Black Scholes Excel Template

Black Scholes Excel Template - In addition, for your better understanding, i’m going to use a. The spreadsheet shoppe has got you covered! These are sample parameters and results. Web how do you determine the fair market value of a european call or put option? Web in this post, we’ll explore the options premium calculator spreadsheet that greatly simplifies options pricing as well as payoff calculation.

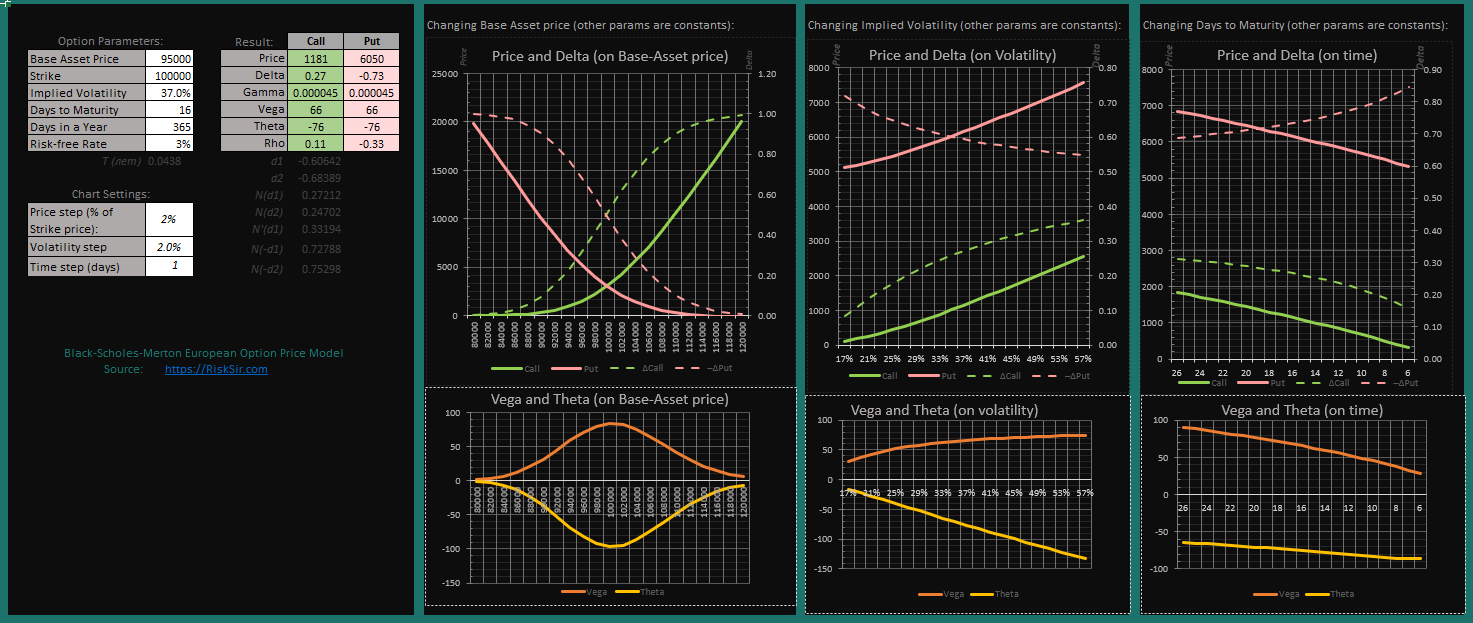

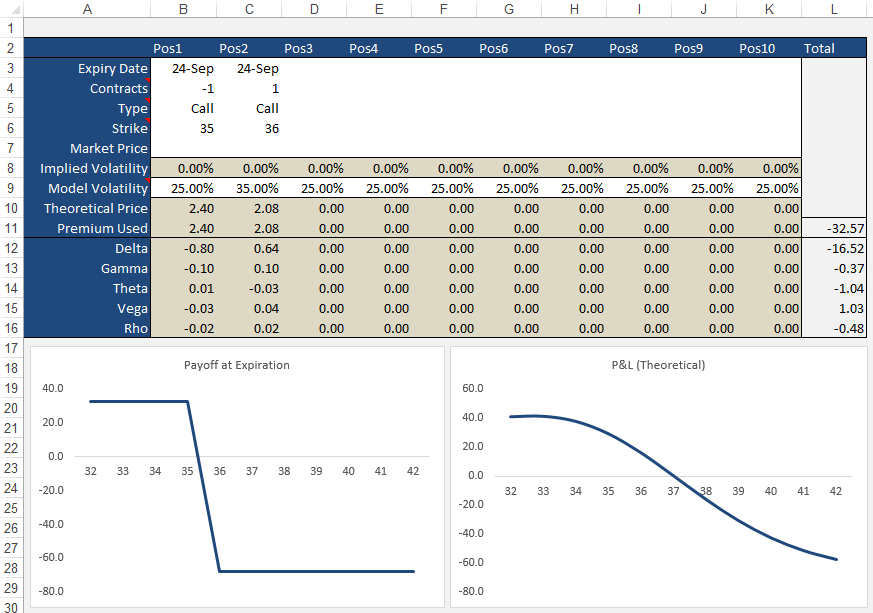

The spreadsheet allows for dividends and also gives you the greeks. Makes it easier to compare the financial results of different companies using it. The spreadsheet shoppe has got you covered! These are sample parameters and results. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. Use marketxls with all options data in excel. Let's learn about the intuition and apply it to price options in excel!

