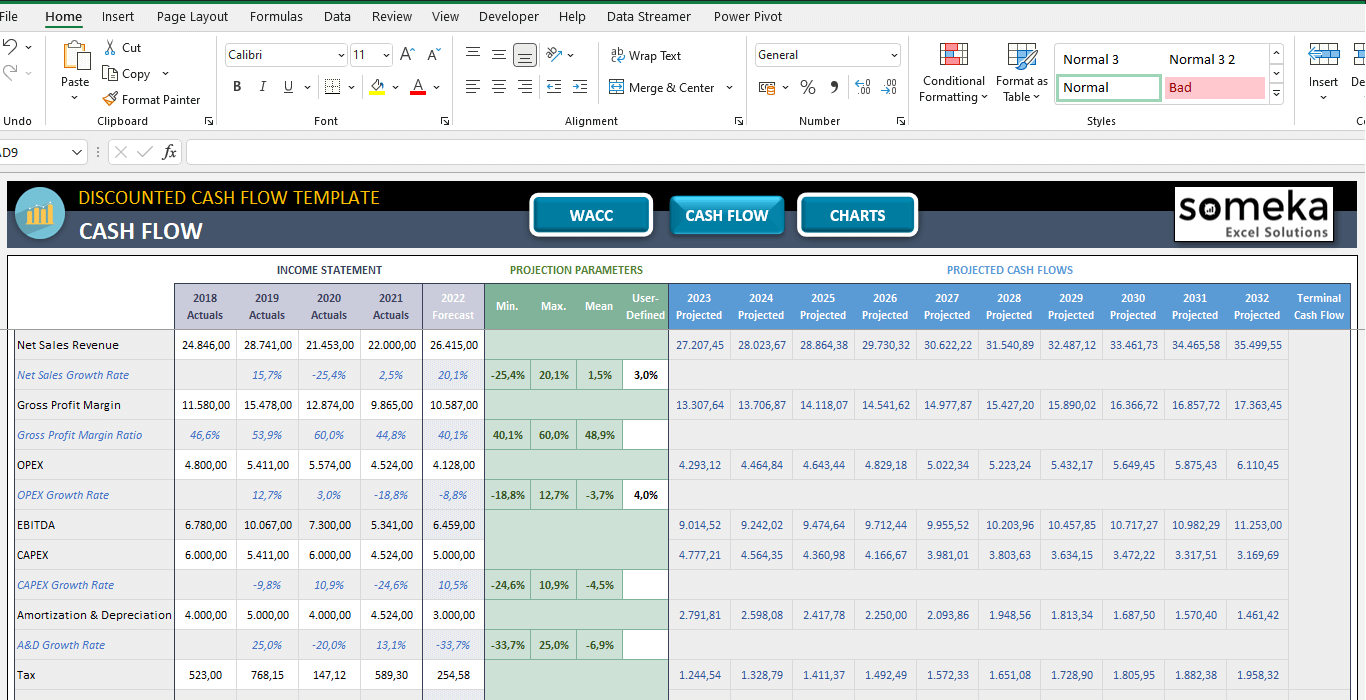

Discounted Cash Flow Excel Template - Gather the cash flow data. Dcf is a valuation method used to determine the present value of an investment by discounting future cash flows. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. Sum the discounted cash flows to find the investment’s npv. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic value, investments, and real estate based on expected future cash flows.

Tailored for both beginners and professionals. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately. Web download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. The present value of each discounted cash flow is then calculated. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. The discounted cash flow formula;

