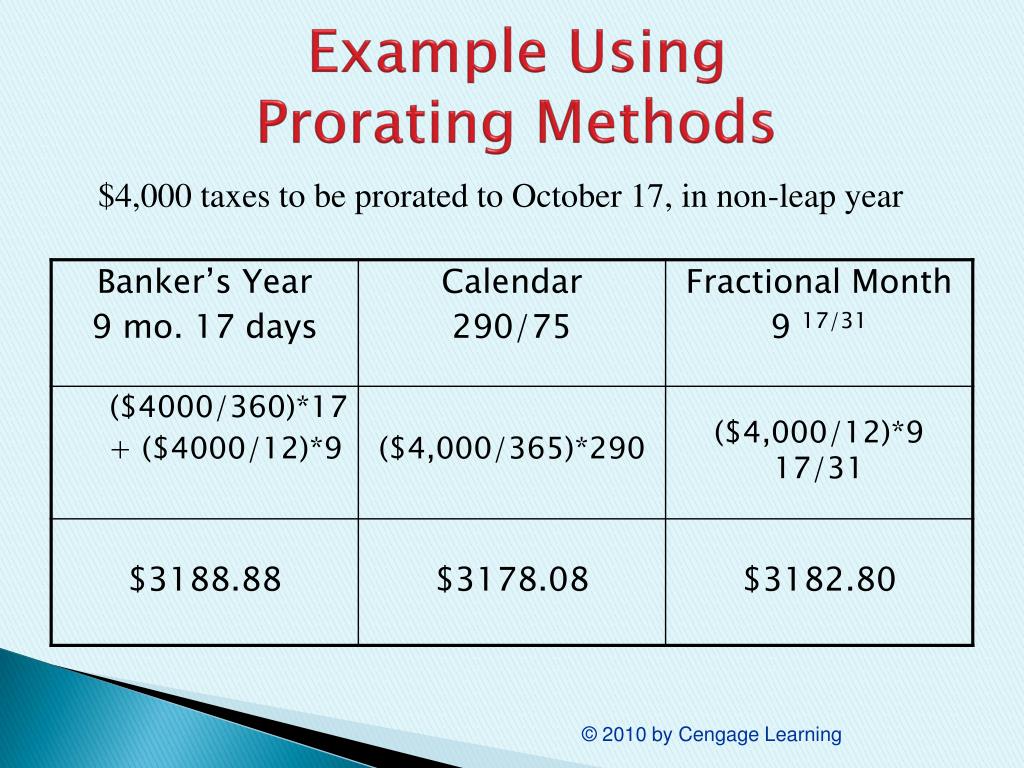

Calendar Year Proration Method

Calendar Year Proration Method - To calculate the amount the seller owes at. Web real estate tax proration table. This table is set up for prorating taxes on a calendar year or lien basis, that is from january 1 to date of closing. If you wish to prorate over a period not based on. Annual dsh audits and overpayments.

Annual dsh audits and overpayments. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying interests of the partners. If you wish to prorate over a period not based on. To calculate the amount the seller owes at. Web assuming the sellers own the property the day of closing, which formula(s) can be used to calculate their prorated debit using the calendar year method? The proration method also affects the calculations in the monthly recurring revenue (mrr) report. Web methods to calculate proration.

Calendar Year Proration Method Real Estate 2024 Calendar 2024 All

Web to pro rate rent based on the days in the calendar year, multiply the monthly rent by 12 months, then divide by 365 days in the year: Web prorate a specified amount over a specified portion of the calendar year. Addition of support or renewal. Proration is inclusive of both specified dates. In real.

Sample Calendar Teaching Mama

Credit of $1,350 and debit of. ($1,350 ÷ 365 = $3.70) 195 days (days from. Proration is inclusive of both specified dates. Web calendar year proration: This table is set up for prorating taxes on a calendar year or lien basis, that is from january 1 to date of closing. Web to pro rate rent.