Excel BlackScholesMerton Option Price and Greeks Financial Risk

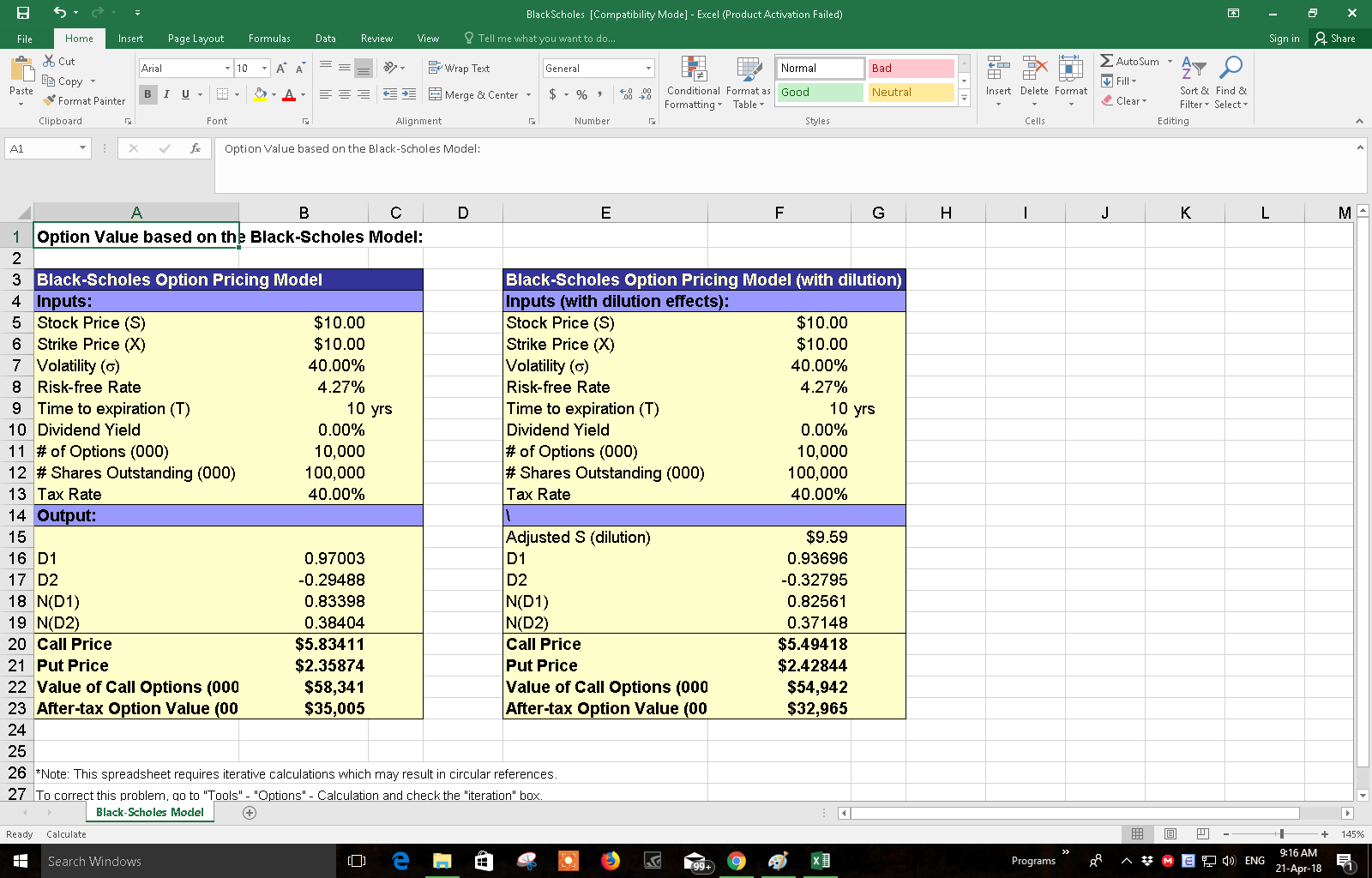

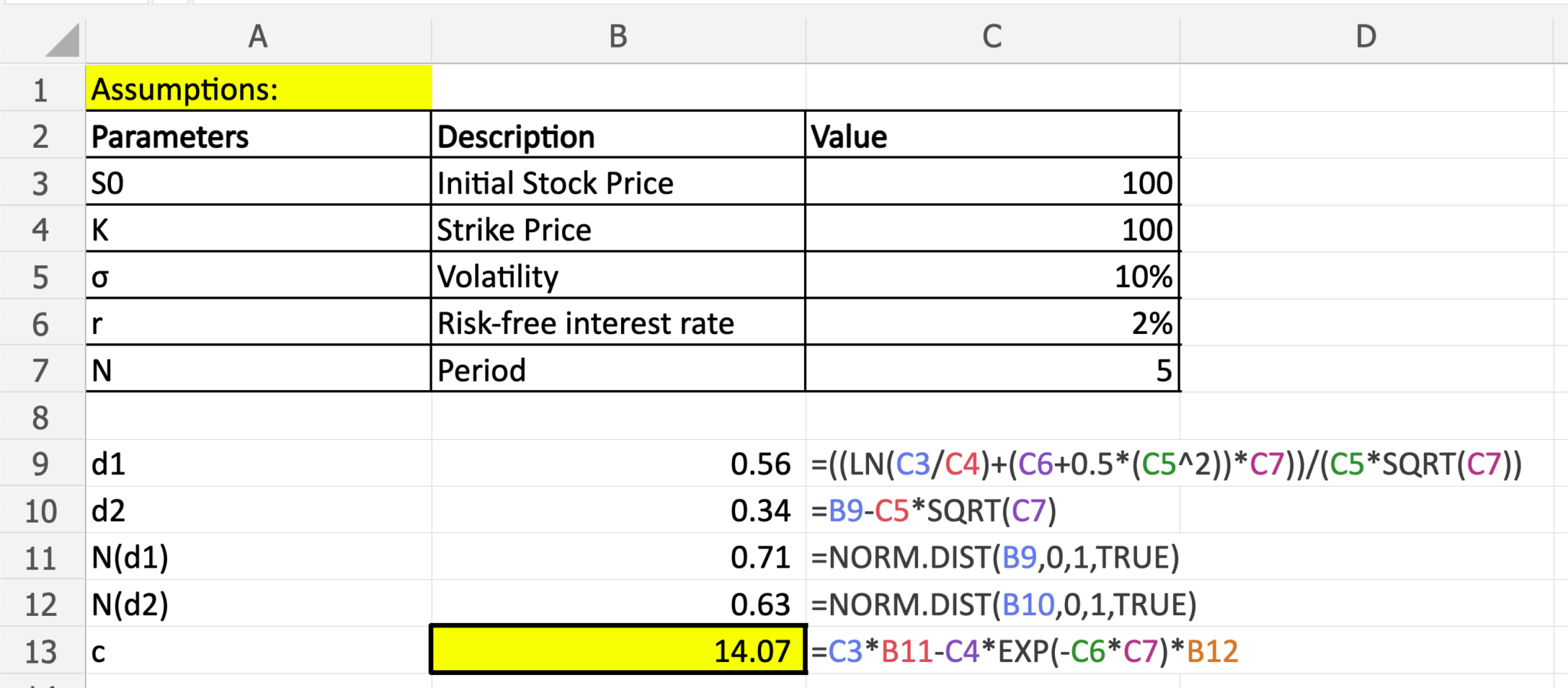

In a new spreadsheet, choose cells to contain the following information (or use these exact cells for simplicity’s sake): Is adequate for companies that do not grant many stock options. Setting up the input cells first, you’ll need to create cells for each of your input variables. Web black scholes excel model is the best.

Black Scholes Excel Template SampleTemplatess SampleTemplatess

Built by finance professors and financial modelers. This video tutorial covers the manual calculations and the. In addition, for your better understanding, i’m going to use a. Let's learn about the intuition and apply it to price options in excel! Use marketxls with all options data in excel. Web black scholes excel model is the.

BlackScholes Excel Pricing Model Eloquens

Login to access this resource. In a new spreadsheet, choose cells to contain the following information (or use these exact cells for simplicity’s sake): This video tutorial covers the manual calculations and the. Built by finance professors and financial modelers. Web how to calculate volatility for black scholes in excel: Setting up the input cells.