DCF Discounted Cash Flow Model Excel Template Eloquens

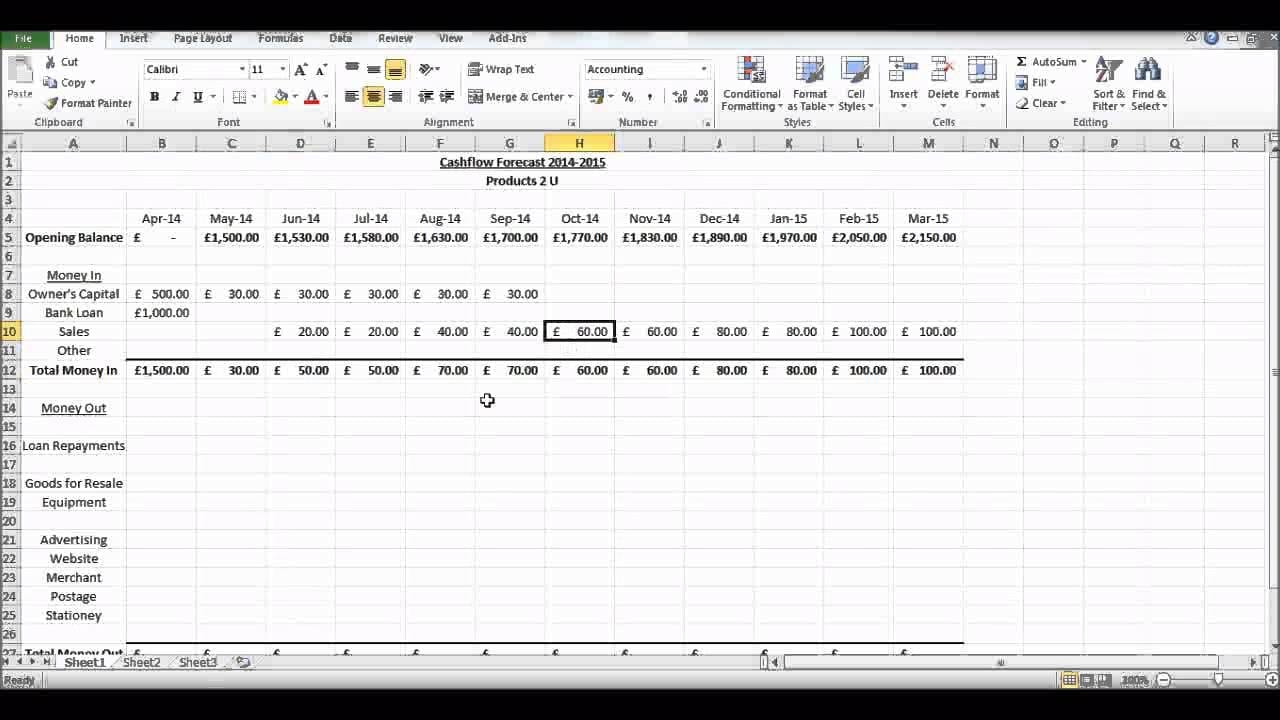

Web list all projected cash flows in a column. Web on this page, you’ll find the following: Web open excel and click blank workbook. Web the goal in a dcf is to reflect the company’s cash revenue, cash expenses, and cash taxes, so we believe the best approach is to deduct the entire operating lease.

Discounted Cash Flow Excel Template Free

Do you need to calculate the present value of future cash flows or assess two options that will impact your cash flow over many years? Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions 1.4 npv of multiple cash flows • 4 minutes..

Free Discounted Cash Flow Templates Smartsheet

Understand discounted cash flow principles and perform accurate valuations in excel. It represents the value of an investor and his/her willingness to pay for an investment, with a. Name the workbook, choose a place to save it, and click the save button. Dcf is a widely used method for valuation, particularly for evaluating companies with.