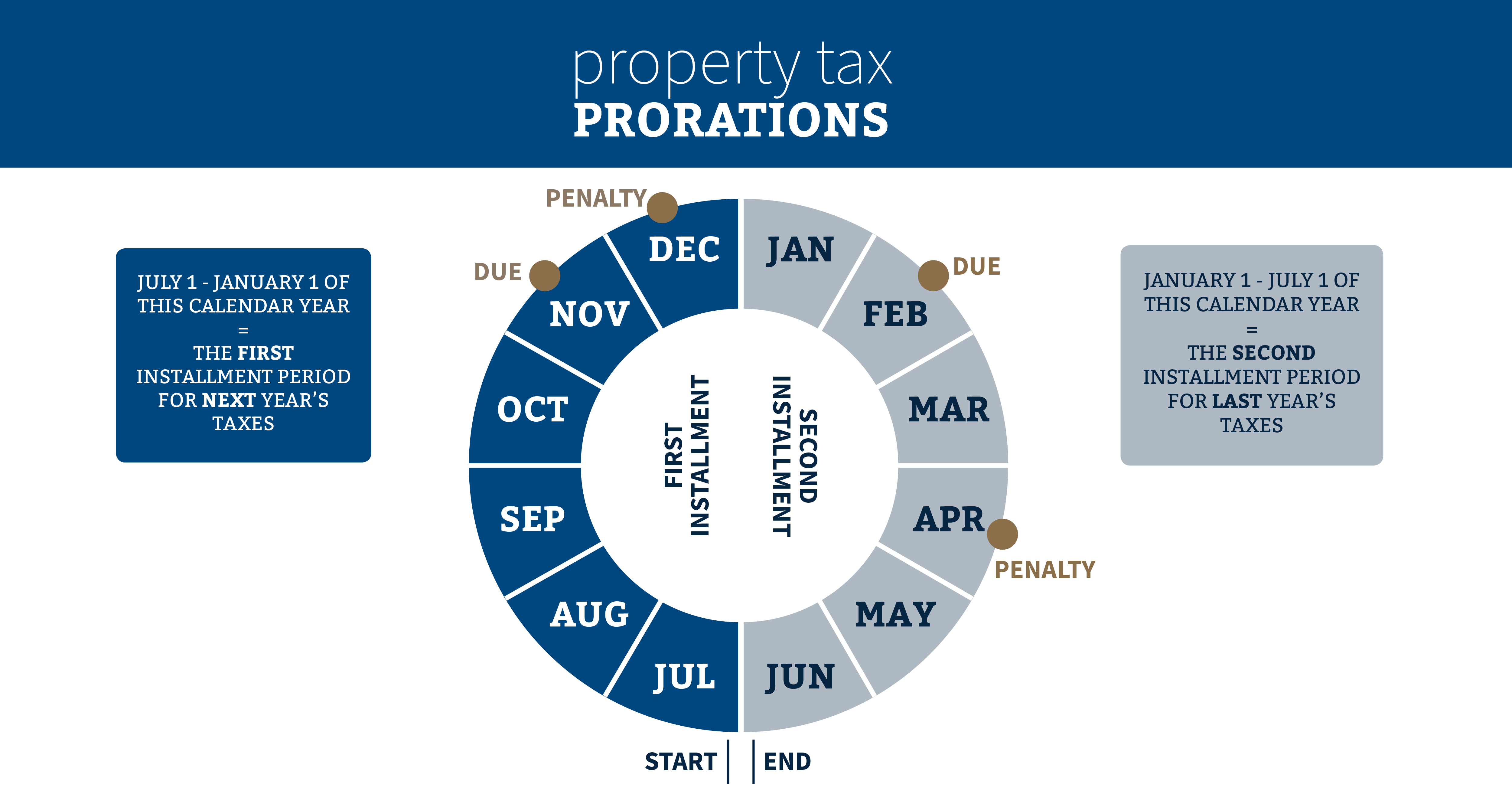

Property Tax Prorations Case Escrow

Web calendar year proration: The seller pays the february tax bill and pays the buyer a proration from january 1 of that year to the date of closing. Web how do you calculate the monthly rate for annual taxes. Web assuming the sellers own the property the day of closing, which formula(s) can be used.