BlackScholes Option Pricing (Excel formula) Dollar Excel

Web need to calculate some puts and calls? Makes it easier to compare the financial results of different companies using it. Robert merton was the first to expand the mathematical understanding of the options pricing model. This video tutorial covers the manual calculations and the. Use marketxls with all options data in excel. Web how.

10 Black Scholes Excel Template Excel Templates

In a new spreadsheet, choose cells to contain the following information (or use these exact cells for simplicity’s sake): The spreadsheet shoppe has got you covered! Web black scholes excel model is the best framework to calculate the underlying value of an option contract. Join | learn about membership. These are sample parameters and results..

Black Scholes Calculator Download Free Excel Template

Makes it easier to compare the financial results of different companies using it. In a new spreadsheet, choose cells to contain the following information (or use these exact cells for simplicity’s sake): Web need to calculate some puts and calls? If you’re just playing around it doesn’t matter how you structure the calculation. Web black.

Black Scholes Option Calculator

Web in this post, we’ll explore the options premium calculator spreadsheet that greatly simplifies options pricing as well as payoff calculation. Let's learn about the intuition and apply it to price options in excel! The spreadsheet allows for dividends and also gives you the greeks. In addition, for your better understanding, i’m going to use.

BlackScholes Model on Excel for Option Pricing YouTube

Login to access this resource. In addition, for your better understanding, i’m going to use a. If you’re just playing around it doesn’t matter how you structure the calculation. Use marketxls with all options data in excel. Robert merton was the first to expand the mathematical understanding of the options pricing model. Web sometimes an.

Blackscholes option pricing model spreadsheet stock market

Web need to calculate some puts and calls? If you’re just playing around it doesn’t matter how you structure the calculation. Makes it easier to compare the financial results of different companies using it. Login to access this resource. The spreadsheet is based on black scholes model and can be downloaded from the end of.