Discounted Cash Flow Excel Template DCF Valuation Template

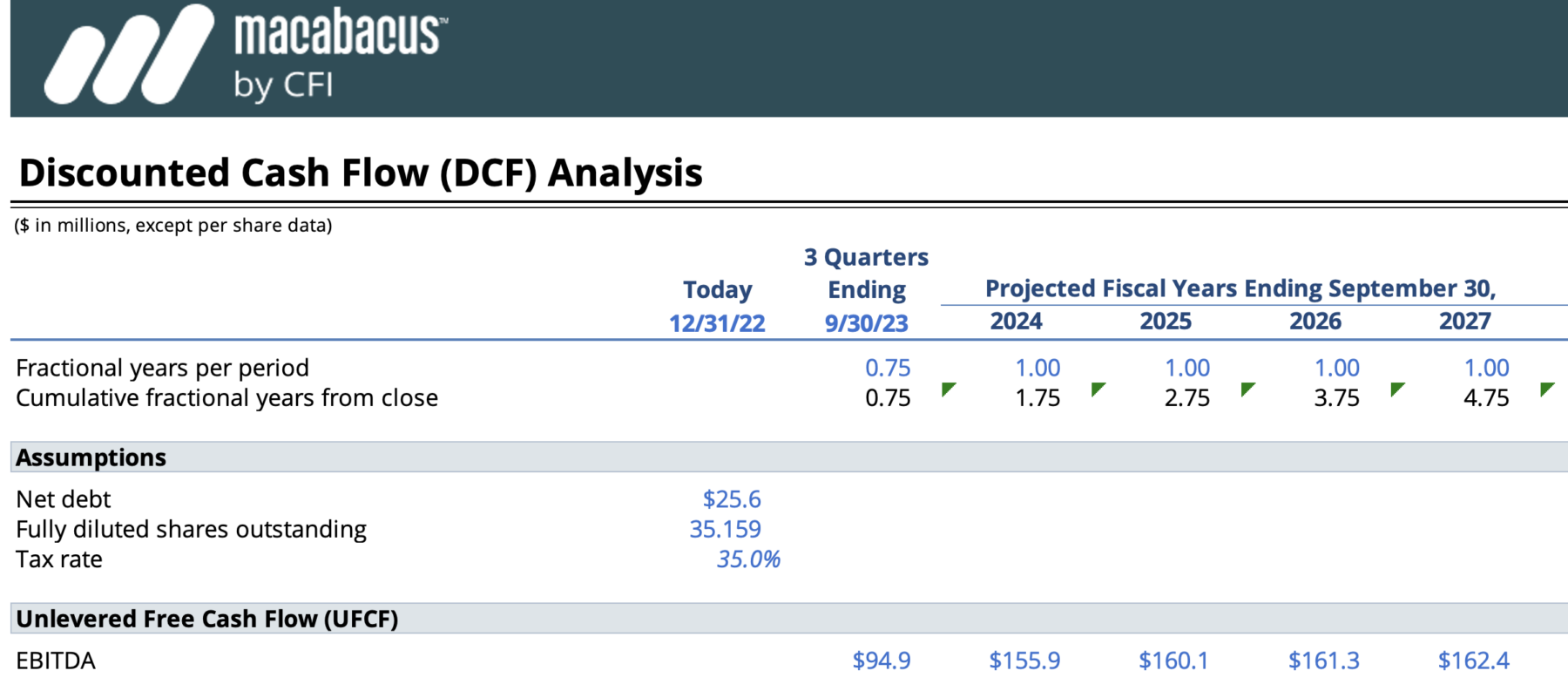

Understand discounted cash flow principles and perform accurate valuations in excel. Web 1.1 future value • 9 minutes. Web the goal in a dcf is to reflect the company’s cash revenue, cash expenses, and cash taxes, so we believe the best approach is to deduct the entire operating lease expense in ufcf. Forecast the company's.

Free Discounted Cash Flow Templates Smartsheet

Use excel formulas like =npv (discount rate, range of cash flows) to calculate the present value of those cash flows. Web on this page, you’ll find the following: Before calculating the discount rate, you’ll need to gather some essential information, including the future cash flows of the investment and the period over which those cash.

DCF Discounted Cash Flow Model Excel Template Eloquens

What is a dcf model? The purpose of the discounted free cash flow financial model template is to provide the user with a useful tool to estimate investment return potential by discounting future cash. This template allows you to build your own discounted cash flow model with different assumptions. Enter your name and email in.

discounted cash flow excel template —

Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. So, this model calculates the present value of expected future cash flows using a discount rate. Web discounted cash flow (dcf) excel.