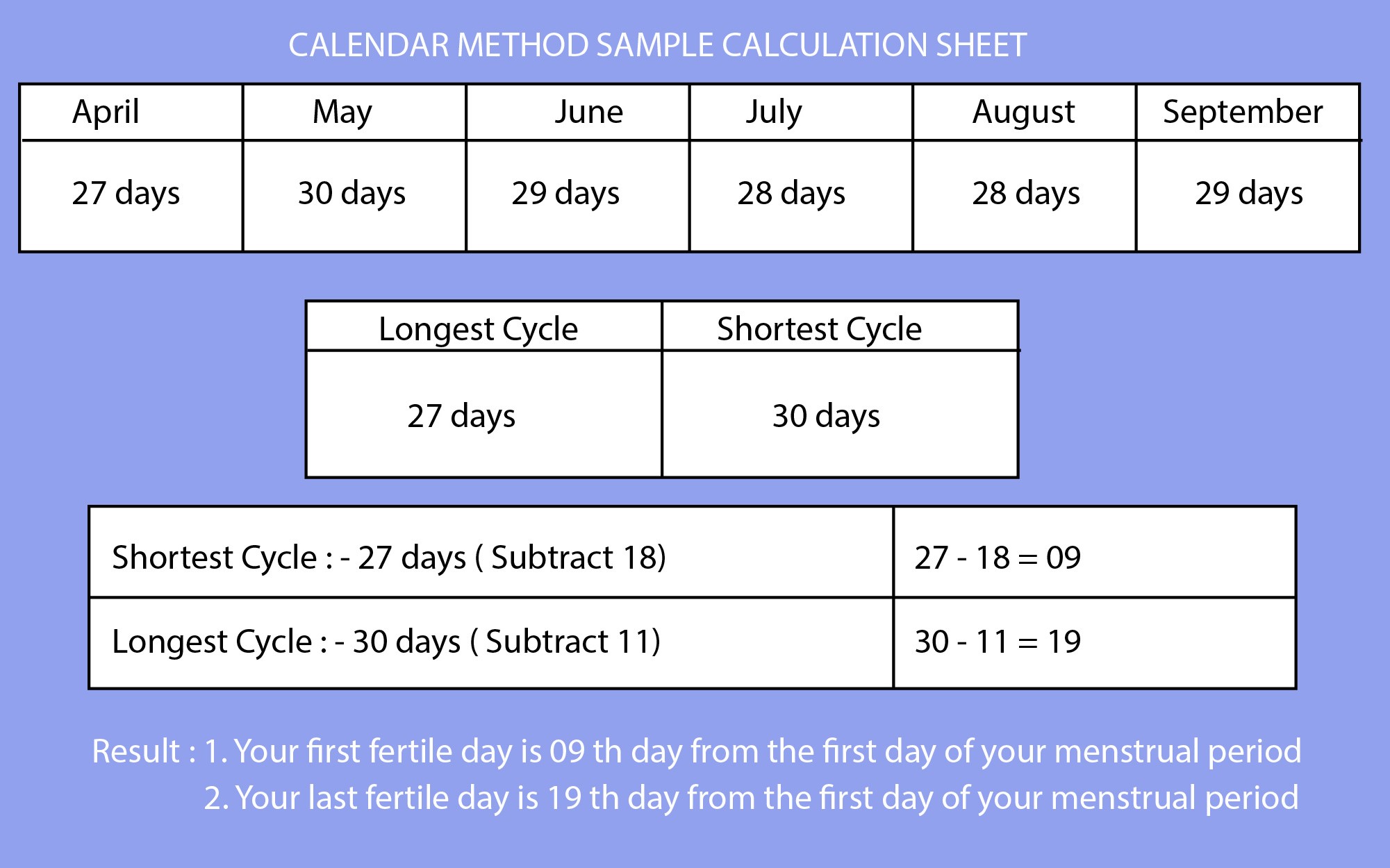

CALENDAR METHOD Simpliest explanation Vlog 8 YouTube

Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). To calculate the amount the seller owes at. Web using a calendar year proration method for calculations, how will these amounts appear on jamal's closing statement? This table is set up for.

Paano Ang Calendar Method Better Than College

Web using a calendar year proration method for calculations, how will these amounts appear on jamal's closing statement? $1,500 monthly rent x 12 months =. Proration is inclusive of both specified dates. Buyer is responsible for the july tax bill. Addition of support or renewal. Annual dsh audits and overpayments. Placement or removal a hold..

Adjusting Overhead with the Proration Method Wize University

Web real estate tax proration table. Using the calendar year proration method (assume that it's. The seller occupied the home from january 1st to may 31st or 151 days. Buyer is responsible for the july tax bill. Annual dsh audits and overpayments. ($1,350 ÷ 365 = $3.70) 195 days (days from. Web using a calendar.

PPT Chapter 16 ________________ Title Closing and Escrow PowerPoint

Web using a calendar year proration method for calculations, how will these amounts appear on jamal's closing statement? Web prorate a specified amount over a specified portion of the calendar year. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing.

What are the different types of contraception? Medicszone

Web we understand the concern expressed by the commenters but disagree that the method for determining the date of discovery of an overpayment should be changed. Web calendar year proration: Using the calendar year proration method (assume that it's. Web methods to calculate proration. Web how do you calculate the monthly rate for annual taxes..

How To Yearly Calendar In Your Bullet Journal + Printable! Archer

The proration method also affects the calculations in the monthly recurring revenue (mrr) report. ($1,350 ÷ 365 = $3.70) 195 days (days from. Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration. The seller pays.

SSA POMS DI 52170.055 Calendars for Proration (19642028) 09/25/2008

Web calendar year of proration means the calendar year in which the closing. Addition of support or renewal. Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). In real estate transactions, calculating prorations accurately ensures fairness between the real estate buyer.

Calendar Year Proration Method Buyer is responsible for the july tax bill. Disproportionate share hospital payments” final rule published in the december 19,. This table is set up for prorating taxes on a calendar year or lien basis, that is from january 1 to date of closing. Addition of support or renewal. Web calendar year of proration means the calendar year in which the closing.

$1,500 Monthly Rent X 12 Months =.

Annual dsh audits and overpayments. Web prs, a calendar year partnership, uses the proration method and calendar day convention to account for varying interests of the partners. Web real estate tax proration table. Web assuming the sellers own the property the day of closing, which formula(s) can be used to calculate their prorated debit using the calendar year method?

Placement Or Removal A Hold.

If you wish to prorate over a period not based on. The seller occupied the home from january 1st to may 31st or 151 days. Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). Web methods to calculate proration.

In Real Estate Transactions, Calculating Prorations Accurately Ensures Fairness Between The Real Estate Buyer And Seller.

Web using a calendar year proration method for calculations, how will these amounts appear on jamal's closing statement? Web assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller owe at closing using the calendar year proration. First, calculate tax and insurance daily rates: To calculate the amount the seller owes at.

($1,350 ÷ 365 = $3.70) 195 Days (Days From.

Proration is inclusive of both specified dates. The proration method also affects the calculations in the monthly recurring revenue (mrr) report. Web how do you calculate the monthly rate for annual taxes. Using the calendar year proration method (assume that it's.

.png?1614945017)