10 Black Scholes Excel Template Excel Templates

Login to access this resource. Is adequate for companies that do not grant many stock options. Web black scholes excel model is the best framework to calculate the underlying value of an option contract. This content is exclusive to members. Web how do you determine the fair market value of a european call or put.

Black Scholes Excel Template The spreadsheet shoppe has got you covered! Login to access this resource. Let's learn about the intuition and apply it to price options in excel! Web need to calculate some puts and calls? Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel.

Is Adequate For Companies That Do Not Grant Many Stock Options.

Web black scholes excel model is the best framework to calculate the underlying value of an option contract. Web in this post, we’ll explore the options premium calculator spreadsheet that greatly simplifies options pricing as well as payoff calculation. These are sample parameters and results. Web need to calculate some puts and calls?

In A New Spreadsheet, Choose Cells To Contain The Following Information (Or Use These Exact Cells For Simplicity’s Sake):

Web how do you determine the fair market value of a european call or put option? Robert merton was the first to expand the mathematical understanding of the options pricing model. Setting up the input cells first, you’ll need to create cells for each of your input variables. Built by finance professors and financial modelers.

The Spreadsheet Is Based On Black Scholes Model And Can Be Downloaded From The End Of This Post.

The spreadsheet shoppe has got you covered! This content is exclusive to members. In addition, for your better understanding, i’m going to use a. Let's learn about the intuition and apply it to price options in excel!

Use Marketxls With All Options Data In Excel.