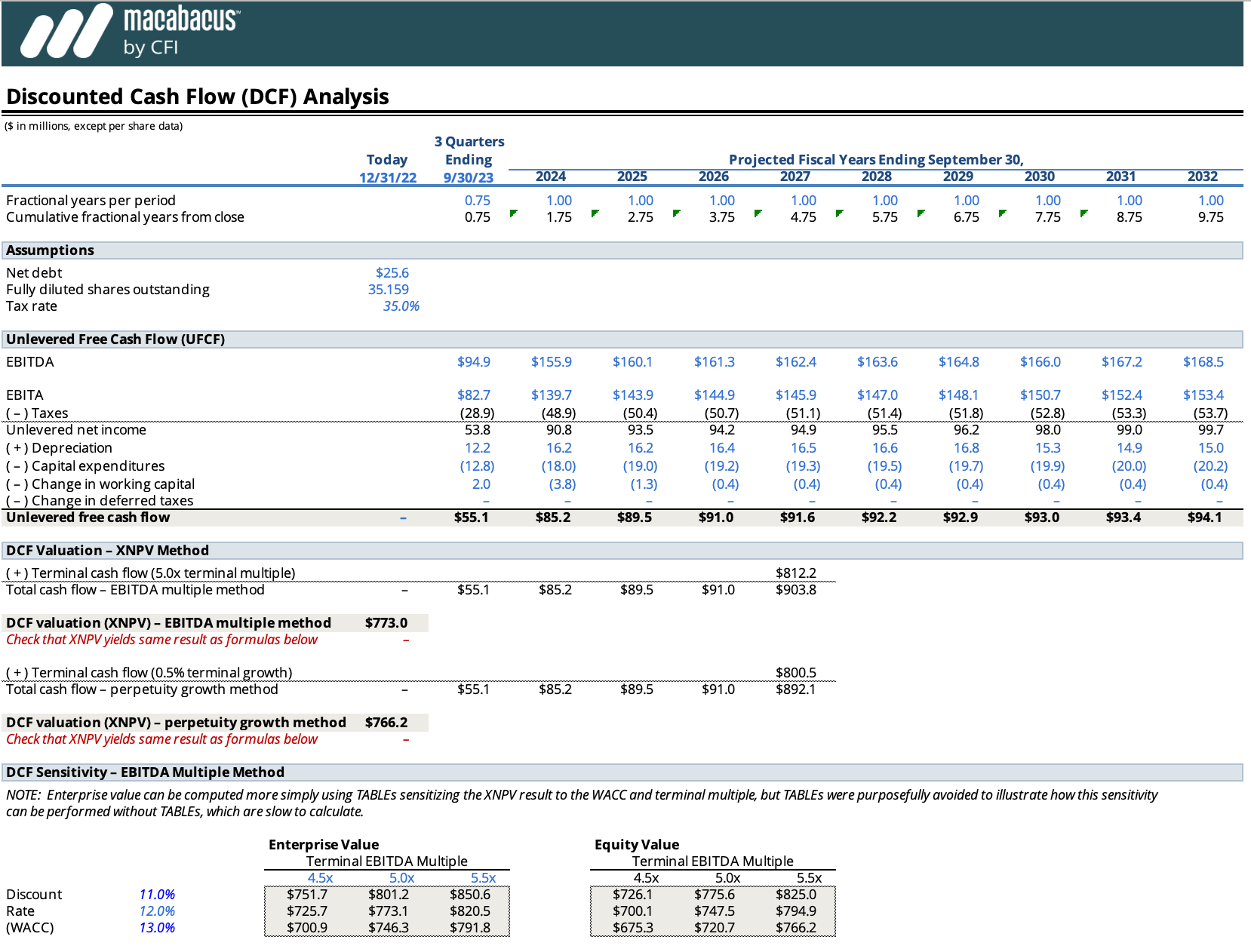

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions The purpose of the discounted free cash flow financial model template is to provide the user with a useful tool to estimate investment return potential by discounting future cash. The template uses the discounted.

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Web list all projected cash flows in a column. Before calculating the discount rate, you’ll need to gather some essential information, including the future cash flows of the investment and the period over which those cash flows will occur. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future.

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where ‘n’ represents the number of periods into the future. Name the workbook, choose a place to save it, and click the save button. Understanding the discount factor and the initial investment is crucial as these.