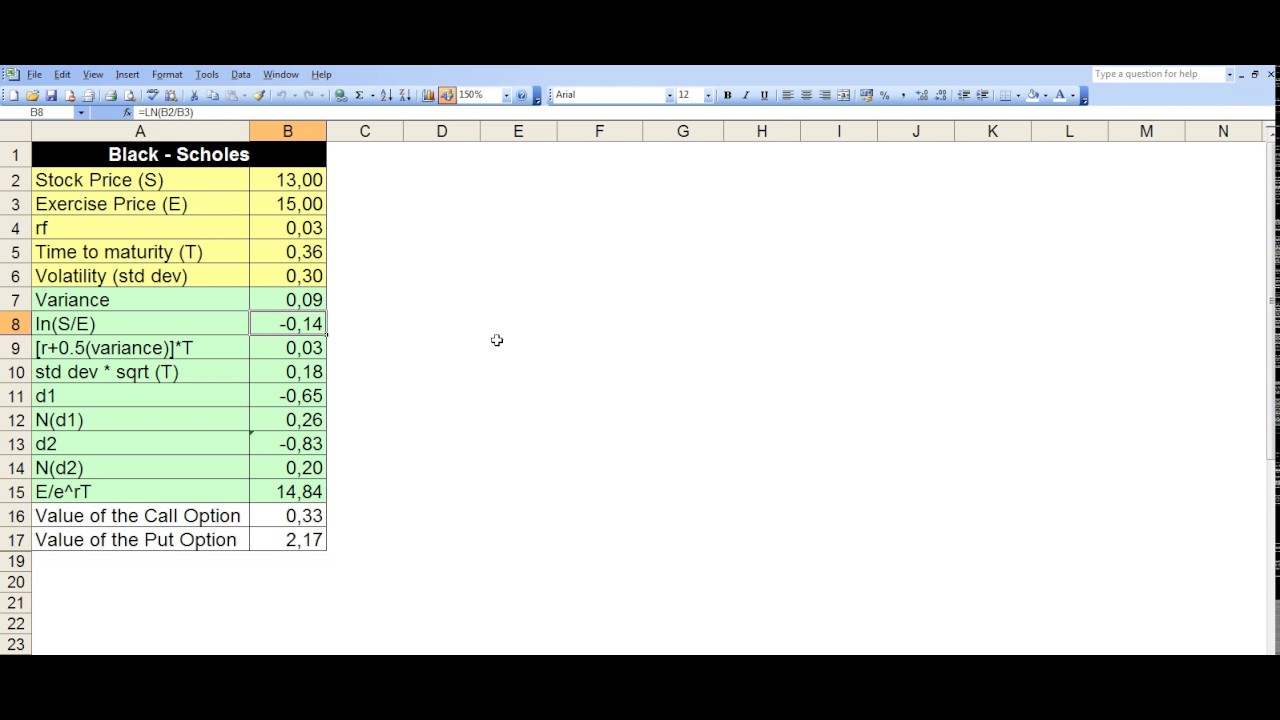

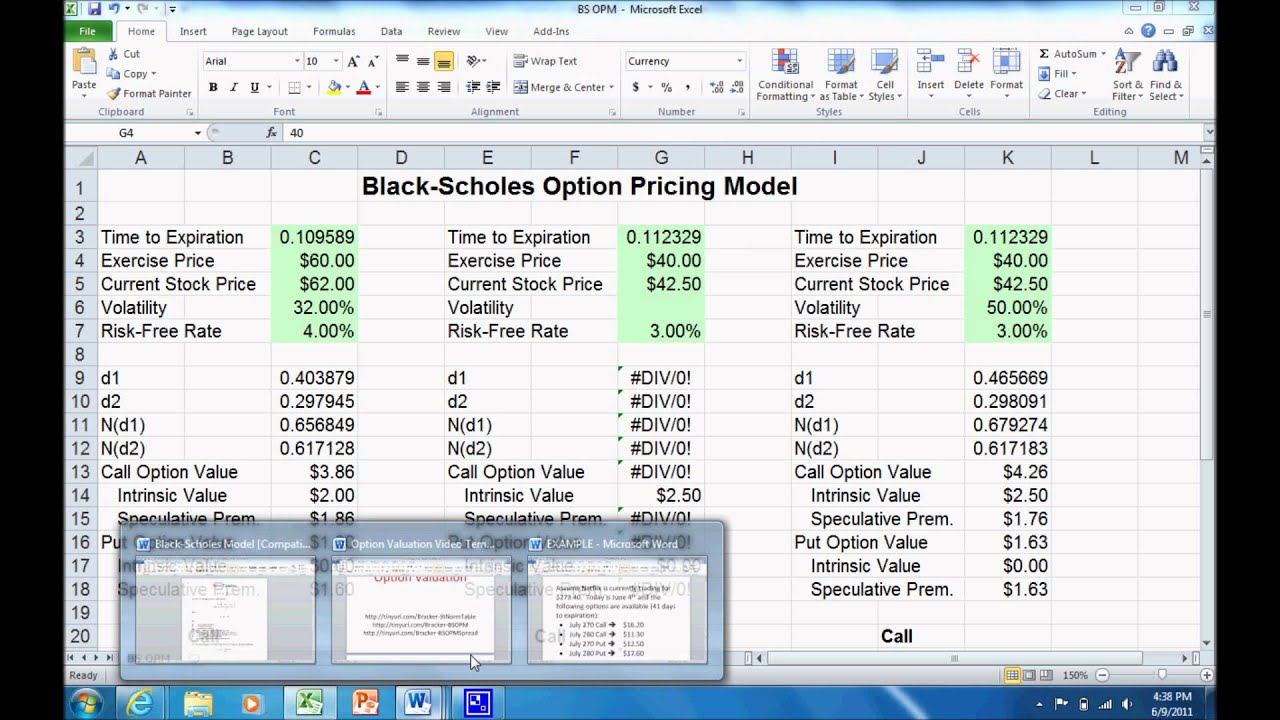

Web how to calculate volatility for black scholes in excel: The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and the annual volatility of the underlying stock is 20%. The spreadsheet allows for dividends and also gives you the greeks. If you’re just playing around it doesn’t matter how you structure the calculation.