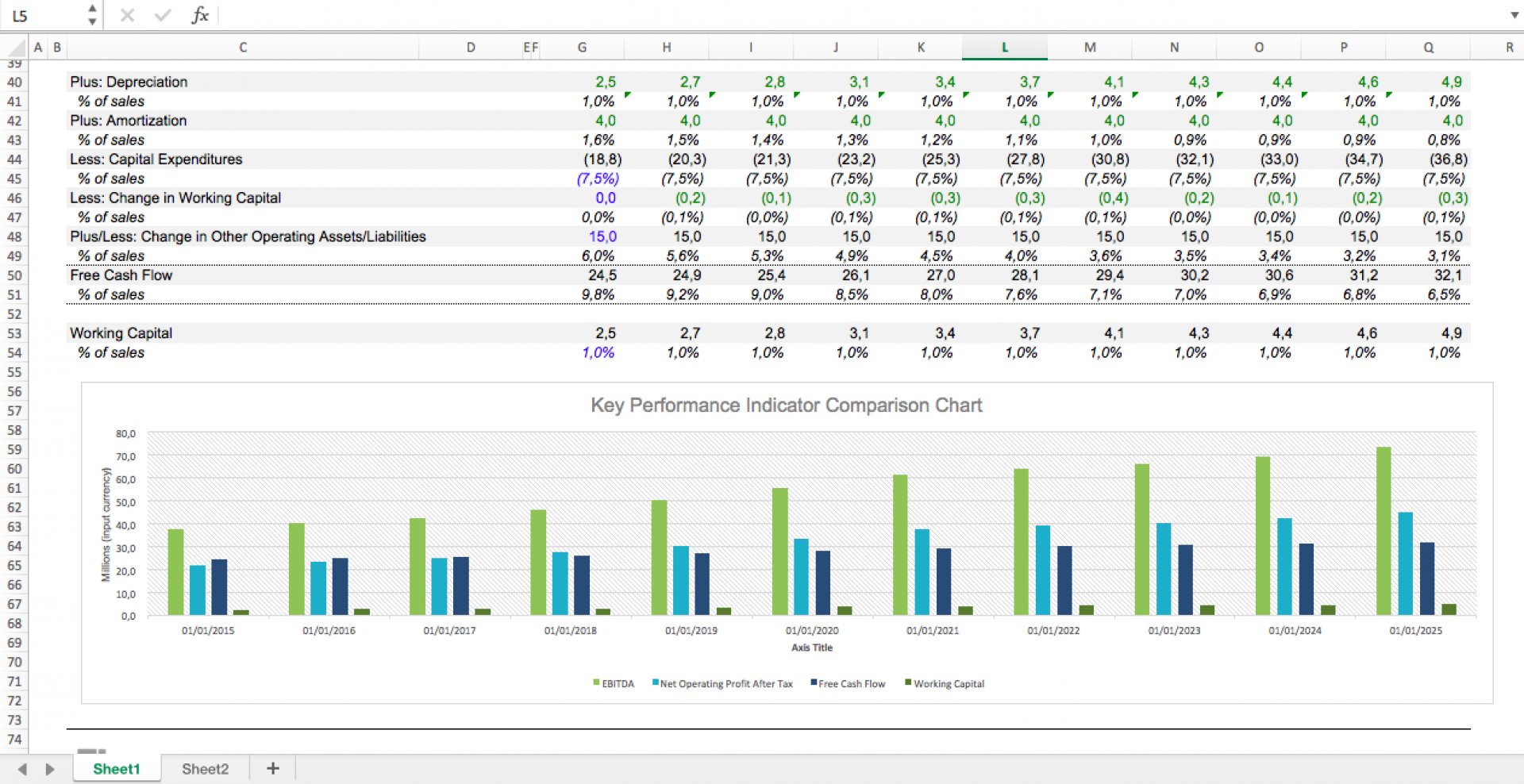

Discounted Cash Flow Excel Template Gather the cash flow data. Web learn how to quickly set up a discounted cash flow calculations in excel. Forecast future cash flows and determine the present value of these cash flows by discounting. Dcf is a valuation method used to determine the present value of an investment by discounting future cash flows. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable templates for determining a company’s intrinsic value, investments, and real estate based on expected future cash flows.

Web Elevate Your Investment Analysis With Our Free Dcf Model Template.

Understand discounted cash flow principles and perform accurate valuations in excel. The purpose of the discounted free cash flow financial model template is to provide the user with a useful tool to estimate investment return potential by discounting future cash. Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions Web this involves dividing each cash flow by the appropriate discount factor, which is calculated as (1+discount~rate)^n (1+discount rate)n, where ‘n’ represents the number of periods into the future.

Instructions For Beta Test • 10 Minutes.

The template uses the discounted cash flow (dcf) method, which discounts future cash. Web have you ever wondered how to calculate the discounted cash flows (dcf) in excel? Use our dcf model template for your financial valuations. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately.

Enter Your Name And Email In The Form And Download The Free Template Now!

1.4 npv of multiple cash flows • 4 minutes. It represents the value of an investor and his/her willingness to pay for an investment, with a. Tips for doing a discounted cash flow analysis; Web the discounted cash flow (dcf) model is a valuation method, used to estimate the value of an investment based on its expected future cash flows.

Web Microsoft Excel Has Made Our Work Easier With The Discounted Cash Flow Formula.

Web the goal in a dcf is to reflect the company’s cash revenue, cash expenses, and cash taxes, so we believe the best approach is to deduct the entire operating lease expense in ufcf. And examples showing how the analysis works in various scenarios. Web master the formula for discounted cash flow in excel with this guide to enhance your financial analysis and investment decisions. Calculating unlevered free cash flows (fcf) key dcf assumptions.